What is Euro Tether (EURT)? Which Advantages Does It Offer?

Euro Tether is the first stablecoin pegged 1:1 to the Euro. It was developed by Tether and is backed by Tether’s reserves. Euro Tether’s native cryptocurrency is EURT. In this article, we will look for answers to questions such as what is Euro Tether (EURT), what does Euro Tether (EURT) do, what are the advantages of Euro Tether (EURT).

What is Euro Tether (EURT)? What Does It Do?

Euro Tether represents ownership of the Euro. The Euro is a blockchain-based digital currency that moves with its price. This places Euro Tether in the stablecoin class. It provides users around the world with a digital representation of the Euro as well as a new way of trading. One of the main purposes of Euro Tether is to hedge against volatility in the cryptocurrency world, as with Tether USDT. Users can also gain flexibility in the crypto market thanks to Euro Tether (EURT).

Tether publishes a record of its current reserve holdings of stable cryptocurrencies in Euro Tether, Dollar, Chinese Yuan. This allows users to transparently monitor the activities carried out by Tether.

What Advantages Does Euro Tether (EURT) Offer?

Euro Tether (EURT) offers a number of advantages to protect against the general volatility of cryptocurrencies and provide ease of trading.

Minimize Transaction Risk:

Thanks to the euro’s stable position, users can achieve better personal portfolio management by solving their needs for minimal transaction risk.

Trade Intermediary:

It is a powerful option for users who want to trade in foreign currencies.

Prevalence:

It is used on many exchanges. It provides convenience to users trading on different exchanges in this respect.

Fast Transfer

Users can make fast transfers anywhere in the world without worrying about delays that can occur with traditional banking transactions.

Fiduciary Currency Option:

Since it is available in many fiat currencies, it is advantageous in meeting the needs of users.

Low Transaction Fee:

It does not burden users financially as it offers low costs for both small and large transfers.

Payment Instrument:

Thanks to its stable and liquid structure, it can be a fast and secure means of payment for people engaged in trade. It also makes it possible for consumers to shop in the real world.

Liquidity Transfers:

Large-scale liquidity can be easily moved to exchanges. In this way, people dealing with trade can trade in a practical way.

How Does Euro Tether (EURT) Work?

Euro Tether are assets that move through the blockchain as easily as other digital currencies but are pegged to the fiat currency, the Euro, on a 1-to-1 basis (for example, 1 EURT = 1 EURO). Euro Tether offers price stability as it is pegged to the fiat currency Euro and is called a stablecoin. This provides traders and funds with a low volatility solution when exiting positions in the market. All Euro Tether tokens are backed by 100% Tether reserves.

Euro Tether is created and managed by a central authority. This allows the company to increase or decrease the supply of stablecoins. For example, when new Euro collateral is added, new Euro Tether (EURT) tokens can be minted. Conversely, when users redeem or destroy their Euro Tethers, these tokens can be “burned” and collateral can also be reduced.

When Tether first took off, it was published on the Bitcoin blockchain via the Omni Layer protocol, a decentralized platform used to create and trade assets on Bitcoin. Today, most Tether tokens are issued on Ethereum (ETH) and other blockchains such as Tron (TRX) and EOS (EOS).

Who are the Founders of Euro Tether (EURT)?

Euro Tether is a token issued by the Honk-Kong based company Tether. This company is the creator of Tether USDT, Tether Gold, Tether CNHT, Tether MXNT, as well as Euro Tether. In this context, it would be better to closely examine the founders of Tether.

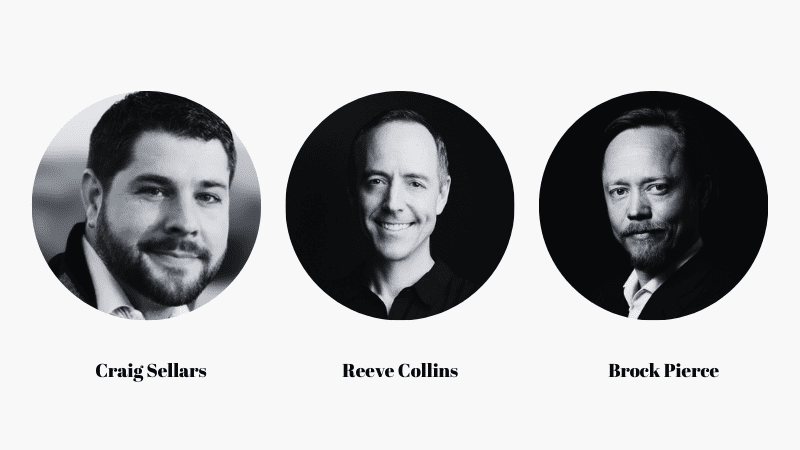

Tether was founded by a group of Bitcoin enthusiasts who were passionate about facilitating the use of fiat currencies in a digital way. These people are Reeve Collins, Brock Pierce and Craig Sellars.

Reeve Collins was co-founder and CEO of Tether. Reeve Collins, who graduated from Washington State University with a degree in Marketing and Economics, has been the founder and CEO of many companies in his career. Prior to Tether, Reeve Collins’ background includes co-founding Traffic Marketplace, an online advertising network; founder of FusionDirect, a DRTV company; founder and CEO of Fingerprint Promotions, a provider of promotional products; co-founder and CEO of Red Lever, a production company; co-founder and CEO of Pala Interactive, a B2B online real money and social gaming platform; and co-founder and CEO of BLOK V, which creates, prints and distributes NFTs. Currently, he is the co-founder of SmartMedia Technologies, a Web 3 platform.

Brock Pierce co-founded and advised Tether. Brock Pierce began studying film at the University of Southern California and dropped out in his first year. Brock Pierce, who has worked in the cryptocurrency and entertainment industry in his career, is also a former actor. As co-founder of Blockchain Capital, Brock Pierce has also served as a director of the Bitcoin Foundation. In addition, it is worth highlighting Block.one, the company behind EOS.

Craig Sellars was a founder and CTO at Tether. In addition to working on Tether, Craig Sellars was and remains a CTO at the foundation of Omni, a protocol that allows users to create and trade properties and currencies using smart contracts with blockchain technology. He has also worked for many other cryptocurrency companies and organizations such as Factom, Synereo, Bitfinex and the MaidSafe Foundation. Trusted by many companies as a technology advisor and CTO, Craig Sellars is now co-founder, CEO and CTO of Self ID, a company that offers a new paradigm for how identity and data is owned and shared with the world.

What Other Things to Know About Euro Tether (EURT)?

To find out a little more about Euro Tether (EURT), it’s worth taking a look at the answers to some of the questions below.

Is EURT a token? Or is it a coin?

Coin is a cryptocurrency created on its own blockchain. A token is a cryptocurrency that does not have its own blockchain and is created on an existing blockchain. EURT is a token because it does not have its own blockchain.

Which blockchain is the EURT token on?

The EURT token exists on several blockchains, such as Ethereum (ETH), Tron (TRX) and EOSIO (EOS).

Is EURT token mining done?

EURT is not mined. In addition, the printing and burning of Euro Tether is carried out by the Tether company according to the balance of supply and demand.

How to buy EURT tokens?

To buy EURTH tokens, it is sufficient to create a membership on ICRYPEX. Once the membership process is complete, other cryptocurrencies including EURT token can be traded quickly, easily and securely.

How to Become a Member of ICRYPEX?

After visiting www.icrypex.com from a browser, you can click on the “SUBSCRIBE” button at the top right of the page, fill in the required information and you can easily create your membership.

From mobile devices, primarily;

Android users can download our app by clicking here, Apple users by clicking here and HUAWEI users by clicking here. After logging in to the application, you can click on the menu icon at the top left, then click on “SUBSCRIBE” to fill in the required information and easily create your membership.