MicroStrategy Will Continue Its Purchases – Liquidation That Comes With A Decline In Bitcoin

MicroStrategy Will Continue Its Purchases

MicroStrategy reported losses for the third consecutive quarter due to the depreciation of its Bitcoin holdings. The company recorded $412 million in impairment expense due to its Bitcoin holdings of approximately $18 billion, and its third-quarter net loss was $340 million. This marks a large increase from the $143.4 million loss in the same period last year. The company’s software unit revenues were also down 10% at $116.1 million, below the $122.5 million expected by analysts. The share price fell 4% following the results. According to CEO Phong Le, MicroStrategy is pursuing its goal of increasing shareholder value and plans to increase Bitcoin as a treasury reserve. To this end, it aims to issue $21 billion in equity and $21 billion in fixed-income securities over the next three years.

Liquidation That Comes With A Decline In Bitcoin

Yesterday’s price drop in Bitcoin led to significant liquidations in the cryptocurrency market. Bitcoin lost nearly $3,000, falling from $72,600 to below $69,000. This decline resulted in the liquidation of the positions of more than 90,000 investors, and the total amount of liquidations exceeded $280 million. The value of the largest liquidation transaction amounted to $11 million. It also saw dips of up to 5% in altcoins such as Ethereum (ETH) and Solana (SOL). As a result of these developments, the total cryptocurrency market cap decreased by nearly $100 billion to less than $2.30 trillion.

ETF Inflows Slow on Thursday

On Oct. 31, 2024, net inflows into Bitcoin spot ETFs fell to $32.1 million, the lowest level in a recent week. Rather than a decrease in investor interest in Bitcoin ETFs, this decline signals that next week’s selection process is slowly starting to price in. On the same day, there was a net inflow of $13 million into Ethereum spot ETFs. This data shows that while Bitcoin continues to dominate the ETF market, Ethereum is also gaining increasing confidence among investors. Analysts predict that both cryptocurrencies continue to attract attention from institutional investors and may gain new momentum in the near future, depending on market conditions.

Ripple – The Latest Situation in the SEC Case

In the case between Ripple Labs and the U.S. Securities and Exchange Commission (SEC), the court instructed the SEC to file a brief by January 2025. This development could affect the course of the case and the future of XRP. Ripple argues that XRP is not a security, while the SEC claims otherwise. The court’s request for additional information from the SEC highlights the complexity and importance of the case. Investors and industry stakeholders are closely following this process.

———————————————————————————

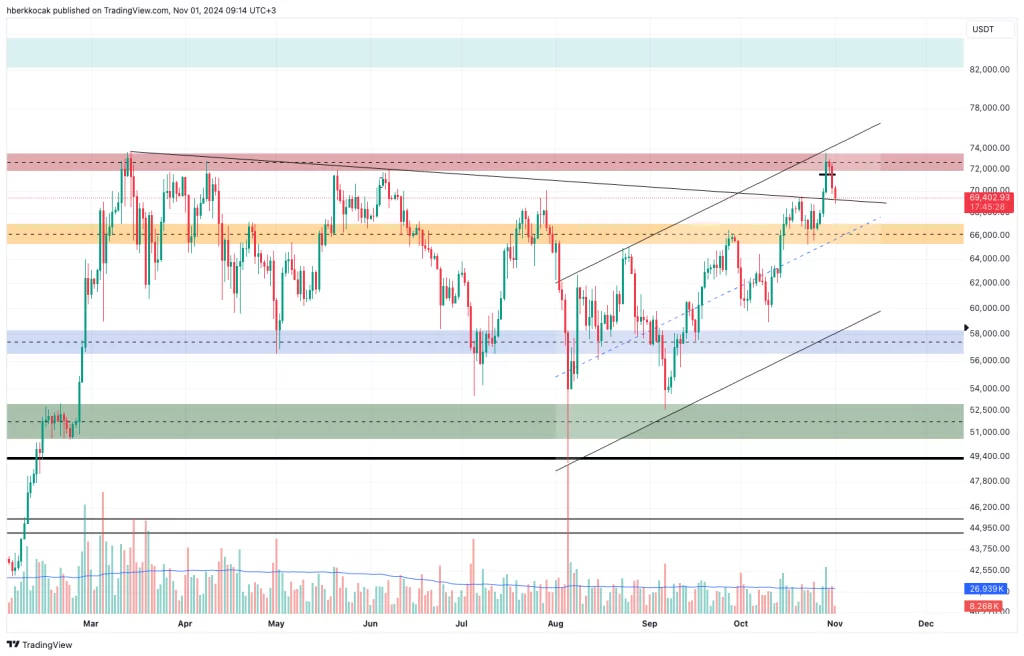

BITCOIN (BTC)

BTC is priced at $69,476 with a loss of 1.18% as of the morning hours. Bitcoin has failed to make a new high for three days, leaving it subject to some profit-taking ahead of today’s jobs data and next week’s election and Fed meeting. This pushed the price below the 72,000 – 73,000 range. At the same time, it allowed the price to return to the 69,500 area, which we expect to be a critical support, as well as the resistance level of the downtrend that has been going on since March, which we broke to the upside days ago. If there is no reaction from this region, we can say that pullbacks may continue in Bitcoin up to $ 66,600 levels.

ETHEREUM (ETH)

ETH is priced at $2,501 with a 0.70% loss of value as of the morning hours. The pricing, which already looked weak in Ethereum, weakened further with the decline of Bitcoin, causing the 2530 support to be broken. Afterwards, Ethereum, which fell to the 2470 region, received a reaction from this region, but we think that it may fall to the 2400 dollar region. We can point to the $2310 region as the most critical level in Ethereum.

RIPPLE (XRP)

XRP is priced at $0.5150 with a loss of 0.34% as of the morning hours. XRP continues its stagnant pricing after the court news. We know that the 0.50 zone is the most solid support zone, at least for now, and on the upside, the $0.5440 and $0.562 levels are strong resistance zones. Although we do not expect great volatility and bullishness for Ripple, developments that may come from the court or election results will increase XRP pricing.

AVALANCHE (AVAX)

AVAX is priced at $24.67 with a loss of 1.44% as of the morning hours. The downward movement in AVAX continues with the growth of the decline in the market. Since breaking 26.50 downwards, AVAX has only been able to make 1 positive close on its 4-hour chart, and we can say that $25 has also been broken downwards and this breakout has been confirmed, so the next support level will be in the range of 23.8 – 24.

SOLANA (SOL)

SOL is priced at $165.88 with a loss of 1.70% as of the morning hours. Solana also has a bullish target of close to 45%, which is due to the ascending triangle breakout after the upside break of the $165 level. This points to the $240 area, which is the ATH level. But first, Solana will need to break through the 195 – 200 band to the upside. Before that, we see that the critical zone 165, which was broken with yesterday’s decline, was retested. If Solana gets a reaction from the 160 – 165 band and continues its rise, $200 will be the new target level.