Microsoft's Bitcoin Investment Proposal to Be Voted On – South Korea Requires Cross-Border Crypto Reporting

Microsoft’s Bitcoin Investment Proposal to Be Put to a Vote

Microsoft has added “Considering investing in Bitcoin” as a voting issue at its December 2024 shareholder meeting. This proposal was presented by the National Center for Public Policy Research. However, the company’s board of directors recommended voting against this proposal, stating that Microsoft already considers cryptocurrencies, including Bitcoin, in its investment strategies. The company emphasized that it has established systems to manage and diversify its corporate treasury, drawing attention to Bitcoin’s volatility. If the proposal is accepted; Microsoft could become the largest public crypto investor, surpassing MicroStrategy and Tesla.

South Korea to Mandate Cross-Border Crypto Reporting

South Korea’s finance minister has announced plans for new regulations that will require crypto firms to report “cross-border crypto transactions” to prevent currency crimes involving digital assets. The requirement will go into effect in the second half of 2025 and will require firms to register in advance and report transactions to the Bank of Korea on a monthly basis. The reported data will be used by tax, customs, and fiscal authorities to track illegal activity. The regulations will be legalized through amendments to the Foreign Exchange Transactions Act to include virtual assets in the country’s foreign exchange laws.

$20 Million in Crypto Stolen from US Government Wallet

A US government wallet linked to the 2016 Bitfinex hack was reportedly compromised with around $20 million worth of crypto assets. The suspicious transfers occurred on October 24 and have raised concerns among blockchain analysts. The wallet moved 1.25 million USDT, 5.5 million USDC, and 13.7 million USDC from DeFi platform Aave to a newly created wallet, while some Ethereum was also sent to exchanges. The US Department of Justice has yet to make a statement on the matter, and investigations into the incident are ongoing.

Ethereum ICO Participant Causes Concerns with 3,000 ETH Sale

An Ethereum ICO participant raised concerns about a possible drop in ETH price when he sold 3,000 ETH for $7.64 million on Oct. 24. The same investor sold 7,000 ETH in July, causing ETH to lose 15% in value. The investor, who bought 254,908 ETH during the ICO, currently has 37,070 ETH. Other early Ethereum investors have also sold large amounts of ETH recently, which has negatively impacted ETH’s market performance.

Pennsylvania Passes Crypto Rights Act

Pennsylvania has passed the Digital Assets Authorization Act, which secures the rights of its citizens to manage cryptocurrencies and use Bitcoin as a payment method. Introduced by state Rep. Mike Cabell, the bipartisan legislation aims to encourage blockchain innovation and provide regulatory clarity. The legislation, which passed the state House of Representatives by a vote of 176-26, now awaits Senate approval and the governor’s signature. The legislation positions Pennsylvania alongside states like Utah and Wyoming that have introduced regulations in the digital asset space, and crypto regulations are expected to play a major role in the state’s 2024 presidential elections.

————————————————————————————————

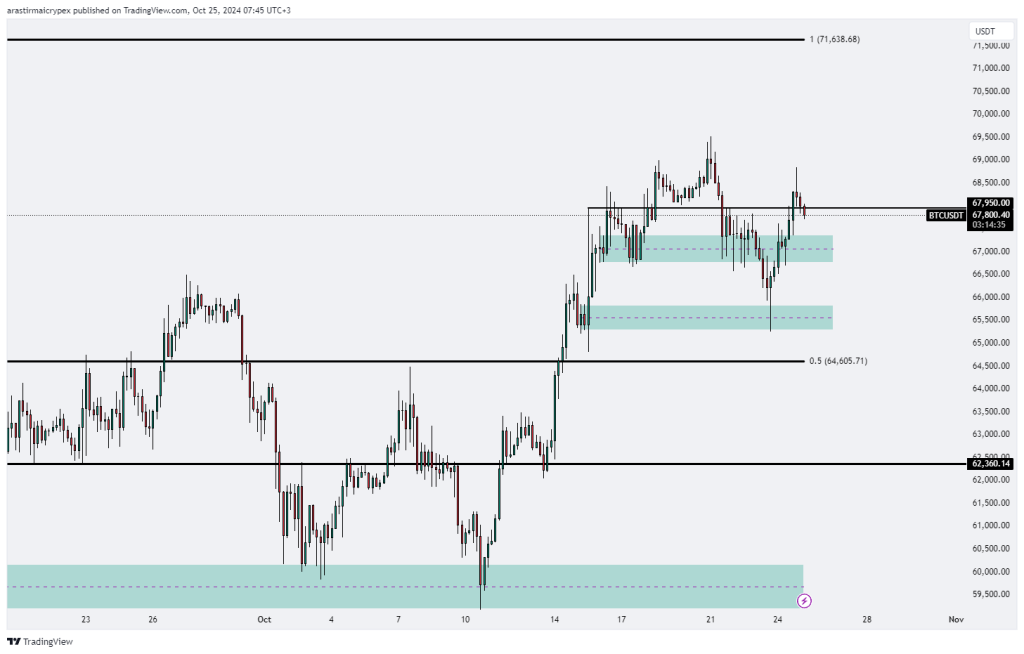

BITCOIN (BTC)

BTC is priced at $67,782 as of the morning hours, down 0.61%. The upper resistance levels are determined as 68,500.00 and 70,000.00. These levels are important resistance points for the price to continue upwards. The lower support levels stand out as 67,000.00 and 64,605.71. If the level of 67,000.00 remains below, a pullback towards the level of 64,605.71 may occur. Especially the closings above the level of 64,605.71 show that the buying side is strong. This situation may be an important strategy for them to wait above the level of 67,950.00 and observe the target of 68,500.00. As a result, it is understood that the level of 67,950.00 is an important threshold and movements may continue above this level, while the levels of 67,000.00 and 64,605.71 should be monitored as critical support points.

ETHEREUM (ETH)

ETH is priced at $2498 with a 1.48% loss in value as of the morning hours. The price is currently at the 2,498.24 support point. If closings occur below this support level, the price is likely to pull back to 2,461.59. Below this level, 2,338.99 stands out as critical support. Upper resistance levels have been determined as 2,560.00 and 2,819.69. In case the 2,560.00 level is exceeded, it is evaluated that a buying movement may begin and the 2,819.69 target can be followed. Therefore, maintaining the 2,498.24 level is of critical importance for the continuation of an upward trend. If the price holds the 2,498.24 level, targets at 2,560.00 and 2,819.69 are visible on the upside, while support levels at 2,461.59 and 2,338.99 are critical on the downside.

RIPPLE (XRP)

As of this morning, XRP is priced at $0.5268, down 0.98%. The price is currently trading at 0.5270, which represents an important support level. If the price falls below this level, the probability of a pullback to 0.5200 increases. The upper resistance levels are determined as 0.5500 and 0.5900. If the 0.5500 level is exceeded, the pair has the potential to reach the 0.5900 target. Therefore, maintaining the 0.5270 level is critical for the continuation of an upward trend. If the price stays above 0.5270, the 0.5500 and 0.5900 targets can be observed above, while the 0.5200 support level stands out as a critical point below.

AVALANCHE (AVAX)

AVAX is priced at $26.29 with a 2.08% loss in value as of the morning hours. The 27.00 and 28.00 levels have been determined as important resistance areas. If the price can break these levels, it will have the potential to reach the 29.00 target. However, if the price falls below the 26.37 level, a pullback towards the lower levels of 25.50 and 24.00 may occur. As a result, it may gain upward momentum by protecting the 26.27 level. However, if this level is broken down, the possibility of a wider decline should be considered.

SOLANA (SOL)

SOL is priced at $173.49 with a 1.52% gain as of the morning hours. The price is currently trading at 173.47, with 163.70 being a significant support point. Above, 180.00 and 192.00 stand out as critical resistance areas. If the price can break this resistance level, higher targets of 188.00 and 192.00 can be tested. However, current price movements should be monitored carefully. If the price breaks below 170.00, the probability of a pullback to 163.70 will increase. As a result, SOL may continue to move upwards if it remains above 173.47.