Trump’s First Day Executive Orders – Cardano and Ripple Collaboration

Trump’s First Day Executive Orders

President-elect Donald Trump plans to issue executive orders on his first day in office that could repeal the U.S. Securities and Exchange Commission’s (SEC) controversial Accounting Bulletin 121 (SAB 121) and address issues of “debanking” in the crypto industry. SAB 121 has been criticized for requiring crypto custody firms to show their clients’ crypto assets as liabilities on their balance sheets. The Trump administration is expected to take a friendlier approach to crypto. The appointment of Paul Atkins as SEC Chairman and David Sacks as the “White House Chief of AI and Crypto” supports this expectation. The crypto industry has long accused the Biden administration of restricting access to banking services, but federal agencies deny these allegations. Trump’s executive orders are also expected to explore granting banking access to crypto firms and potentially creating a “Bitcoin reserve.”

Cardano and Ripple Collaboration

Cardano founder Charles Hoskinson confirmed that Ripple is in talks to integrate its Ripple USD (RLUSD) stablecoin onto the Cardano blockchain. Launched last month, RLUSD has already garnered attention by being listed on exchanges like Bitstamp and Bullish, with more expected to be available soon. The integration aims to enhance Cardano’s DeFi capabilities, attract new users, and strengthen its stablecoin ecosystem, which includes other stablecoins like USDM and Djed. Hoskinson praised the RLUSD team and expressed optimism about the collaboration, but Cardano’s market price fell more than 9% following the announcement. If successfully executed, this collaboration could benefit both platforms, increasing interoperability and innovation in the blockchain space.

Tether Moves to El Salvador in Crypto Expansion

Tether, the creator of stablecoin USDT, is moving its headquarters to El Salvador, supporting the country’s ambition to become a global crypto trading hub. According to CEO Paolo Ardoino, this will be Tether’s first physical headquarters. The company chose El Salvador because of its crypto-friendly policies and new digital asset license. Tether has been criticized for its reserves, but has noted that its assets are mostly backed by US Treasury bonds. The move aims to increase El Salvador’s visibility in the crypto industry.

Sony Launches Soneium Blockchain Mainnet

Sony Block Solutions Labs, Sony’s blockchain subsidiary, has announced the mainnet launch of its public blockchain platform Soneium. Built on Optimism’s OP Stack and Superchain technology, Soneium aims to bridge the gap between Web2 and Web3, protect creators’ rights, and ensure fair value distribution between creators and fans. Since its testnet launch in August 2024, the platform has seen significant engagement with 15.4 million active wallet addresses and over 50 million transactions. Key initiatives like Sony’s NFT-based Fan Marketing Platform and Soneium Spark incubation program aim to empower creators and users with accessible blockchain applications. With the mainnet launch, Sony plans to explore new frameworks and use cases that integrate digital and physical experiences.

MicroStrategy Increases Bitcoin Reserves to 450,000 BTC

MicroStrategy has purchased an additional 2,530 Bitcoins, bringing its total holdings to 450,000 BTC. The company said it spent $243 million on the purchase, paying an average of $95,972 per Bitcoin. This was one of ten consecutive weeks of Bitcoin purchases under MicroStrategy’s “21/21 Plan” announced in October 2024.

The company sold 710,425 shares between January 6 and 12 to fund these purchases, and said it could issue shares worth $6.5 billion for future purchases. The total cost of MicroStrategy’s Bitcoin holdings is approximately $28 billion, with an average purchase price of $62,691.

UK Announces Plan to Strengthen Economy with Artificial Intelligence

UK Prime Minister Keir Starmer is set to announce the AI Opportunities Action Plan, which aims to make the country a global leader in artificial intelligence. The government predicts that full adoption of AI could add £47 billion to the economy annually over the next decade. The plan’s three main focuses will be on building AI infrastructure, accelerating adoption of the technology and taking a step ahead in international competition. An “AI Growth Zone” will be established in Oxfordshire, with similar zones to be rolled out in other industrial transformation regions.

Trump’s Treasury Nominee Bessent Is Liquidating Bitcoin ETFs

US Treasury Secretary nominee Scott Bessent is planning to liquidate his various investments, including Bitcoin ETFs, in order to avoid conflicts of interest in his new role. According to the New York Times, Bessent has more than $700 million in assets and investments. These investments include a Bitcoin ETF worth $250,000 to $500,000, a margin loan with Goldman Sachs worth more than $50 million, and an account for trading Chinese currencies.

Bessent submitted a letter to the Senate confirmation process that includes an ethics agreement and financial disclosures, stating, “If confirmed as Treasury Secretary, I will avoid any conflicts of interest.”

———————————————————————————————

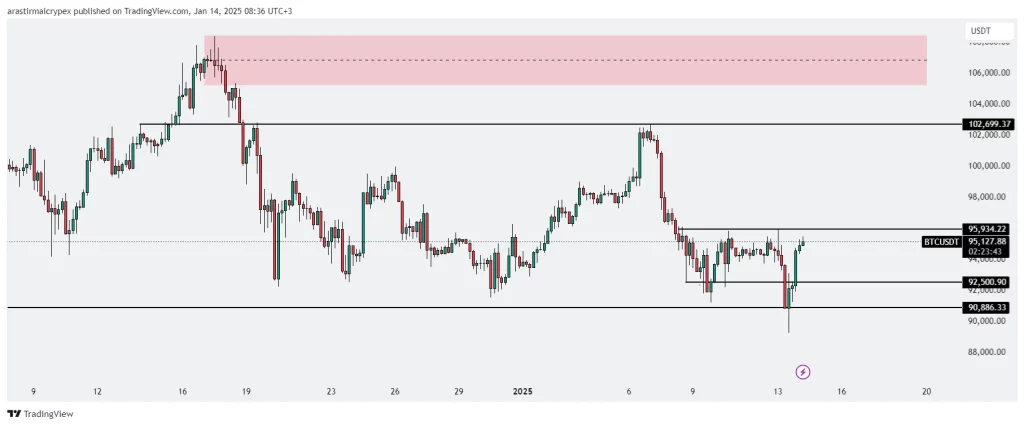

BITCOIN (BTC)

BTC is trading at $95,176 as of this morning, down 0.68%. The price has reacted strongly from the support area at 92,500.90 and has made an upward move. This suggests that this level is in strong demand. Above, the 95,934.22 level appears as a short-term resistance. If this level is broken, the price is likely to move towards the next resistance level at 102,699.37. Breaks above 102,699.37 could send the price higher towards the red zone (around 107,000-108,000 range) which is clearly marked on the chart. This area is a strong supply area that could face intense selling pressure. On the downside, the 92,500.90 level will continue to act as a significant support. If there is a break below this level, the price can be expected to pullback towards the next support level at 90,886.33.

ETHEREUM (ETH)

ETH is priced at $ 3,265 as of the morning hours with a 1.46% gain in value. The price tested a previously broken support level around 3,370 and was rejected from here. The price is currently in a support area near 3,220.55. On the upper side, the 3,550-3,600 area is a strong resistance area. In order for the price to reach this area, it must first break the current horizontal resistance area at 3,370. If this happens, the next target could be 3,829.69. On the downside, if the current support level of 3,220 is broken, the price can be expected to move towards the next support level of 3,130-3,150. This level could act as significant support, overlapping with previous lows.

RIPPLE (XRP)

XRP is priced at $2.54 with a 0.68% increase in value as of the morning hours. XRP, which broke the 2.4733 resistance with rapid recoveries after rapid pullbacks yesterday, started the new day above this level and is trying to stay above the 2.4733 support level. In upward movements, the 2.6019 level stands out as the first resistance point. If this level is exceeded, the price can be expected to head towards the 2.6747 main resistance zone. In particular, a permanent break above the 2.6747 level can trigger an increase that can carry the price to the 2.7864 level. In downward movements, the 2.4733 level should be monitored as a strong support. If this level is broken, the price may decline to the 2.3645 support zone. Below the 2.3645 level, the 2.2709 region is another critical support area where buyers can concentrate. Therefore, it is important for investors to carefully monitor the identified critical support and resistance levels.

AVALANCHE (AVAX)

AVAX is trading at $ 35.50 levels with a 0.57% gain as of the morning hours. It will be important for AVAX, which started the new day by testing the 35.50 resistance level, to maintain its persistence above this level in order to continue the rise. If the upward movement continues, the 37.29 level appears as the first resistance. If this region is exceeded, the price may rise to 38.84 and then 40.06 levels, and these levels may work as resistance. In the event of a downward movement, the 35.50 level should be monitored as the first support area. If this level is broken, the price may pull back to the 34.31 and 33.01 support levels. The 33.01 level in particular is critical as it has previously been tested as a strong support area. Therefore, it is important for investors to carefully monitor the identified critical support and resistance levels.

SOLANA (SOL)

SOL is priced at $ 185.30 as of the morning hours with a 1.34% gain in value. For SOL, which broke the 193.60 resistance in the morning hours, it will be important for it to stay above this level in order for the positive trend to continue. Then, the resistance at 191.26 appears to be a critical area in the short term. If this level is broken, the price may move towards 194.20 and then 199.48. However, if selling pressure increases above the 191.26 resistance, the price may fall again. In downward movements, the 183.60 level should be followed as the first support. If this support is broken, the price may fall to the strong support area at 177.10. Further below, the 169.09 and 164.04 levels stand out as strong support areas. The price can be expected to find buyers at these levels.