Howard Lutnick Confirmed As US Trade Secretary – Strategy’s $2 Billion Convertible Bond Move

Howard Lutnick Confirmed As US Trade Secretary

The US Senate has confirmed Donald Trump’s crypto-friendly nominee Howard Lutnick as Commerce Secretary by a vote of 51-45. Lutnick will take on the Commerce Department’s mission of creating jobs, stimulating economic growth, and supporting innovation. He is also expected to support Trump’s policy of pressuring trade partners by increasing import duties. During his Senate confirmation process, Lutnick argued that tariffs do not cause inflation and stated that he would use import duties as a trump card to remove barriers to US exports.

Lutnick served for many years as CEO of the financial firm Cantor Fitzgerald, and his company operated as one of Tether’s custodians. Lutnick, who announced that he will leave all his business connections at Cantor due to his new role, continues his support for Bitcoin.

Strategy’s $2 Billion Convertible Note Move

Strategy (formerly MicroStrategy), which issued a profitability warning due to a $1.79 billion impairment loss from its Bitcoin assets, announced on the same day that it will issue $2 billion in convertible notes with 0% interest. The company stated that it will use the proceeds from this bond sale for general corporate purposes. However, the main goal is to finance Bitcoin purchases. The bonds mature on March 1, 2030, and investors can convert them with cash, Class A shares, or both.

The amount of Bitcoin on the company’s balance sheet increased by 258,320 BTC in 2024, reaching a total of 478,740 BTC. Strategy, which holds $46 billion worth of BTC, warned that market volatility could negatively impact the company’s financial stability.

SEC Reviewing Bitwise’s XRP Spot ETF Application

The U.S. Securities and Exchange Commission (SEC) has officially accepted Bitwise’s XRP spot ETF application. The proposal, submitted by Cboe BZX Exchange on Feb. 6, envisions XRP trading as a commodity-based investment fund. The SEC has a 90-day period to review the application and make a decision. If approved, the ETF would offer investors the opportunity to invest in regulated XRP through traditional financial instruments.

The application states that XRP is designed for fast and low-cost cross-border payments, while Bitcoin and Ethereum are more commonly used as stores of value. In addition, it is emphasized that Ripple’s XRP sales cannot be considered a security, citing the court decision between Ripple and the SEC.

FTX Begins Making First Payments to Customers in Bankruptcy Process

Bankrupt FTX has begun its first distribution of funds to customers. “Convenience Class” customers, who are owed up to $50,000, will begin receiving their payments in the next one to three business days. According to FTX, the funds will be accessible through BitGo and Kraken platforms. The next round of payments will be made on April 11.

FTX’s bankruptcy plan, which was approved in October 2024, promises to pay 98% of creditors at least 118% of the amount they claim in cash. However, some creditors argue that payments should be made in crypto.

Solana Crashes Over LIBRA Meme Coin Scandal

Solana (SOL) lost 8.8% of its value in the last 24 hours due to the LIBRA meme coin scandal, dropping to $163. This was SOL’s lowest level since December 2023. The crypto asset lost 16.5% in the last week and 39.1% in the last month.

Analysis revealed connections between LIBRA issuers and US First Lady Melania Trump’s MELANIA token. Solana’s decline is not only due to meme coin scandals, but also due to the upcoming unlock of 11.2 million SOL tokens. These assets, which will be released on March 1, were sold to institutional investors after the FTX crash.

Massive Interest in Ethereum ETFs

Ethereum’s upcoming Pectra upgrade has led investors to turn to ETH. Ethereum spot ETFs traded in the US recorded a total net inflow of $393 million this month, while Bitcoin ETFs experienced a net outflow of $376 million.

While the ETH price has not yet fully reflected this interest, analysts are highlighting faster transactions, improved staking mechanisms, and increased institutional interest with the Pectra update. With the upgrade expected to take place on April 8, the probability of Ethereum breaking the $3,000 level has increased to 30%.

Elon Musk-Led Department of Government Efficiency (DOGE) Takes Action Against the SEC

Elon Musk-led Department of Government Efficiency (DOGE) is taking aim at the U.S. Securities and Exchange Commission (SEC). According to Politico, DOGE is reportedly about to launch an investigation into the SEC. DOGE opened more than 30 sub-accounts in X with the aim of reducing unnecessary spending in government institutions and started collecting information about waste, corruption and abuses at the SEC by making an open call through the “DOGE SEC” account.

SEC’s Closed Meeting and Possible Withdrawal in Ripple Case

The US Securities and Exchange Commission (SEC) will hold a closed meeting on February 20, and its agenda includes issues related to litigation processes and sanctions. The possibility of withdrawing the appeal process for the Ripple case may be on the agenda at this meeting.

Recent management changes at the SEC and the new structure of the Crypto Task Force signal a change in attitude towards crypto regulations. Legal experts say the SEC could drop its anti-crypto sanctions and the possibility of dropping its appeal is growing.

Tether Makes Bid for a Majority Stake in Latin American Agricultural Giant Adecoagro

Tether has made an “unexpected” offer to acquire a majority stake in Adecoagro, a leading agricultural producer in Latin America. The offer, which aims to increase the company’s current 19.4% stake to 51%, was set at $12.41 per share.

Tether announced that it had made $13 billion in net profit in 2023 as it continues its strategy of investing in different areas beyond the crypto sector. Following the announcement of the offer, Adecoagro shares rose by 8% to $10.48.

——————————————————————————————

BITCOIN (BTC)

BTC is priced at $95,300 as of the morning hours, losing 0.38%. BTC is trading at 95,308, moving in an important support area. Having retreated to 93,388 levels as of yesterday, BTC has rejoined the safe zone with rapid recoveries. Holding on to this support level will be critical for BTC. If the possible 95,033 level is broken, it can first be expected to decline to 94,094. Then, there is a possibility of deepening further down to the supports of 93,227 and 91,792. In order for an upward movement to continue, the 96.374 level needs to be overcome. If this level is maintained, the 97.746 and 99.510 resistances can be targeted. As Bitcoin continues to trade in a critical region, whether the support levels can be maintained will be decisive in terms of the direction of the price movement.

ETHEREUM (ETH)

ETH is priced at $ 2,690 as of the morning hours with a 0.72% loss in value. Ethereum is exhibiting a horizontal movement, trading at 2,691. While the 2,761 level stands out as an important resistance point, the 2,622 and 2,581 support levels below should be followed carefully. The price staying above the 2,622 level is of critical importance for the rise to continue. In case of upward movements, if the 2,761 level is exceeded, the 2,836 and 2,919 resistance zones can be targeted. In a downward movement, breaking the 2,581 level may cause the price to pull back to the 2,523 and 2,399 levels. While Ethereum’s price movement fluctuates within a certain range, the breakout direction will be important in determining the trend.

RIPPLE (XRP)

XRP is priced at $ 2.69 as of the morning hours with a 1.17% loss in value. After breaking the 2,550 support level, XRP is showing movement at 2.52 levels with pullbacks. If the pullback continues, the 2,466 and 2,379 support levels should be followed in the movements. Especially if it falls below the 2,379 level, it is possible that the selling pressure will increase and the price may decline to 2,256. If an upward break occurs from the 2.550 level, an increase may be seen up to the 2.655 level. However, if it cannot be sustained above 2.655, pullbacks may occur again.

AVALANCHE (AVAX)

AVAX is trading at $ 23.33 as of the morning hours with a 0.81% loss in value. AVAX is trading just below the 23,632 resistance. Currently, the price is under downward pressure and the 22,920 support is being tested. If this level is broken, a drop to the 21,027 support may occur. It will be important for the price to show a strong recovery and maintain stability above the 24,468 level for buyers to step in. Otherwise, the selling pressure is likely to continue and the support levels are likely to be tested again. In the event of a possible rise, if the price is sustained above 23,632, it may be possible for the price to rise to 24,468. Then levels 25,640 and 27,087 can be targeted.

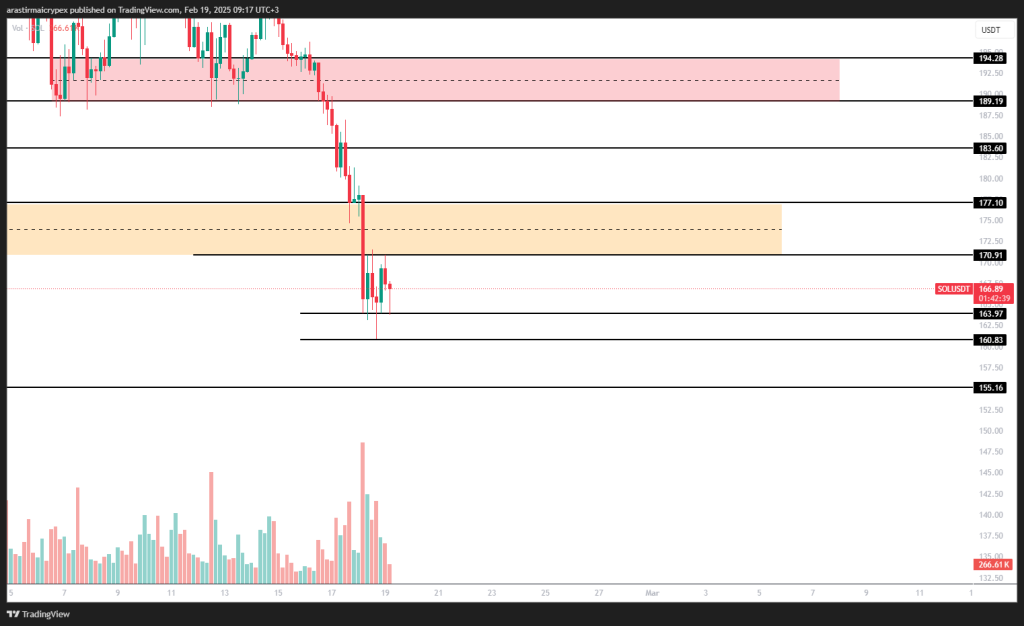

SOLANA (SOL)

SOL is priced at $ 166.85 as of the morning hours with a 1.45% loss in value. SOL is moving just below the 170.91 resistance. If the pullback in SOL continues, the 163.97 and 160.83 support levels can be tested first. The 155.16 level in particular stands out as a strong support area. If the downtrend continues, losing this level may trigger a pullback to the 144.00 level. For a possible positive trend, it will be important to first break the 170.91 and then the 177.10 levels and maintain continuity above them. Then, the 183.60 level can be targeted in the continuation of the rise.