CleanSpark Recovers 200 MW After Hurricane Helene – Ethereum Foundation Has Sold Over $10 Million in ETH This Year

CleanSpark Recovers 200 MW After Hurricane Helene

CleanSpark shut down 365 MW of capacity at its Georgia facilities ahead of Hurricane Helene, but has since brought 200 MW back online and expects to be back at full capacity by October 4. The company’s hash rate has returned to 22 EH/s and is expected to reach 28 EH/s once all facilities are fully operational. Despite the storm’s impact, CleanSpark’s diversified portfolio has allowed it to maintain 10.5 EH/s in Northwest Georgia, Mississippi and Tennessee. The company expressed its condolences to those affected by the hurricane and stated that its long-term hash rate targets are 37 EH/s by the end of 2024 and 50 EH/s by 2025.

Ethereum Foundation Sold Over $10 Million Worth of ETH This Year

This year, according to on-chain data, the Ethereum Foundation sold $10 million (3,766 ETH) worth of ETH, including a recent transaction of 100 ETH ($263,000). The foundation has faced criticism from the community for these large transfers, with calls for increased transparency. Ethereum researcher Justin Drake said that a financial report will be released soon, indicating that the foundation spends about $100 million per year, with about $650 million in its main wallet. Co-founder Vitalik Buterin said that their strategy is to spend 15% of the remaining funds in the foundation annually to maintain longevity.

FTT Gains 50% Value with FTX Refund News

FTX’s native token, FTT, has gained 50% on rumors of false payments. However, FTX’s actual payment plan has yet to be approved and the next hearing is scheduled for October 7. If approved, claims under $50,000 could start being paid by the end of 2024, while larger claims could wait until mid-2025. FTX creditors were outraged to learn that the firm’s payment plan set aside 18% of revenue for a special fund for certain shareholders, and that this information was revealed after they voted. Creditors estimate they will only be able to recover 10% to 25% of their assets.

TRON DAO Strengthens Network Integrity

TRON DAO has strengthened its network integrity by completing a security assessment of the Java – Tron client conducted by ChainSecurity. The assessment identified vulnerabilities related to PBFT messages, permissionless fork block censorship, and resource consumption of unsigned blocks, all of which were quickly resolved by the TRON development team. The key fixes include limiting PBFT message processing, filtering invalid fork blocks, and removing unsigned blocks from the transaction, ensuring network stability is maintained. TRON DAO sees this assessment as a milestone in maintaining security and emphasizes its commitment to providing a secure and stable blockchain ecosystem for its global user base.

Ethereum Gas Fees Increase by 498%

Gas fees on the Ethereum network have increased by 498% over the past two weeks, pushing the average transaction cost from $0.09 to $1.69. This increase was driven by higher DEX trading volumes, higher USDC deposit rates on Aave, and a 17% increase in ETH transfer volumes. This increase in the network led to a 900% increase in total daily ETH burn fees, reaching 2,097 ETH. Despite the positive momentum shift in price, ETH price still remains below critical resistance levels, with the 100-day and 200-day exponential moving averages acting as significant hurdles.

Former Chinese Finance Minister Calls for Closer Scrutiny of Cryptocurrencies

Former Chinese Vice Minister of Finance Zhu Guangyao called on China to reconsider its stance on cryptocurrencies at the 2024 Tsinghua PBC Chief Economist Forum, noting global policy shifts, particularly in the US. Zhu cited the SEC’s approval of Bitcoin and Ethereum ETFs and support from figures such as US presidential candidate Donald Trump as examples of increasing international acceptance of digital assets. While acknowledging the risks of cryptocurrencies, he stressed that China should closely monitor these developments. Despite China’s history of being restrictive, Hong Kong has adopted a more open approach, creating a regulatory framework to attract global crypto firms to the city.

Powell Hits the Brakes on Another Huge Rate Cut This Year

US Federal Reserve Chairman Jerome Powell said they are not in a rush to cut interest rates further after this month’s 50 basis point cut, and said only two more small cuts are likely by the end of the year. Emphasizing that future interest rate decisions will depend on economic data, Powell said they are taking a cautious approach to easing monetary policy. While lower borrowing costs are generally positive for risky assets such as stocks and crypto, Powell warned that the pace of cuts will vary depending on economic performance. The market currently expects the federal funds rate to fall another 50 basis points by the end of the year, with the target range set at 4.00% to 4.25% after the December meeting.

————————————————————————————————

BITCOIN (BTC)

BTC is priced at $63,770 with a 0.70% increase in value as of the morning hours. $66,500 was seen but could not be sustained above it. Pricing is seen between 63,000 – 65,000. If it is sustained above 66,000, the price can go up to 70,000. A pullback to 63,000 can occur in pricing below 64,500.

ETHEREUM (ETH)

ETH is priced at $2636.70 with a 1.33% increase in value as of the morning hours. After an increase to $2700, a pullback occurred and the rise is currently continuing. A move to $2800 can be seen in pricing above $2700. In the pullback, $2550 seems to be a strong support.

RIPPLE (XRP)

XRP is priced at $0.62 with a 1.47% gain as of the morning hours. It is trading at 0.62 on the 4-hour chart and is showing an upward trend. The price broke the middle resistance at 0.6100 and is currently consolidating at the 0.64 – 0.60 resistance. Breaking the 0.66 resistance is critical for the continuation of the rise. If this resistance is not overcome, the price is likely to fall back to the additional support point at 0.60. If this support level is broken, the risk of falling back to the stronger support area at 0.58 may increase.

AVALANCHE (AVAX)

AVAX is priced at $28.43 with a 2.63% increase in value as of the morning hours. The 30.80 level was seen. Permanence could not be achieved at first, but there is a movement towards that level again. If pricing above $30 is seen, an increase to $33 can be seen. 28.00 seems strong as the first support.

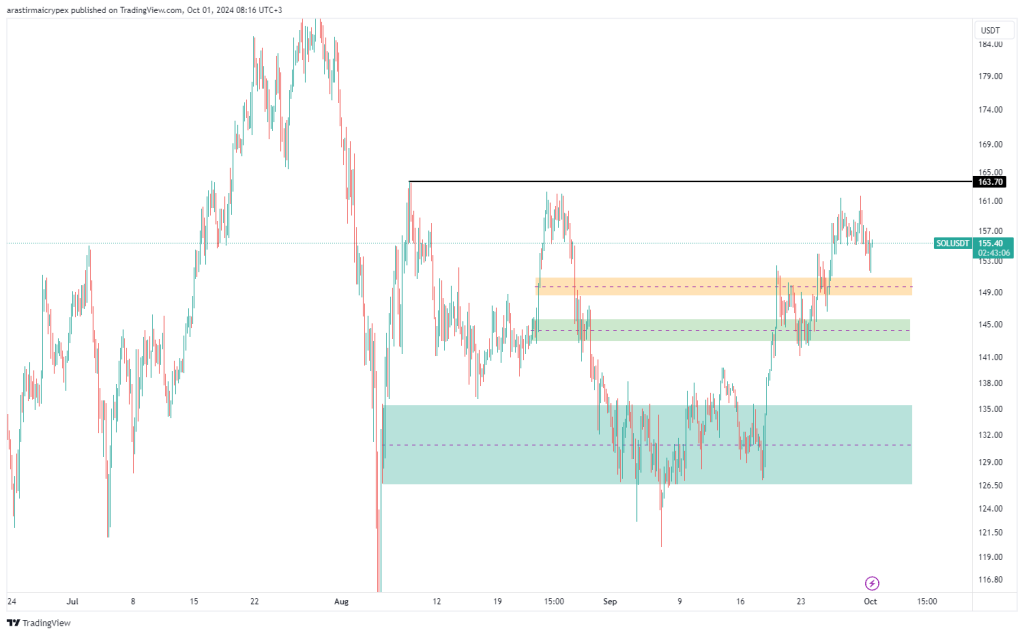

SOLANA (SOL)

SOL is priced at $155.36 with a 1.87% increase in value as of the morning hours. It rose to $162. After falling to $152, the rise continues. If it stays above $160, a rise to $170 can be seen. 150 seems strong as the first support.

OUNCE GOLD

The ounce is priced at $2642 with a 0.29% increase in value as of the morning hours. In the 4-hour chart, the rise started after the pullback. The 2686 level was seen. $2600 – $2620 works as a major support. $2700 can be seen in the continuation of the rise. In pullbacks, $2640 – $2620 seems to be a strong support.

OUNCE SILVER

Silver is priced at $31.36 with a 0.80% gain as of the morning hours. On the 4-hour chart, the price broke the 31.19 resistance level. It is likely to encounter resistance at 32.50 and pullback. In a possible pullback, the price is expected to fall towards the 31.20 and then 28.700 support levels. If the rising band is broken upwards, the rise will likely continue.