Harris and Trump Tied Up at Polymarket – Telegram Founder Pavel Durov Arrested in France

Harris and Trump Tied Up at Polymarket

On the Polymarket platform, US Vice President Kamala Harris and former President Donald Trump are neck and neck with 50% odds of winning the November presidential election. Harris’ odds rose from 46% last week to reach that level. Trump is leading in key states like Georgia and Arizona, while Harris is ahead in Michigan and Wisconsin. Trump, a cryptocurrency supporter, recently received support from Robert F. Kennedy Jr., while Harris has yet to publicly support the crypto industry.

Telegram Founder Pavel Durov Arrested in France

Telegram founder and CEO Pavel Durov was arrested by the National Anti-Fraud Office (ONAF) upon arrival at Le Bourget airport in France. Durov is expected to appear before an investigating judge and face a variety of charges, including terrorism, fraud and money laundering. Durov usually tries to avoid such arrests by avoiding travel in Europe, but this time he was caught.

Ethereum Foundation Transfers 35,000 ETH to Kraken

The Ethereum Foundation has transferred 35,000 ETH to the Kraken exchange. The transfer was made as part of routine treasury management, but it caused concern among investors because it was not announced in advance. The foundation said the ETH will be sold gradually, avoiding market volatility. The move highlights the challenges of balancing transparency and regulatory recommendations in managing large crypto assets.

Two Mining Pools Control 57% of Bitcoin Hashrate

Foundry USA and AntPool have come to control 57% of Bitcoin’s hashrate, raising concerns about the network’s increasing centralization. This concentration of power could threaten Bitcoin’s decentralized nature and potentially lead to a “51% attack,” where a single entity could reverse transactions. This also poses the risk that mining pools could be pressured to censor transactions. The growing influence of these pools highlights the need to address the centralization problem to maintain Bitcoin’s security and independence.

————————————————————————————————

BITCOIN (BTC)

BTC is priced at $63,900 with a 0.50% loss in value as of the morning hours. An increase of up to $65,000 was achieved but could not be sustained. If the downward movement continues, $62,700 seems to be a strong support position. The $65,200 region also appears as a strong resistance.

ETHEREUM (ETH)

ETH is priced at $2742 with a 0.14% loss in value as of the morning hours. There was an increase from $2570 to $2820. Permanence could not be achieved at this level. In pullbacks, $2500 seems strong after $2700. If a breakdown occurs below the $2500 level, pullbacks to $2330 may be seen. If $2820 is broken upwards, pricing up to $3000 may be seen.

RIPPLE (XRP)

XRP is priced at $0.596 with a 0.62% loss in value as of the morning hours. Persistence above $0.60 will be quite positive. XRP rose to $0.65 due to the news, but permanence was not achieved. In pullbacks, a pullback to $0.58 may occur. In prices above $0.60, increases to $0.70 may be seen.

AVALANCHE (AVAX)

AVAX is priced at $26.98 with a 0.22% increase in value as of the morning hours. Pricing above $26 is seen. $25 is a region that is likely to work as support. With the reaction it will receive from this region, an increase of up to $29 may occur. If the pullback deepens, the price may go up to $22 after $24.

SOLANA (SOL)

SOL is priced at $159.83 with a 0.56% increase in value as of the morning hours. After the rise from $112 to $164, the pullback seems to have stopped. In case the pullback occurs again, $150 is a strong support. As for resistance, $164 seems strong for now.

OUNCE GOLD

As of the morning hours, the ounce of gold is priced at $2510 with a 0.10% loss in value. After the ATH was renewed, prices below $2500 were seen, but we are above $2500 again. $2535 is now our first resistance zone. If there is a break above this level, ATH can be renewed again. The range of $2470 and $2465 seems strong as strong support in pullbacks.

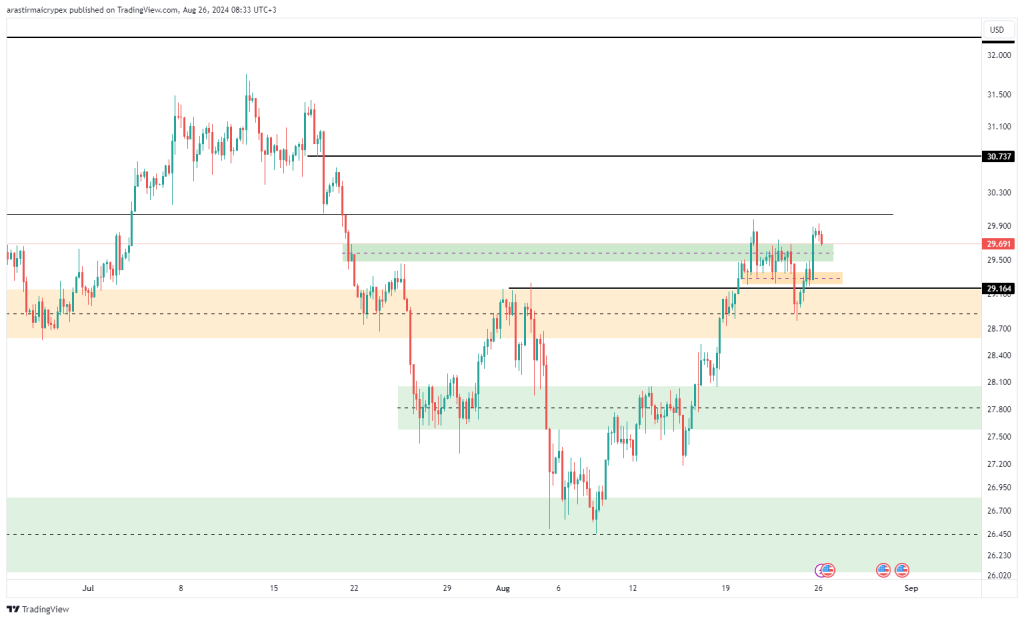

OUNCE SILVER

Silver is priced at $29.68 with a 0.54% loss in value as of the morning hours. A 29.10 breakout occurred and a retest was given. In the continuation of the rise, an increase of up to $30.73 may occur. In pullbacks, 29 and 28.70 appear to be strong supports.