Post-Election Altcoin Rally? – Tether Denies Accusations

Bitwise Official Raises Bitcoin Targets

Matt Hougan, chief investment officer (CIO) at Bitwise Asset Management, said on Wednesday that if Trump wins next week’s election, it could start the altcoin rally. Hougan said Trump’s victory would also provide a solution to regulatory issues. At the same time, Hougan said, “We will go to $100,000 next year,” and showed his goals for next year, while stating that some altcoins may be more sensitive to the political landscape due to problems caused by regulatory uncertainties, unlike Bitcoin.

Tether Rejects Accusations From U.S.

On Friday last week, it was claimed that the US government was planning to launch an investigation into Tether for violations under anti-money laundering laws. The Wall Street Journal, which first shared the story, also stated that the source did not name him. About 1 week later, a Tether official criticized The Wall Street Journal for making inconsistent claims, stating that it was grossly irresponsible to publish such a story without official approval from government officials. At the same time, he stated that they were not aware of such an investigation by the government.

Cryptocurrency Companies’ Balance Sheets Are Announced

In these days when the 3rd quarter balance sheets of companies in the USA continue to be announced, the balance sheets of 3 companies working on cryptocurrencies were announced on Wednesday. While Coinbase, the US-based cryptocurrency exchange, announced a profit in the third quarter on its balance sheet, the fact that its trading volumes more than doubled and its transaction revenues almost doubled were evaluated as positive for the cryptocurrency market. Riot, one of the largest mining companies, experienced a 65% year-on-year increase in revenues, while the company stated that although they were able to increase their hashrate levels, they could not increase at the targeted rate. The company generated a total of 1104 Bitcoins during the quarter; Bitcoin has reduced its production costs to $35,367, demonstrating that they are the industry leader in energy efficiency.

Lido Establishes Chainlink Integration

With the support of Chainlink’s Cross-Chain Communication Protocol (CCIP), Lido has deployed a new cross-chain staking feature on the Ethereum Layer-2 networks Arbitrum, Base, and Optimism. In this way, users will be able to receive wstETH by staking ETH. Chainlink’s Data Feeds and Automation services provide wstETH yield rate and liquidity management. Lido, thanks to this feature; It aims to facilitate users’ ETH transactions without the need for intermediaries.

VanEck Plans to Provide Easy Access to Solana Staking with Kiln

Continuing its cryptocurrency investments and moves, VanEck plans to provide its institutional investors with a fast and easy Solana staking service by collaborating with Kiln, a digital asset rewards platform. Through this collaboration, VanEck will enable its customers to stake their SOL tokens without the need for any technical features or applications. The company also plans to add staking solutions in its Solana-based exchange products, ETN and ETFs.

——————————————————————————-

BITCOIN (BTC)

BTC is priced at $72,296 with a 0.08% gain in value as of morning. Although Bitcoin retreated a little after its rise above $73,000, it has managed to maintain permanence above $72,000. In Bitcoin, which received a reaction after yesterday’s decline from the 71,500 regions, which we can describe as the critical region, we see that the ETF performance continues to rise and there is an inflow of 880 million dollars on Wednesday. We can say that the inflation data that will come today may have a greater impact on pricing, so it is necessary to be ready for possible upward and downward movements in Bitcoin.

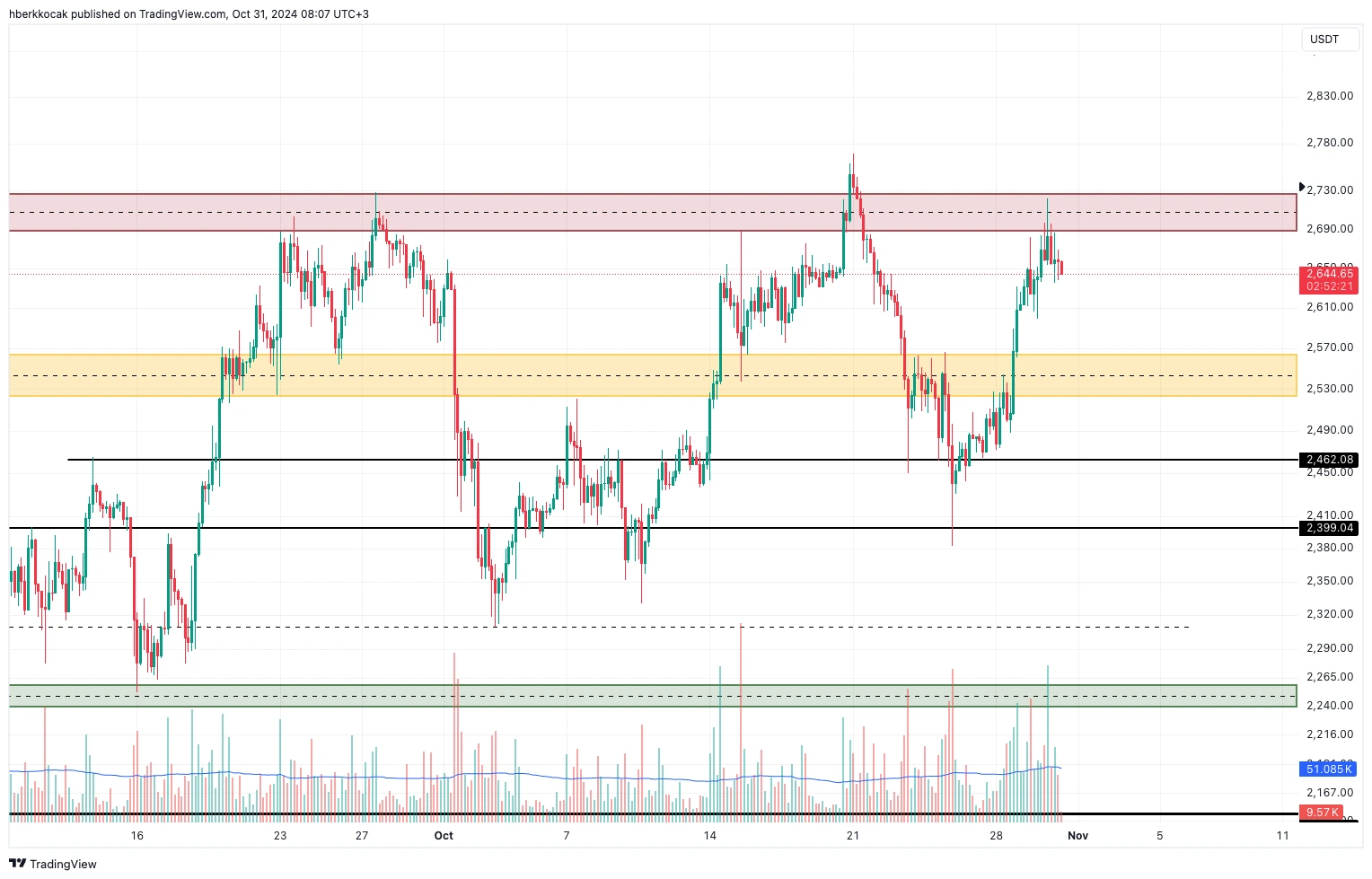

ETHEREUM (ETH)

ETH is priced at $2,646 with a 0.42% loss in value as of morning. Although we saw an attack on $ 2700 again after the good movement of the last three days in Ethereum yesterday, we see that it failed to break out again and retreated to the 2640 band. Although we expect that if the 2700 band is broken or the green zone on the chart can be entered, there will be an expectation of $ 3000 in Ethereum again; Due to its weak pricing and sellers’ appearance in the $2700 area, Ethereum could not break out of this zone and retreated. If the pullback continues, the 2630 – 2560 range will serve as a very critical support zone.

RIPPLE (XRP)

XRP is priced at $0.5211 with a loss of 0.34% as of the morning hours. XRP continues its stable pricing after the court news. We know that the 0.50 zone is the most solid support zone, at least for now, and on the upside, the $0.5440 and $0.562 levels are strong resistance zones. Although we do not expect great volatility and bullishness for Ripple, developments that may come from the court or election results will increase Ripple pricing.

AVALANCHE (AVAX)

AVAX is priced at $25.97 with a 0.76% depreciation as of the morning hours. The strong pricing seen in AVAX for a while; After the downward break of the uptrend, we see that it has been replaced by a seller-like image, and in this process, it has not been affected by the rises seen on either Bitcoin or Ethereum. AVAX continues to decline after its latest reaction from the $27 area on Tuesday, with 25.60 and 24.46 levels seen as support levels. On the upside, 26.40 and 27.50, which broke out yesterday, can be used.

SOLANA (SOL)

SOL is priced at $175.22 with a 0.17% gain in value as of morning. Solana also has a bullish target of close to 45% stemming from the ascending triangle breakout following the upside break of the $165 level. In this case, the price target is the $240 area, which is the ATH level. But first, Solana will need to break through the 195 – 200 band to the upside. Prior to this, $182 in the upward movement and $172 in the downward movement stand out as important support levels in the short term.