ApeCoin Provides Local Yield and Gas Functionality – Stripe Makes Crypto History with $1.1 Billion Bridge Acquisition

ApeCoin Provides Local Yield and Gas Functionality with Bridges on ApeChain

ApeCoin enables users to earn local yields on APE, ETH, and stablecoins by launching bridges on ApeChain, increasing liquidity and cross-network asset transfer. APE becomes the first token to function as gas and yield on ApeChain thanks to LayerZero’s OFT standard integration. ApeCoin’s core user incentive program is expected to further increase token usage and engagement. The market reacted positively, causing APE to gain 76% in 24 hours.

Stripe Makes Crypto History with $1.1 Billion Bridge Acquisition

Stripe has made the largest acquisition in its history and in the crypto industry, buying stablecoin platform Bridge for $1.1 billion. Bridge offers software that helps people accept stablecoin payments and was valued at $200 million after previously raising $58 million. The move highlights Stripe’s growing efforts in the crypto space, following the company’s relaunch of USDC on Ethereum, Solana, and Polygon. Stripe has also partnered with Coinbase to integrate its payments services into the Coinbase ecosystem.

US Spot Bitcoin ETFs Reach Record Net Asset Value of $66 Billion

US-based spot Bitcoin ETFs have reached a record total net asset value of over $66 billion after a six-day streak of positive inflows. These ETFs saw their best performance since March, recording over $2 billion in inflows in the past week alone. The ETFs’ value has been boosted by the 12% increase in Bitcoin prices since Oct. 10. BlackRock’s IBIT ETF had the biggest individual gain, gaining over $3 billion in asset value over the same period. The SEC has also approved options trading for several spot Bitcoin ETFs.

Vitalik Buterin’s Solutions to Centralization and Staking Problems in Ethereum

Vitalik Buterin, one of the founders of Ethereum, has offered several suggestions to solve the problems experienced in the network centralization and block production with staking. Buterin stated that economies of scale in staking attract small pools to larger pools, and therefore 88% of block production is done by just two entities. To combat this, he suggested a limit on the amount of Ether that users can stake and that staking penalties should be limited to 12.5% of the staked ETH. He also offered solutions such as the “fork-choice-enforced inclusion list” and the “BRAID” system, which divides block production among multiple actors, in order to decentralize block production.

PayPal’s Stablecoin PYUSD Becomes a Strong Competitor, Increasing Market Share by 57%

PayPal’s stablecoin PYUSD stands out as a strong competitor in the stablecoin market, increasing its market dominance by 57% in Q3 2024. While USDT and USDC continue to dominate the market, the rise of PYUSD suggests that the market may change direction. Launched in 2023 and backed by US dollar reserves, PYUSD has grown faster than USDC and USDT, reaching a market cap of $1 billion in 383 days. HashDex Research attributes PYUSD’s growth to possible institutional adoption and expansion into Solana, predicting that it could gain more market share in the future.

————————————————————————————————

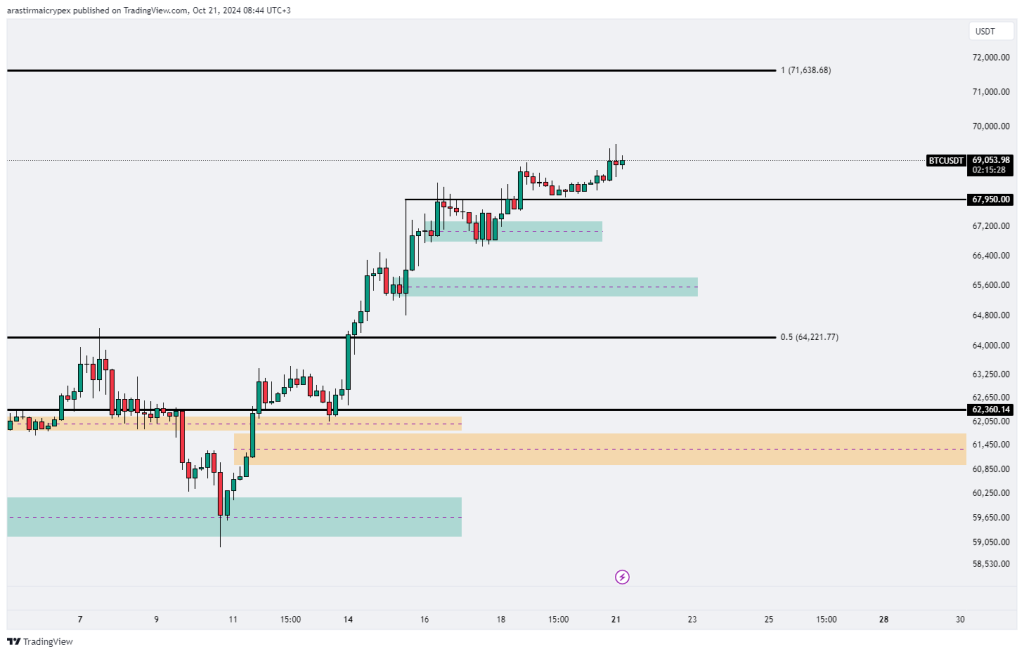

BITCOIN (BTC)

BTC is priced at $69,052 with a 0.03% gain as of the morning hours. The price is trading above the 67,950 level, which stands out as an important support point. If the price can maintain this support, the upward movement can be expected to continue. In the upper region, there is a critical resistance at 71,638.68. If this resistance is overcome, there may be a potential rise towards the 72,000 level. However, if the price falls below 67,950, the probability of a pullback to the 67,200 and 66,400 levels increases. In particular, the 64,221.77 level stands out as an important support point for possible deeper corrections. In summary, BTC’s direction will be determined depending on whether the 67,950 support is maintained or the 71,638.68 resistance is overcome.

ETHEREUM (ETH)

ETH is priced at $2736 with a 0.38% loss in value as of the morning hours. The price is approaching an important resistance area at 2,690. This resistance has played a significant role in the price movements in recent days and if it is exceeded, an increase towards higher levels, especially 2,819, can be seen. Below, there is an important support area at 2,570. This level may offer buying opportunities in possible pullbacks. However, if the price loses the 2,461.59 support, deeper corrections can be expected and a decline to 2,338.99 may be experienced. In general, the direction of ETH will be determined depending on whether the 2,690 resistance is overcome or the 2,570 support level is maintained.

RIPPLE (XRP)

As of this morning, XRP is priced at $0.5477, down 0.09%. The price is approaching a significant resistance area at 0.5500. This level has been a significant resistance point in past price movements. If XRP can break above 0.5500, the price is likely to rise to 0.5800. There is support below at 0.5400. This support may offer buying opportunities in possible pullbacks. However, if the price falls below this support level, a decline to lower levels such as 0.5250 and 0.5100 may occur. In general, the direction of XRP will be determined depending on whether the 0.5500 resistance is broken or the 0.5400 support is maintained. Monitoring these levels is critical in evaluating buying and selling opportunities.

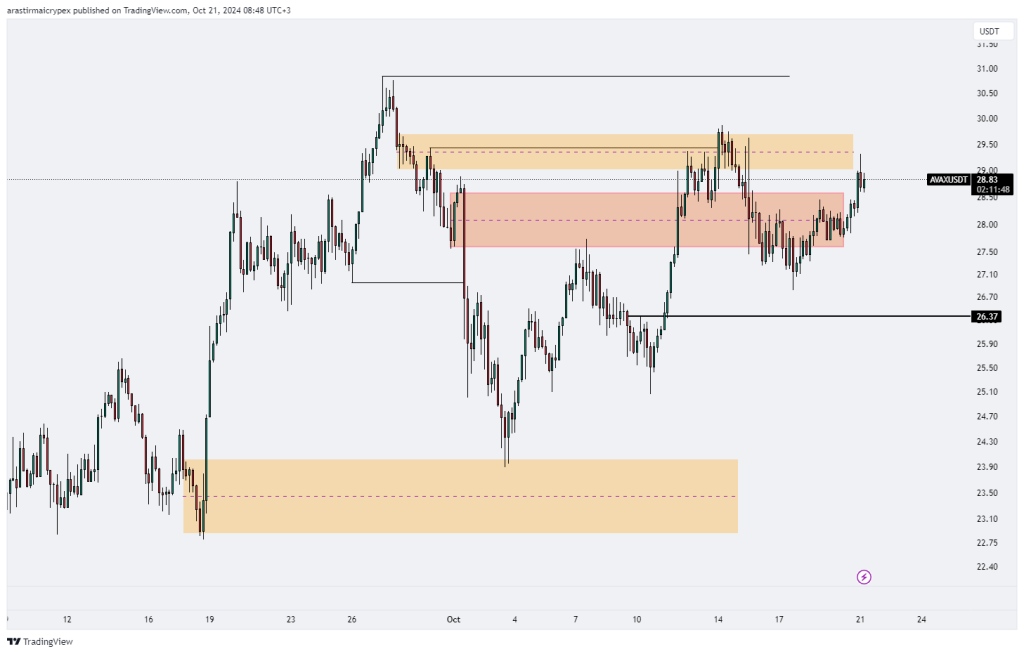

AVALANCHE (AVAX)

AVAX is priced at $27.48 with a 0.55% gain as of the morning hours. The price is approaching a significant resistance area at 29.00. This level stands out as a significant resistance point in past price movements. If AVAX can break 29.00, the price is likely to rise to 30.00. Below, there is strong support at 26.37. This support may offer buying opportunities in possible pullbacks. However, if the price falls below this support level, a decline to lower levels such as 25.90 may be experienced. In general, the direction of AVAX will be determined depending on whether the 29.00 resistance is broken or the 26.37 support is maintained.

SOLANA (SOL)

SOL is priced at $169.52 with a 1.25% gain as of the morning hours. The price is trading above an important support area at 163.70. This support may offer buying opportunities in possible pullbacks. If the SOL price falls below this support level, the 157.00 and 153.00 levels will stand out as important support points for deeper pullbacks. In the upper region, the 173.00 level is an important resistance point. If the price can overcome this resistance, a rise towards 178.00 can be expected. The price has been fluctuating strongly above the 163.70 support in recent days and is approaching the 173.00 resistance. In general, the direction of SOL will be determined depending on whether the 173.00 resistance is broken or the 163.70 support is maintained.