Trump’s Trade Tariffs Drop Bitcoin Below $100,000 – MicroStrategy to Continue Buying Bitcoin with New $563 Million Fund

Trump’s Trade Tariffs Drop Bitcoin Below $100,000

President Donald Trump has signed an executive order imposing steep tariffs on imports from Mexico, Canada and China. Products from Mexico and Canada will be taxed by 25%, while products from China will be taxed by 10%. Trump said he took this step to stop the flow of illegal opioids. Crypto markets, which were open over the weekend, were negatively affected by this development. Bitcoin fell by more than 5% to below $100,000, while Ethereum (ETH), XRP and Solana (SOL) lost between 10-15%. Canadian Prime Minister Justin Trudeau announced that they are ready to give a strong response to the US decision.

MicroStrategy to Continue Buying Bitcoin with New $563 Million Fund

MicroStrategy announced that it will invest another $563 million to expand its Bitcoin assets. The company will provide this fund through the sale of “Series A perpetual preferred stock” with an interest rate of 8.00%. MicroStrategy, which currently holds 471,107 BTC, is the largest Bitcoin holder among publicly traded companies. Former CEO Michael Saylor reiterated his confidence in the long-term value of Bitcoin, predicting a Bitcoin price of $3 million in the worst-case scenario and $49 million in the most optimistic forecast. The company’s move is seen as an indication of its strong belief in Bitcoin’s long-term potential.

21Shares Files SEC Application for Spot Polkadot ETF

Asset management company 21Shares has joined the crypto ETF trend in the US by filing a spot ETF application for Polkadot (DOT). The SEC filing stated that the ETF will be listed on the Cboe BZX exchange and that Coinbase will act as the DOT custodian. Although Polkadot’s price performance has been weak recently, Bloomberg analyst James Seyffart said the market will determine whether there is demand for the product. The filing is part of a growing number of crypto ETF filings following the resignation of former SEC Chairman Gary Gensler.

NYSE Files to List Grayscale’s Spot Dogecoin ETF

NYSE Arca has filed with the SEC to convert Grayscale’s Dogecoin Trust into a spot Dogecoin ETF. The filing is part of Grayscale’s efforts to expand its ETF offerings for XRP, Litecoin, and other altcoins. The Dogecoin ETF would give investors access to DOGE without requiring direct ownership. Coinbase Custody Trust will act as the ETF’s custodian, while BNY Mellon will handle administration and transfers. The SEC will decide on the application within 45 days.

Stablecoin Market Surpasses $200 Billion

The stablecoin market cap has reached a record high, exceeding $200 billion, and this increase is seen as a harbinger of a possible rise in the crypto market. According to CryptoQuant data, the stablecoin market has grown by $37 billion since November. Tether (USDT) maintains its leadership with a market cap of $139 billion, while Circle’s USDC has grown by 48% in the last three months, reaching $52.5 billion. The increase in liquidity in stablecoins could trigger a new bull run in Bitcoin and the overall crypto market.

Tether Announces $83,758 BTC and $13 Billion in Profit in 2024

Tether announced that it made $13 billion in net profit in 2024 and its Bitcoin reserves reached 83,758 BTC. It was stated that the company’s total assets reached $157.6 billion, while it supported the USDT supply with $7 billion in excess reserves. The USDT supply increased by $45 billion in 2024, reaching a total of $143 billion. Tether has also been licensed as a Digital Asset Service Provider (DASP) in El Salvador and is preparing to launch new products in the fields of artificial intelligence, telecommunications and finance.

US Marshals Misses Deadline to Give Silk Road Bitcoin Report to Senator Lummis

The US Marshals Service (USMS) has missed a deadline to give Senator Cynthia Lummis a report on the management of Bitcoin seized from the Silk Road case. Lummis expressed concern that the sale of approximately 69,370 Bitcoins could result in a loss of approximately $7 billion based on current market value. Lummis assessed the potential loss of past Bitcoin sales at 98 percent and called for greater transparency. The USMS plans to brief Lummis in the next few weeks. Lummis also chairs the newly established Digital Assets Subcommittee, which aims to create a comprehensive regulatory framework for digital assets.

Bitcoin Volume Hits 11-Month Low, Mempool Cleared

The number of transactions on the Bitcoin network fell to an 11-month low in January, continuing a three-month downtrend. With the reduced transaction volume, Bitcoin’s pending transactions (mempool) have largely been cleared, and transaction fees have fallen to record levels. Many blocks were mined before they were completely filled on Saturday. While there was a brief spike in transactions, particularly before President Trump’s second term, the trend quickly reversed. The decline has made it harder for miners to stay profitable, with some major U.S.-based mining companies considering a shift toward artificial intelligence and high-performance computing services.

India Reassesses Crypto Regulation

India is reviewing its crypto asset policies to align with changing global attitudes. Economic Affairs Secretary Ajay Seth said that changes in the use and acceptance of crypto assets have caused the discussion paper to be delayed. The decision comes after US President Donald Trump ordered a review of regulations for the digital asset sector. While India is known for its strict regulations and high taxation policies, crypto investments are rapidly increasing. As the country embraces blockchain technology, the legal status of private crypto assets remains unclear.

Genius Group Seeks to Increase Bitcoin Treasury to $100 Million

AI-based education company Genius Group will hold a rights offering to increase its Bitcoin treasury holdings to $100 million. Existing shareholders will have the right to purchase additional shares at $0.50 per share. The company aims to raise a total of $33 million and plans to increase its Bitcoin reserves from $45 million to $100 million with the additional funding. The rights are exercisable until February 14, 2025 and continue to trade on NYSE American.

——————————————————————————————

BITCOIN (BTC)

BTC is priced at $ 93,043 as of the morning hours, down 4.76%. The price retreated from an important resistance at 102,451.99, breaking the 96,060.85 support and moving down rapidly. The current price is at 93,052.95, with the next support point appearing at 91,370.06. The orange area on the chart represents an area where the price had previously worked as resistance. A sharp selling pressure formed below this area and the price fell rapidly. The upper red zone indicates a stronger resistance area and the reversal occurred before this level was reached.

ETHEREUM (ETH)

ETH is priced at $ 2,467 as of the morning hours with a 13.91% loss in value. The 3,220.55 level worked as an important support, but this level seems to have been broken strongly and become resistance. The price can be expected to find strong support at the 2,469.57 and 2,168.07 levels, but the downtrend is dominant for now. In particular, there was a sharp break below the 3,220.55 level and the price headed down rapidly. The consolidation area between 3,220 and 3,400, where the previous horizontal movement occurred, can now be considered a resistance area. This decline indicates that there is strong selling pressure on the market. The price is currently moving close to the 2,469.57 level and is likely to see a reaction from this area. However, if this support is broken, the price is likely to fall to the 2,168.07 level.

RIPPLE (XRP)

XRP is priced at $ 2,187 with a 14.88% loss as of the morning hours. The 3.20 level stood out as a strong resistance and the price experienced a sharp decline after testing this level. The orange zone between 2.8716 – 2.7220 served as a demand area, but became resistance after being broken. The price is currently trading close to the blue support zone between 2,400 – 2,200 and a reaction movement can be expected in this zone. However, if this support zone is broken, there is a possibility that the price will fall to the lower support zone between 1,800 – 1,600. In general, the downtrend is dominant and there is strong selling pressure. Whether the price can hold on to the current blue support zone in the short term is a critical indicator. If there is an upward reaction from this zone, the price can be expected to test the 2.7220 level. Otherwise, the decline is likely to continue.

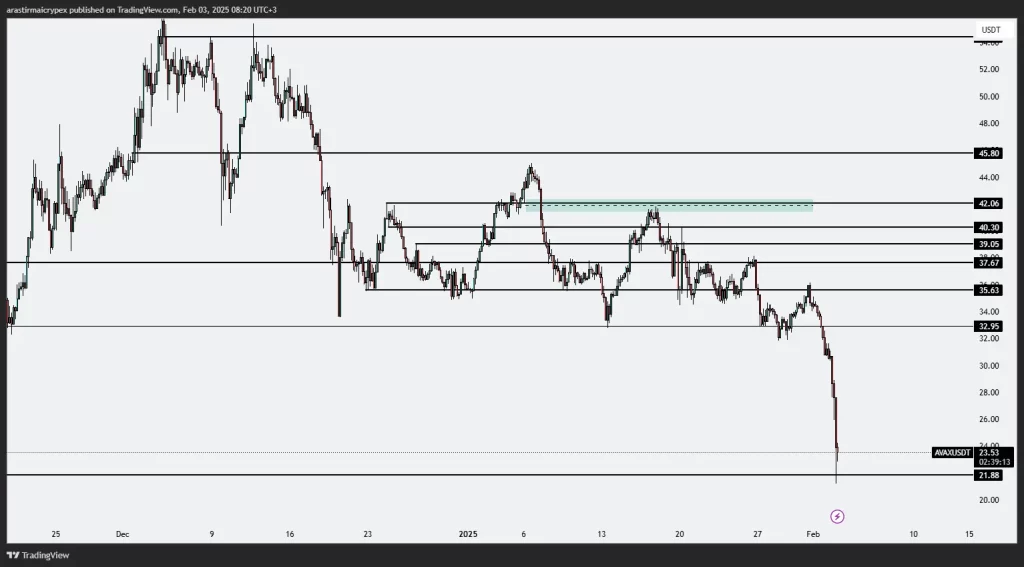

AVALANCHE (AVAX)

AVAX is trading at $ 23.53 with a 14.90% loss as of the morning hours. Although intermediate levels such as 40.30, 39.05 and 37.67 stand out as resistance – support transformation zones, the price is trading well below these levels. The 32.95 and 35.63 levels previously worked as support, but caused the selling pressure to accelerate after they were broken. The price is currently trading at 23.54, which is testing the short-term support. If it reacts from this level, the price can be expected to test 32.95 first. However, if this support is broken, the price is likely to fall to 21.88. Given the downtrend and strong selling pressure, it is important to monitor volume data and oversold areas. Price action at 23.54 is a critical indicator for assessing the recovery potential.

SOLANA (SOL)

SOL is priced at $ 192.80 as of the morning hours with a 5.31% loss in value. The 229.30 level had previously worked as support, but became resistance after being broken. The price broke the 201.83 level and fell to 192.34 and is currently testing this area. If this level is dropped below, the price is likely to decline towards the next support level around 180. On the other hand, in a possible recovery, the price may first test 201.83, then 229.30. In general, the downtrend is seen to be strong and the increase in volume data may indicate continued selling pressure. In addition, momentum indicators reaching oversold areas may trigger a short-term reaction movement.