Ripple and SEC Case Over – Cooperation Between Arbitrum and Circle

Lawsuit Between Ripple and SEC Ended

Ripple was fined $125 million by the SEC, which is well below the SEC’s proposed $2 billion penalty. Judge Analisa Torres accepted some of the SEC’s requests, ruling that Ripple be banned from future securities law violations and impose this fine. This comes as the SEC claimed that Ripple raised $1.3 billion through the sale of XRP in 2020 and that it was an unregistered security. Ripple CEO Brad Garlinghouse described the court’s decision as a victory for Ripple and the industry, stating that this decision clarified the company’s future growth.

Collaboration Between Arbitrum and Circle

Arbitrum said in a statement on August 7 that it is collaborating with stablecoin issuer Circle to support the use of USDC for Orbit Chains. The Ethereum-based scaling solution is part of a broader set of initiatives it is currently pursuing with Circle, the company said. Introduced in March 2023, Orbit Chains enable the creation of highly customizable networks with advanced throughput and governance features.

Agreement Between Ripple and DIFC Innovation Center

Ripple has struck a deal with the DIFC Innovation Centre, the development division of the Dubai International Financial Center (DIFC), to spur blockchain and cryptocurrency growth in the United Arab Emirates. According to the official announcement, Ripple will connect emerging developers with the DIFC Innovation Center through the XRP Ledger, a decentralized layer-1 blockchain. Additionally, this agreement aims to extend the potential of the technology to traditional institutions.

Hong Kong Virtual Bank Launches Bitcoin and Ethereum ETF Service

Hong Kong-based virtual bank Mox has launched a crypto ETF service for customers after launching the Mox Invest platform. Standard Chartered subsidiary Mox Invest has become the first virtual bank to offer direct trading of spot Bitcoin and Ethereum ETFs on its platform, launching in Hong Kong earlier this year, positioning itself as a one-stop investment and banking platform for retail investors.

Brazilian Securities and Exchange Commission Approves Solana-Based ETF

The Brazilian Securities and Exchange Commission (CVM) has approved a Solana-based ETF, it announced on Wednesday. This ETF is the first in Brazil and among the first Solana-based ETPs globally. The world’s first Solana ETF was launched on the SIX Swiss Exchange in June 2021 by Switzerland-based investment product provider 21Shares. According to CVM’s database, the Solana-based ETF is still in the pre-operational stage and has not yet been approved by the Brazilian exchange B3.

Grayscale, Bitwise and NYSE American Apply for 3 Ethereum ETF Options

New York Stock Exchange (NYSE) American LLC has proposed a rule change that would allow it to list and trade options for three Ethereum ETFs operated by crypto asset managers Grayscale and Bitwise. In a filing with the Securities and Exchange Commission on Aug. 7, NYSE American asked the SEC to allow options listing and trading for Bitwise Ethereum ETF (ETHW), Grayscale Ethereum Trust (ETHE), and Grayscale Ethereum Mini (ETH). NYSE American said allowing options trading on three Ethereum ETFs would benefit investors.

Robinhood’s Second Quarter Crypto Revenues Increased 161%

Robinhood reported big second-quarter earnings growth. Cryptocurrency transaction revenues increased by 161% annually, reaching $81 million, and transaction volume increased by 137% by 2023, reaching $21.5 billion. Options remained Robinhood’s largest source of revenue at $327 million. The company acquired the globally operating crypto exchange Bitstamp in June. Robinhood’s monthly active users increased to 11.8 million, a 9% increase compared to last year.

————————————————————————————————-

BITCOIN (BTC)

As of the morning hours, BTC is priced at $ 56,950 with a 3.28% gain in value. After a rise to $70,000, a serious selling pressure was encountered and a decline occurred to the level of $48,500. There seems to be a reaction from this region. $59,000 appears as the resistance level. If pricing is above $59,000, there may be an increase up to $65,000. In case of a decline, $54,000 is a strong support area.

ETHEREUM (ETH)

ETH is priced at $2425 with a 3.54% gain in value as of the morning hours. After losing the $2800 level, there was a rapid decline to the $2160 level. It seems like he’s gotten a reaction from here so far. If an upward reaction occurs, a rise up to $2650 may be seen. In case of a decrease, a withdrawal may occur up to $2200.

RIPPLE (XRP)

As of the morning hours, XRP is priced at $0.6038 with a 0.73% gain in value. After yesterday’s news, there was an increase from $ 0.49 to $ 0.65, but it could not be permanent. $0.58 remains strong for now. If there is an upward reaction from here, pricing above $0.66 may be seen. In case of a pullback, $0.54 appears as major support.

AVALANCHE (AVAX)

AVAX is priced at $20.74 with a 4.53% gain in value as of the morning hours. With the horizontal band breaking downwards, the retreat deepened. If the withdrawal deepens, a withdrawal may occur up to $11.83. In case of an upward movement, $23 will appear as resistance.

SOLANA (SOL)

SOL is priced at $152.95 with a 5.65% gain in value as of the morning hours. When we examine the daily chart, we see that the $120 level, which we follow as the support zone, was tested with the sharp price movement seen yesterday and received a strong reaction from this area. As the reaction movement continued, the $150 level was broken upwards. The first resistance zone appears at $160. If it persists above this zone, the $170 level can be tested. In case of withdrawals, the $150 and $145 levels can be followed as support.

CHAINLINK (LINK)

As of the morning hours, LINK is priced at $9.98 with a 5.27% gain in value. When we examine the daily chart, we see that there is a good reaction movement from the $ 8.50 region, which we follow as an important support zone, and it is priced just below the $ 10 level. If it persists above this region, first the 11 and then 12 dollar levels can be targeted. In case of withdrawals, the $ 9.50 level can be followed as short-term support.

FIL

FIL is priced at $3,533 with a 5.37% gain in value as of the morning hours. When we examine the hourly chart, we see that the $ 3.57 level, which we follow as the resistance zone, creates a positive price movement. If this movement breaks upwards, the $3.70 region may be tested. In case of withdrawals, the $ 3.30 region appears as support.

OUNCE OF GOLD

As of the morning hours, ounce gold is priced at 2395 dollars with a 0.51% gain in value. After the rise to $2478, the decline continues. The $2350 region is a critical support zone. In case of an upward movement, increases up to 2500 dollars may be seen. The $2350 region is likely to act as support in case of pullbacks.

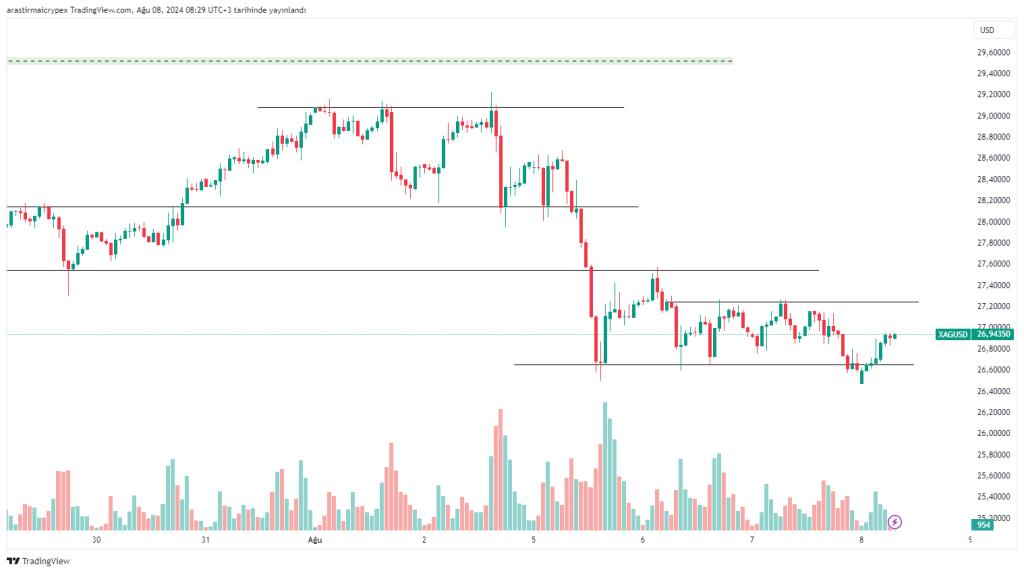

OUNCE OF SILVER

As of the morning hours, silver is priced at $26.94 with a 1.25% gain in value. When we examine the hourly chart, we see a horizontal movement between the $26.50 and $27.50 levels. These two levels can be followed as main support and resistance zones. In case of an upward break, the $28 level may be tested. The $26.80 region can be followed as a short-term support area.