Trump to Create Strategic Reserve with US Crypto Assets – World Liberty Financial Switches from Bitcoin to Ethereum

Trump to Create Strategic Reserve with US Crypto Assets

Donald Trump is open to the idea of creating an “American-first strategic reserve” with US-based digital assets such as Solana, Ripple and USD Coin. It is stated that Trump plans to appoint crypto-friendly regulators and end banking bans affecting crypto initiatives. The new administration also aims to create a Bitcoin reserve by issuing crypto-focused executive orders. However, it is emphasized that legislative support is required for such a reserve to be permanent. While these steps paint an optimistic picture for the crypto sector, some concerns are that Bitcoin’s market leadership may weaken.

World Liberty Financial Switches from Bitcoin to Ethereum

Trump-affiliated DeFi platform World Liberty Financial has swapped 103 Wrapped Bitcoin for 3,075 Ethereum worth approximately $ 10 million. The platform stated that this move was made as part of regular treasury management and was not for sale. Following the transfers, World Liberty’s crypto asset portfolio has shrunk to a total of $17.27 million. The platform, which had a portfolio size of $83 million in December, has drawn attention by spending a large portion of its assets. This change has led to speculation that the company is making a strategic shift to Ethereum.

VanEck Files for New Onchain Economy ETF

VanEck has filed for a new exchange-traded fund (ETF) focused on digital asset infrastructure. The fund, which will be managed through a subsidiary based in the Cayman Islands, plans to invest 80% of its assets in blockchain companies and digital transformation firms. These firms include crypto exchanges, payment gateways, mining operations and infrastructure service providers. The fund will focus on technologies and infrastructure supporting the digital asset ecosystem, not directly on crypto assets. However, it was also stated that it will not invest in stablecoins or stablecoin products. The move is seen as a strategic approach by VanEck to the digital transformation market.

Oklahoma, Texas Introduce Bitcoin Reserve Bills

Oklahoma and Texas have introduced reserve bills that aim to integrate Bitcoin as a strategic asset in public finance. In Texas, Senator Charles Schwertner introduced SB 778, a bill that proposes to include Bitcoin in the state’s financial reserves. In Oklahoma, Representative Cody Maynard introduced the Strategic Bitcoin Reserve Act, which proposes to allocate a portion of retirement funds and savings accounts to Bitcoin. These initiatives are part of a growing trend across the U.S. to use Bitcoin as a hedge against inflation and store of value.

Grayscale XRP Trust Reopens

Grayscale Investments has relaunched its XRP Trust for accredited investors. The investment vehicle provides regulated access to the market without directly purchasing and managing XRP. The reopening of the trust comes after Ripple Labs’ partial victory in its ongoing legal action with the SEC. While the sale of XRP to the general public is not considered a security, institutional sales are still controversial. Grayscale is also expanding its digital asset product portfolio with the launch of the Lido DAO and Optimism Trusts. The current price of XRP is $3.27, with a market cap of $188.23 billion.

Trump’s Treasury Secretary Nominee Scott Bessent Opposes CBDC

President-elect Donald Trump’s Treasury Secretary nominee Scott Bessent has come out strongly against the idea of a US Federal Reserve Digital Currency (CBDC) during his Senate confirmation hearing. Bessent said that CBDCs are generally necessary for countries that do not have investment alternatives, and that the US does not see such a need. Bessent, who advocates the development of a modern digital monetary policy, said that the Federal Reserve should not issue digital dollars. Although crypto asset topics were discussed in a limited way in the session, Bessent’s statements are considered an important message in the industry.

Phantom Wallet Raises $150 Million in Series C Round

Phantom Wallet has raised $150 million in a Series C financing round at a valuation of $3 billion. The round was led by Sequoia Capital and Paradigm, with a16z and Variant also participating. CEO Brandon Millman noted that there is an increasing trend for users to buy crypto directly through digital wallets instead of centralized exchanges. Phantom Wallet has 15 million monthly active users and $25 billion in self-custody assets. It ranked ninth among the most popular free iPhone apps in November. With the new resources, Phantom aims to accelerate crypto adoption and become the world’s largest and most trusted consumer finance platform, especially based on its dominance over Solana. The funding round surpasses Sygnum Bank’s recent $58 million fundraising, making it the largest crypto funding round of 2025 so far.

Ethereum Staking Service from PostFinance

Swiss state-owned bank PostFinance has begun offering Ethereum staking to its 2.7 million customers, allowing users to stake as little as 0.1 ETH. The service integrates with PostFinance’s existing systems, allowing customers to see their staking rewards in their asset statements alongside their other crypto assets. The move follows the bank’s previous crypto initiatives, including a crypto trading and custody service launched in 2023 and a crypto custody platform developed in 2022. PostFinance plans to add other crypto assets to its staking service in the future.

——————————————————————————————

BITCOIN (BTC)

BTC is priced at $101,650 as of this morning, gaining 1.66%. The price is currently at 101,633.45 and an upward movement is observed. The 102,699.37 level is a key resistance area that the price is currently testing. If this level is broken, the upward momentum can be expected to continue and the price can head towards the red resistance area at 104,000.00 – 108,000.00. However, if the price rejects this resistance area, the first support point of the pullback is at 95,934.22. Further below, 92,500.90 and 90,886.33 levels attract attention as other support areas.

ETHEREUM (ETH)

ETH is priced at $ 3,369 as of the morning hours with a 1.86% gain in value. The price is currently at 3,370.45 and is moving sideways. The green zone between 3,300.00 – 3,370.00 levels is a strong support zone. Consolidation of the price above this area may pave the way for an upward movement. In upward movements, the price may be expected to reach the red resistance zone at 3,500.00 – 3,600.00 levels. Breaking this zone may allow an increase to 3,829.69. However, if the price is rejected from the red resistance zone, a pullback towards the support levels may occur again.

RIPPLE (XRP)

XRP is priced at $ 3.33 with a 2.67% gain as of the morning hours. The current price level is at 3.3204 and a strong uptrend is observed. The 3.2000 level stands out as an important support area. If the price continues to stay above this level, the upward movement is likely to continue. In the upward scenario, it can be evaluated that the price may move towards the 3.4000 level. However, there is a possibility of encountering new resistance at this level. If the 3.2000 support is broken downwards, the 2.8716 level stands out as the next support.

AVALANCHE (AVAX)

AVAX is trading at $40.71 with a 1.62% increase in value as of the morning hours. The current price level is seen at 40.66 and an upward momentum continues. The 42.06 level stands out as a strong resistance area. The price has approached this level and a rejection or breakout may occur here. If the price breaks the 42.06 resistance, the next target may be the 45.00 level. However, if this resistance area is maintained, the price is likely to pull back to the 40.30 and 39.05 support levels. Below the 39.05 level, the 37.67 level stands out as the next support.

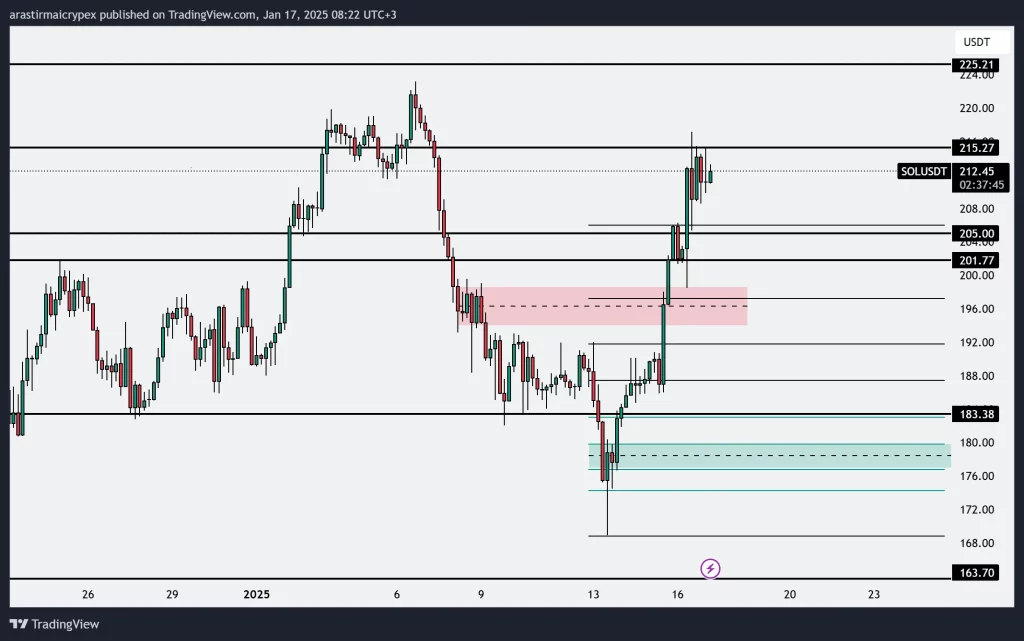

SOLANA (SOL)

SOL is priced at $212.58 with a 0.68% gain as of the morning hours. The current price is traded at 212.50 and the price is close to the 215.27 resistance level. This level can be considered as a significant resistance for the upward movement. If the price breaks this level, the next target could potentially be 225.21. In the downward movement, the first support point is 205.00. Below this level, the price could pull back to 201.77. In the event of a stronger decline, the support level at 183.38 will be important. This level also points to a strong demand zone where the previous uptrend started.