SEC Approves Trump Media’s $2.3 Billion Bitcoin Treasury Deal – SharpLink’s Huge ETH Purchase

SEC Approves Trump Media’s $2.3 Billion Bitcoin Treasury Deal

The SEC has approved Trump Media’s $2.3 billion sale of 56 million shares and 29 million convertible notes. The company will use the funds to set up a Bitcoin treasury. The BTC will be included as cash equivalents on the company’s balance sheet, with custodial services provided by Crypto.com and Anchorage Digital.

Trump Media has also filed for a Bitcoin ETF. The move, backed by a $100 million investment from DRW Investments CEO Don Wilson, aims to integrate BTC into the payments infrastructure on its Truth Social and Truth+ platforms. However, it was noteworthy that this investment brought up conflicts of interest related to the Trump family.

Massive ETH Purchase from SharpLink

SharpLink Gaming has become the second largest ETH holder after the Ethereum Foundation by purchasing 176,270 ETH for approximately $ 463 million as part of its strategy to grow its Ethereum treasury. The purchase was financed with a $ 425 million private equity raise led by Consensys. SharpLink CEO stated that this step was taken with a strong belief in Ethereum’s future role in the digital economy.

The company also raised an additional $ 79 million between May 30 and June 12 and announced that it will use this income to purchase ETH. However, after a potential 68 million share sale application was made to the U.S. Securities and Exchange Commission (SEC), shares fell by 70%.

Metaplanet Reaches 10,000 BTC Target, New Target 210,000 BTC

Japanese investment firm Metaplanet completed its 2024 target by increasing its total Bitcoin holdings to 10,000 with its latest purchase of 1,112 BTC. The company announced that it made this purchase for approximately $ 117.2 million. On the same day, the issuance of $ 210 million in interest-free bonds to the Cayman Islands-based EVO Fund was approved. It was stated that the bond proceeds will be used to purchase more Bitcoin.

Metaplanet, which turned from the traditional hotel and technology sectors to a Bitcoin treasury in 2024, aims to accumulate a total of 210,000 BTC by 2027. This amount corresponds to about 1% of Bitcoin’s total supply. However, Metaplanet has become one of the most shorted stocks in Japan, with some analysts arguing that the company’s valuation is pricing the BTC price at exorbitant levels such as $596,000.

Cardano Founder Makes $100 Million Defi Move

Cardano founder Charles Hoskinson has proposed that $100 million of the ADAs held in the Cardano Foundation treasury be used for investment in the ecosystem. The plan includes the purchase of local stablecoins such as USDM, USDA, and IUSD, as well as external assets such as Bitcoin. The aim is to strengthen the DeFi infrastructure, increase stablecoin issuance to 30-40% of TVL, and facilitate the listing of Cardano-based assets on exchanges.

Although there are also cautious views in the community due to the price impact, Hoskinson is confident in ADA’s liquidity depth. The sales are planned to be spread through methods such as OTC and TWAP. Hoskinson, who stated that the Ethereum Foundation similarly supports developers, emphasized that Cardano should fund itself with its own assets. While the discussions are ongoing, the plan has not yet been made official.

Spot Solana ETF Race Accelerates

On June 13, seven major investment companies, including Fidelity, Grayscale, VanEck and Franklin Templeton, filed new or updated S-1 documents for the spot Solana ETF with the U.S. Securities and Exchange Commission (SEC). The common element that draws attention is that all applications include staking. While Fidelity applied for the Solana ETF for the first time, VanEck, Grayscale and other companies revised their existing applications by adding staking details.

According to ETF experts, the increase in applications creates optimism in the market, while it is emphasized that the process is still at the beginning. Bloomberg analysts state that the SEC will conduct many rounds of negotiations before granting approval. The SEC’s request for detailed updates to some of the applications and clarification on staking rewards and redemption processes indicate that the applications are being actively reviewed. Solana’s futures trading on CME is also considered to be among the factors that increase its chances of approval.

SEC Appoints Former Blockchain Executive to Senior Position

The U.S. Securities and Exchange Commission (SEC) has announced new appointments, including those with experience in the crypto and blockchain fields. Blockchain.com’s former head of institutional markets Jamie Selway has been named director of the SEC’s “markets and transactions” division, while Brian Daly from the law firm Akin Gump has been appointed head of the investment management unit.

These appointments come as Congress prepares to vote on the CLARITY Act, which aims to clarify the authority of the SEC and the Commodity Futures Trading Commission (CFTC) over digital assets. The SEC also announced that it has withdrawn some crypto-focused regulatory proposals it had published in the 2022-2023 period.

Vietnam Gives Legal Ground to Crypto

On June 14, the Vietnamese National Assembly passed the new Digital Technology Industry Law, which recognizes and regulates digital assets. The law, which will come into force on January 1, 2026, introduces a formal legal framework for crypto assets and virtual assets by classifying them into separate categories. While the new law does not cover securities or digital central bank currencies, it aims to bring anti-money laundering and cybersecurity measures in line with international standards.

The law offers various incentives not only for crypto, but also for strategic areas such as artificial intelligence, semiconductors, and digital infrastructure. With practices such as the integration of digital skills into education policies, R&D support, and tax exemptions, Vietnam aims to become one of the global technology hubs. With this move, Vietnam became the first country to enact a new tax-specific regulation for digital technology.

Brazil Hits Crypto Earnings with a New Tax Blow

Brazil has ended its crypto tax exemption for small investors and introduced a flat-rate tax of 17.5% on digital asset gains. The regulation, which came into effect on June 12, has been expanded to include cryptocurrency holders and assets on foreign exchanges. Previously, monthly sales of up to 35,000 reais were exempt from tax.

The new system may increase the tax burden for low-volume investors, while lower rates may be an advantage for investors with high-volume transactions. In addition, investment income will be assessed on a quarterly basis and losses can be offset for up to five quarters in the past. This period will be shortened starting in 2026. The government also increased taxes on fixed-income financial products by 5% and betting income by 18%.

——————————————————————————————

BITCOIN(BTC)

BTC recovered with the support it received from the $ 101,315 level and is currently priced at $ 106,160. If the $ 107,319 level is broken in the short term, the rise may accelerate and accelerate towards $ 111,861. Otherwise, the $ 105,778 and $ 101,315 levels will come to the agenda as support again. These two levels will play a critical role in maintaining the upward structure of the price.

ETHEREUM(ETH)

On the ETH chart, the price seems to have entered a recovery trend after testing the $ 2,550 support. While the $ 2,679 level stands out as the first important resistance point, if this level is exceeded, there may be an increase potential up to $ 2,874. Closing below $ 2,550 may cause the $ 2,385 support to come to the fore.

RIPPLE(XRP)

XRP is showing an upward recovery with the support it received from the $ 2.10 level. However, the $ 2.28 – $ 2.36 range is a strong resistance band and the continuation of the rise may be limited unless this region is passed. If it holds above $ 2.17, a new attack towards this level can be expected. Otherwise, 2.10 support may be retested.

AVALANCHE(AVAX)

AVAX continues to struggle to form a base at $ 18.90. This region has been tested many times in recent weeks and is a support area where buyers have stepped in. In a potential upward movement, the $ 20.25 – $ 21.48 – $ 22.79 levels should be followed as resistance, respectively. However, if the price loses the 18.90 support, a pullback to around $ 17.50 is possible.

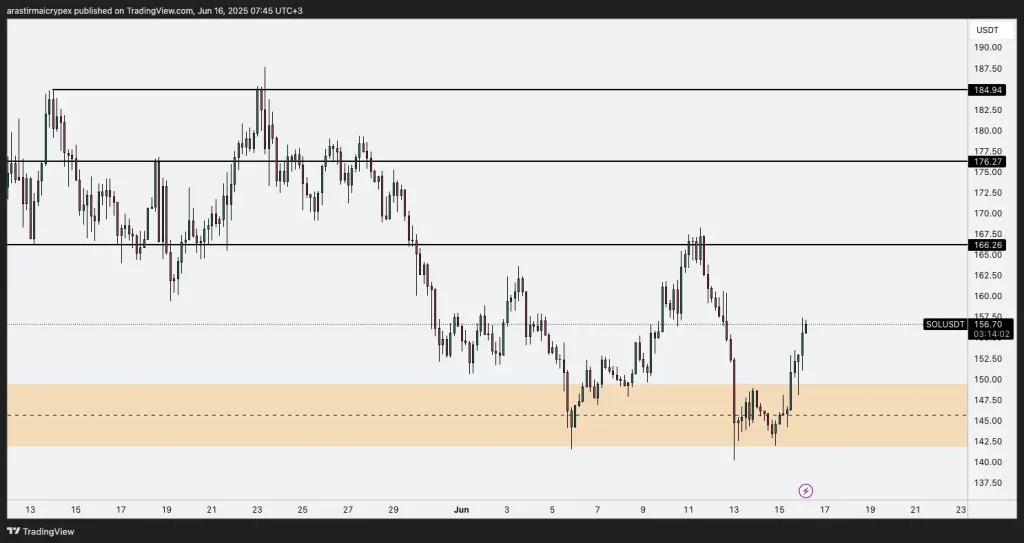

SOLANA(SOL)

The Solana price received a strong reaction from the liquidity support area in the $ 144 – $ 147 band and rose to the $ 156 level. Considering that this area worked as both support and resistance in previous price movements, the buying interest from here was an expected reaction in technical terms. If the upward movement continues, the 166.26 and then the 176.27 levels can be followed as resistance. Below, the $ 147 – $ 144 band is preserved as the main support again.