Avalanche Unveils Crypto Visa Card – $79 Million Outflow in Spot Bitcoin ETFs

Avalanche Unveils Crypto Visa Card

The Avalanche Foundation has launched the Avalanche Card, a new Visa card that allows spending with cryptocurrencies like USDC, WAVAX, and sAVAX. Available both physically and virtually, the card is linked to a self-custody wallet with unique addresses for each cryptocurrency. Card usage does not impact credit scores and there are no spending fees. The card, which will be available first in Latin America and the Caribbean, is provided by Rain Liquidity, which does not offer FDIC insurance, and residents of some countries are not eligible. Users can sign up for a waiting list for early access.

$79 Million Outflow in Spot Bitcoin ETFs

Spot Bitcoin ETFs in the U.S. recorded net outflows of $79 million on Tuesday, ending a seven-day streak of inflows exceeding $2.6 billion. Outflows were led by Ark and 21Shares’ ARKB, which saw outflows of $134.74 million. BlackRock’s IBIT ETF saw net inflows of $42.98 million, while Fidelity’s FBTC saw net inflows of $8.85 million. Despite the outflows, the ETFs saw total net inflows of $21.15 billion. This coincided with a previous streak of inflows when Bitcoin reached $69,400.

Bitcoin Hash Rate Hits Record Level

Bitcoin’s hash rate reached a new all-time high of 791.62 million TH/s, up 74% YoY. This increase was driven by the adoption of advanced mining technology. US-based miners like Marathon Digital and CleanSpark control 29% of the global hash rate due to their efficiency and funding advantages. Bitcoin’s mining difficulty is also approaching a record high of 95.88 trillion, up 4.17%. Despite the increased difficulty, daily mining revenues remained steady at $38.38 million, down 33.2% from last year. Bitcoin reached a three-month high of $69,000.

Data Enhancement with AI and Blockchain from Chainlink

Chainlink has announced the results of a trial to improve corporate action data reporting using AI and blockchain, with partners including Euroclear, Swift, UBS, and Franklin Templeton. The initiative demonstrated that AI, oracles, and blockchains could save businesses $3 million to $5 million per year by automating and standardizing complex corporate action processes. Chainlink used AI models from OpenAI, Google, and Anthropic to create unified, verifiable data records for financial events. The project achieved 100% consensus in fixed income securities and will include future integration of Swift standards and addressing AI-related responsibilities. Chainlink’s token, LINK, is trading sideways despite ecosystem integrations.

FCA Advocates for Strict Crypto Regulation

The UK Financial Conduct Authority (FCA) is advocating strict crypto regulations to prevent money laundering, despite concerns about the potential negative impact on growth in the sector. Val Smith, head of digital assets and payments at the FCA, said these rules are important to protect the financial system from risks such as money laundering. While some fear that these regulations could reduce the number of crypto businesses in the UK, Smith said protecting the integrity of the market is a priority. He also warned against lowering regulatory standards, saying this could undermine the long-term sustainability of the sector.

————————————————————————————————

BITCOIN (BTC)

BTC is priced at $67,000 with a 0.56% gain as of the morning hours. Resistance levels have been determined as 67,950.00 and 71,638.68, which are points to be considered in case the price moves upwards. It is observed that the price movement finds support at an average level of 66,000.00 and has previously remained below this level. It is seen that the level of 62,360.14 has been determined as another important support point. If the price falls below this support level, a decline to the level of 57,572.75 may occur. As a result, it is important that the resistance of 67,950.00 should be overcome for upward movements, and that the support levels of 66,000.00 and 62,360.14 should be protected for downward movements.

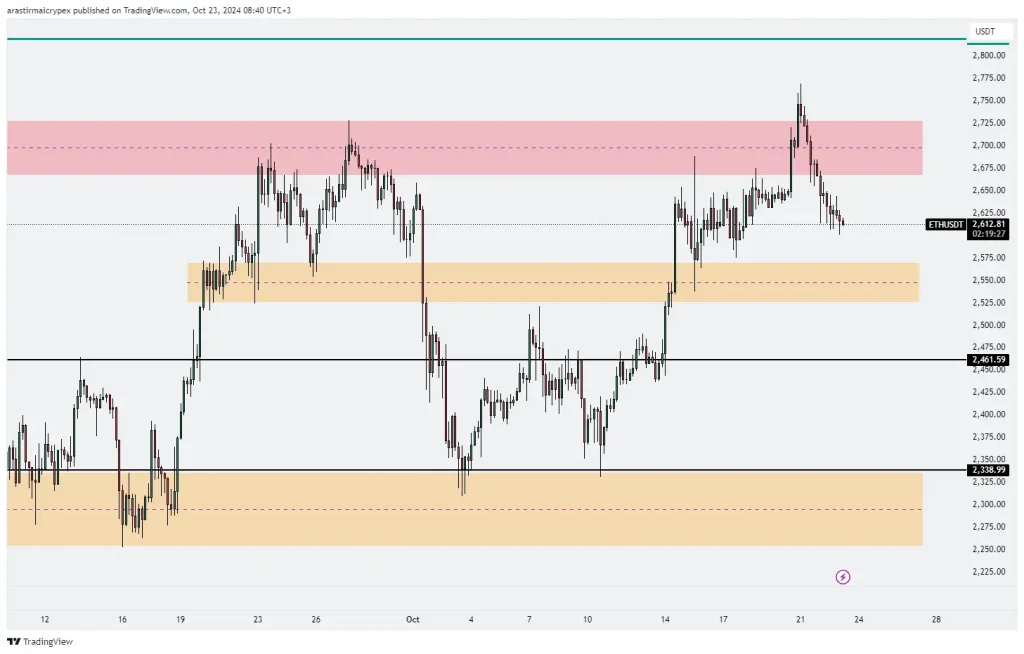

ETHEREUM (ETH)

ETH is priced at $2611 with a 0.43% loss as of the morning hours. There are two important resistance areas between the levels of 2,675.00 and 2,700.00. These levels are critical points to consider in case the price moves upwards. The levels of 2,550.00 and 2,461.59 have been determined as important support areas. If the price falls below these support levels, there is a risk of falling to the level of 2,338.99. In addition, the level of 2,500.00 is a level to watch in order to determine whether the price can rise again. As a result, it should be emphasized that the resistance levels of 2,675.00 and 2,700.00 should be overcome for upward movements, while the support levels of 2,550.00 and 2,461.59 should be protected in downward movements.

RIPPLE (XRP)

As of the morning hours, XRP is priced at $0.5294 with a 1.56% loss in value. The 0.5900 and 0.5800 levels have been determined as critical resistance areas. If the price moves towards these levels, it is thought that selling pressure may increase. The 0.5100 and 0.4900 levels are important support areas. If the price falls below these support levels, more selling pressure may occur below and there is a risk of a decline to the 0.4900 USDT level. As a result, the 0.5900 and 0.5800 levels stand out as resistance levels to be considered in upward movements, while the 0.5100 and 0.4900 support levels are also highlighted as points to be monitored in possible declines.

AVALANCHE (AVAX)

AVAX is priced at $27.24 with a 1.45% loss in value as of the morning hours. The red areas between 28.50 and 29.50 levels constitute a significant resistance zone. If the price reaches these levels, it is predicted that selling pressure may increase. If the price manages to overcome this resistance level, targets of 30.00 and above may come to the agenda. Below, there is a strong support zone at 26.37. If the price falls below this level, there is a risk of a decline towards 25.00 levels. However, a closing below 26.37 indicates that more selling pressure may be effective.

SOLANA (SOL)

SOL is priced at $168 with a 1.1% gain as of the morning hours. The 167.50 USDT level stands out as a resistance point above the parity. If the price breaks this level, 170.00 and then 175.00 levels can be targeted. On the other hand, there is a support zone below at 163.70. If the price breaks below this level, the probability of a drop towards 160.00 levels will increase.