Bitcoin Correlation with Gold at 5 Month High – Polymarket Predicts Ethereum Won’t Reach New ATH

Bitcoin Correlation with Gold Reaches 5-Month High

Bitcoin’s correlation with gold has increased, reaching a five-month high, reflecting its evolving role as a store of value amid economic uncertainty. This increase in correlation is based on both assets being seen as hedges against inflation and financial instability. Ethereum’s correlation with gold, on the other hand, remains low, reflecting Ethereum’s utility and its different perception due to the continued developments in the decentralized finance (DeFi) ecosystem. This difference highlights the distinct roles that Bitcoin and Ethereum play in investor portfolios.

Polymarket Predicts Ethereum Won’t Reach New ATH

According to Polymarket, a decentralized information markets platform, most investors are betting that Ethereum will not reach its all-time high (ATH) by the end of the year. This skepticism comes despite recent bullish trends and positive market activity in the crypto space. The ongoing market sentiment reflects broader concerns about Ethereum’s future performance and potential regulatory hurdles. Overall, investors appear cautious, and there is a consensus across the market that Ethereum will not be able to surpass its previous ATH this year.

US M2 Money Supply Nears New Highs, Financial Assets Reach Record Highs

The US M2 money supply is approaching new highs amid expansionary policies by the Federal Reserve and other global central banks. This influx of liquidity is contributing to asset prices in a variety of financial markets, including stocks and cryptocurrencies. The increase in money supply is seen as a response to economic challenges and is intended to stimulate growth, but it also raises concerns about long-term inflation. Observers are closely monitoring the potential impact on financial stability and future economic policies.

SEC Puts Ethereum ETF Options on Hold After Bitcoin ETF Approval

The SEC has temporarily paused its decision on Ethereum ETF options, despite approving Bitcoin ETFs. This decision reflects ongoing regulatory scrutiny and the need for further evaluation of Ethereum’s market dynamics and risks. Meanwhile, the Ethereum ETF market has seen significant net outflows due to regulatory uncertainty. This delay contrasts with Bitcoin ETFs following a clearer regulatory path.

Gensler Did Not Consider Digital Assets Ahead of Congressional Work Deadline

US SEC Chairman Gary Gensler faced intense questioning at a congressional hearing, with lawmakers criticizing the SEC’s stance on cryptocurrencies. Gensler remained silent on digital assets in his speech, but later faced extensive questioning about the agency’s lack of clear regulatory guidelines for the crypto industry. The hearing highlights a growing tension between the SEC and Congress that highlights the need for a more specific regulatory framework to address digital assets and their market impact.

————————————————————————————————

BITCOIN (BTC)

BTC is priced at $63,613 with a 0.73% gain as of the morning hours. On the 4-hour chart, it has entered an upward trend by breaking the falling trend line. However, although the middle resistance at 65,000 has been tested, this level has not been broken and the price is currently consolidating below this level. In the current situation, it seems difficult for the uptrend to continue unless a break above the 65,000 resistance occurs. Otherwise, the price may retreat towards the support point at 56,600. This region stands out as an important support area where the price can experience a recovery. The lowest region in terms of support levels has been determined as 52,555. Breaking the 65,000 resistance is key for the continuation of the rise.

ETHEREUM (ETH)

ETH is priced at $2611 with a 1.22% gain as of the morning hours. On the 4-hour chart, it is progressing in an uptrend. The upper resistance at 2,820 has been tested but this level could not be broken. The price is currently consolidating below this level. In the current situation, the 2,820 resistance must be broken for the continuation of the rise. If this resistance cannot be overcome, the price is likely to fall back to the important support at 2,466.47. The level of 2,373.44 stands out as an additional support area to be followed in the medium term. In downward movements, the strongest support is at 2,168.07.

RIPPLE (XRP)

XRP is priced at $0.5843 with a 0.19% gain as of the morning hours. It is trading at 0.5855 on the 4-hour chart and is showing a sideways trend. The price tested the middle resistance at 0.6100 but could not break this level and is currently consolidating below this resistance. Breaking the 0.6100 resistance is critical for the continuation of the rise. If this resistance is not broken, the price is likely to fall back to the additional support point at 0.5500. If this support level is broken, the risk of falling back to the stronger support area at 0.5100 may increase.

AVALANCHE (AVAX)

AVAX is priced at $27.70 with a 1.54% gain as of the morning hours. It is traded at 27.17 on the 4-hour chart and is progressing in an uptrend. The price tested the upper resistance at 28.00 but could not break this level and is currently consolidating below this resistance. In order for the rise to continue, the 28.00 resistance must be broken. Otherwise, the price is likely to fall back to the important support at 24.69. In case of falling below this support level, additional support at 22.82 should be followed. The strongest support point at lower levels appears to be 21.88.

SOLANA (SOL)

SOL is priced at $150.04 with a 1.39% gain as of the morning hours. It is traded at 146.43 on the 4-hour chart and is progressing in an uptrend. The price tested the middle resistance at 155.00 but could not break this level and is currently consolidating below this resistance. In the current situation, the 150.00 resistance must be broken for the rise to continue. Otherwise, the price may fall back to the support point at 142.00. In the event of falling below this support level, the stronger support area at 129.50 may come to the fore. Above, the upper resistance at 163.70 stands out as a target to be watched in possible increases.

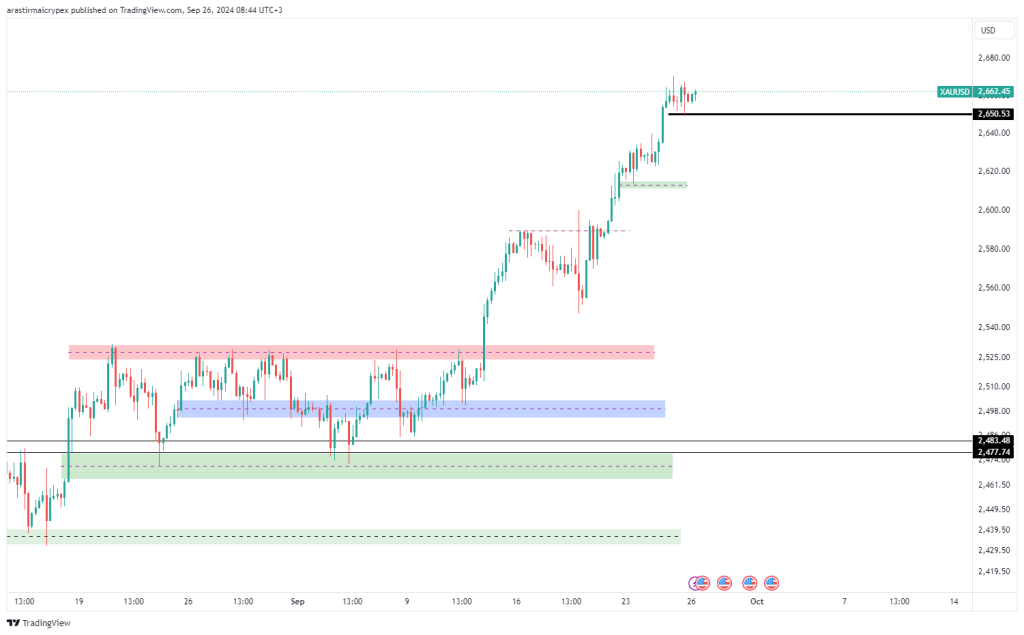

OUNCE GOLD

The ounce of gold is priced at $2662 with a 0.18% increase in value as of the morning hours. ATH was refreshed on the 4-hour chart and the level of 2670 was seen. $2600 – $2620 works as a major support. $2680 can be seen in the continuation of the rise. In pullbacks, $2660 – $2630 seems to be a strong support.

OUNCE SILVER

Silver is priced at $31.96 with a 0.40% gain as of the morning hours. On the 4-hour chart, the price broke the 31.19 resistance level. It is likely to encounter resistance at 32.50 and pullback. In a possible pullback, the price is expected to fall first to the 31.20 level and then to the 28,700 support level. If the rising band is broken upwards, the rise will likely continue.