Trump’s FED Pressure Hits Dollar Crypto Rises – Paul Atkins Inaugurates

Trump’s FED Pressure Hits Dollar Crypto Rises

US President Donald Trump’s criticism of Fed Chairman Jerome Powell and calls for a rate cut led to sharp fluctuations in the markets. On April 21, the S&P 500, Nasdaq and Dow Jones fell by over 2.4%, while the US Dollar Index (DXY) fell to its lowest level in three years. Trump said, “There is almost no inflation left,” demanding that interest rates be reduced immediately and stating that Powell should be dismissed.

Contrary to these developments, crypto markets showed a strong stance. While the total market value remained at $ 2.83 trillion, Bitcoin saw its highest level in the last four weeks at $ 88,500. “Bitcoin’s resilience has been remarkable,” Bitfinex analysts wrote.

Paul Atkins Officially Takes Office

The SEC has announced that long-time crypto advocate Paul Atkins has taken office as its new chairman. Under Atkins’ leadership, crypto regulations are expected to be made clearer and friendlier.

Atkins, who was nominated by President Donald Trump and confirmed by the Senate, has made reforming regulatory frameworks a “priority.” The SEC has also created a task force dedicated to crypto and has recently backed away from controversial practices.

Strategy Buys 6,556 BTC for $555 Million

Michael Saylor’s firm Strategy has purchased 6,556 Bitcoins for an average of $84,785 between April 14 and 20, bringing its portfolio to $555.8 million The latest purchase represents 1.2% of the firm’s total reserves of 538,200 BTC. The purchase was funded by the sale of $547.7 million in stock and $7.8 million in preferred stock.

The company, which has purchased 91,800 BTC so far in 2025, has increased its reserves by 17% this year. Saylor has re-energized its aggressive buying after a brief pause in late March.

Deutsche Bank and Standard Chartered Make US Crypto Move

A consortium of global banks, including Deutsche Bank and Standard Chartered, are exploring ways to expand their crypto operations in the US. According to the Wall Street Journal, the move is seen as a signal of traditional finance’s return to the sector after a period of stagnation following the FTX crash and the closure of crypto-friendly banks. Donald Trump’s crypto-friendly rhetoric is also shown as the political wind behind this interest.

Meanwhile, crypto firms such as BitGo, Circle, Coinbase and Paxos are reportedly preparing to obtain a bank license in the US. The only crypto firm with a federal bank license, Anchorage Digital, is under investigation as part of the El Dorado Task Force’s money laundering investigation. Anchorage denied the allegations and argued that the information in the news was based on speculation.

There Are 72 Crypto ETFs Awaiting SEC Approval

The SEC currently has 72 different crypto ETF applications on its desk. Notable assets such as XRP, Solana, Litecoin, Dogecoin and even the 2x leveraged Melania token are among these applications.

According to Bloomberg analyst Eric Balchunas, 2025 could be a “crazy year” for crypto ETFs. The filings include a 10-leveraged ETF offering from Cayman Islands-based Turtle Capital. The SEC’s decision to adopt a more crypto-friendly approach this year is fueling interest from institutional and retail investors.

USDC Nears $61 Billion, Institutional Demand Grows

USDC supply has increased by $17 billion since the beginning of the year, approaching $61 billion. This growth represents a much stronger momentum than USDT, which has increased by $7 billion in the same period.

Circle’s transparent reserve structure and regulatory compliance have made USDC a preferred choice among institutional investors. With potential IPO plans and regulatory clarity in Europe and the US, USDC is becoming the go-to stablecoin for regulation-sensitive players.

Circle Aims to Revolutionize Global Payments

Circle has introduced its new payments network, CPN, that works with USDC and EURC stablecoins. The platform aims to make cross-border payments 24/7, low-cost, and instant.

This initiative, launched with over 20 partners including dLocal, WorldRemit, and Deutsche Bank, targets the slow and expensive nature of traditional banking systems. With this move, Circle plans to become the foundation of the global payments infrastructure rather than just a stablecoin issuer.

MANTRA Burns 150 Million OM Tokens, Targeting 300 Million

MANTRA CEO John Mullin has permanently burned 150 million OM tokens in an effort to regain community trust. The move is part of a transparency and supply reduction strategy following the price crash.

A total burn of 300 million OM tokens is targeted, which will both reduce the supply by 17% and increase staking APRs. This step, which came after the sharp decline on April 13, is seen as a critical move to renew confidence in the project and revitalize the ecosystem.

———————————————————————————————

BITCOIN (BTC)

BTC is trading at $88,200 as of the morning hours, gaining 0.87% in value. The Bitcoin price continued its upward momentum with the support it received from the 83,000 USDT level and rose to the 88,727 resistance. This region is a strong supply area that has created selling pressure in the past. In the short term, the 86,100 level can work as an intermediate support. In the event of a downward correction, the liquidity area at the 83,000 level can be monitored as an important defense line. If an upward break occurs, prices above 89,000 may increase the momentum.

ETHEREUM (ETH)

ETH is priced at $ 1,580 as of the morning hours with a 0.27% loss in value. The price structure, which continues to remain below the 1,768 USDT level in the Ethereum chart, is being pressured by the falling trend line. In particular, the 1,680 – 1,720 band has created a strong supply zone and the price is retreating before breaking this zone upwards. This structure shows that the selling pressure continues. Although the 1,580 support is currently maintained, if it persists below this level, the 1,500 region may come to the fore again.

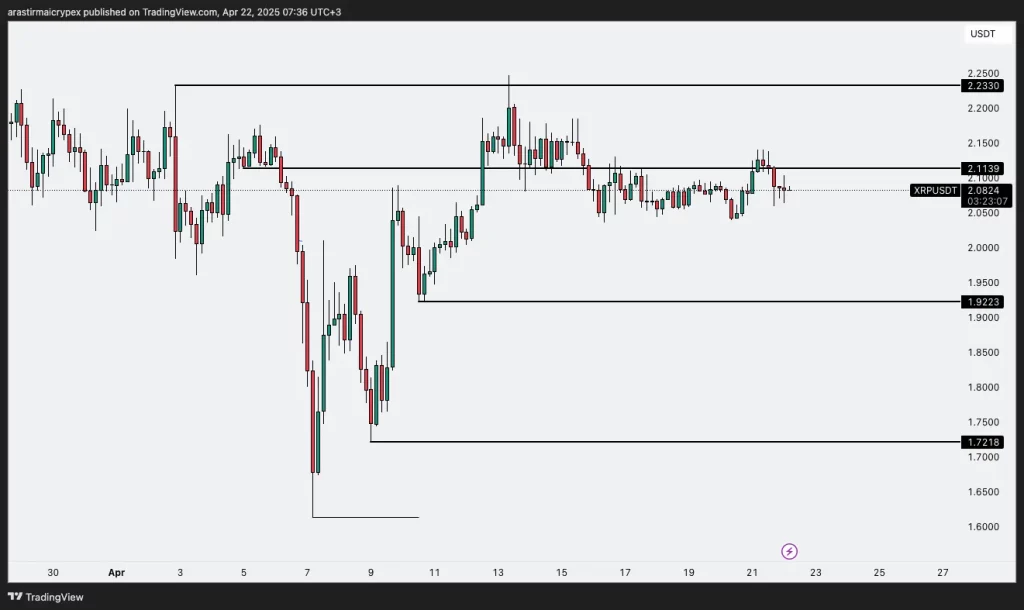

RIPPLE (XRP)

XRP is trading at $ 2.0827 levels with a loss of 0.13% as of the morning hours. The XRP price retreated after testing the 2.11 resistance and is currently trying to balance at 2.08 levels. As long as the 2.1139 level is not broken, this area will continue to remain a strong resistance. Below, the 1.9223 level can be followed as the intermediate support and 1.7218 as the main support zone. Horizontal movement and compression show that the price is looking for direction.

AVALANCHE (AVAX)

AVAX is trading at $ 19.86 as of the morning hours with a 0.30% loss in value. After the support it received from the 17.74 level, the AVAX price continued to rise and reached the 19.95 resistance. AVAX, which is currently facing sales in this resistance area, is in a short-term correction trend. In downward corrections, the 17.70 – 17.00 area can be followed for purchases. Prices above 20.50 and above may mean that the bulls take control.

SOLANA (SOL)

SOL is trading at $149 levels with a 1.82% gain as of the morning hours. Solana reached the strong resistance area in the 139 region with the rise it started from the 124 USDT level. This region draws attention as an area where the price has previously encountered selling pressure. The price is following a horizontal course here and is giving signals of indecision. In possible downward corrections, the 136 – 132 range can be monitored as support. Daily closes above 140 may trigger a new upward impulse movement.