Russia Uses Crypto to Trade Oil to Bypass Sanctions – VanEck Files for Avalanche ETF

Russia Uses Crypto to Trade Oil to Bypass Sanctions

Russia is increasing its use of crypto assets in its oil trade with China and India to bypass US and EU sanctions. According to Reuters’ sources, oil companies are speeding up the currency conversion process by using digital assets such as Bitcoin, Ethereum and USDT as payment instruments. Russia’s strategy has gained momentum, especially after the December legal regulations allowing crypto assets to be used in international payments.

Authorities state that crypto assets are only an alternative payment method and are used in conjunction with traditional financial systems. However, this step could lead to new sanctions from Western countries. Russia continues to test digital rubles and is preparing new regulations that will increase individual investors’ access to crypto trading. On the other hand, despite the sanctions, crypto assets are expected to play a permanent role in Russian trade, as they have in countries such as Iran and Venezuela.

VanEck Files Avalanche ETF Application

Global investment management company VanEck has filed an S-1 application with the U.S. Securities and Exchange Commission (SEC) for its Avalanche (AVAX) spot ETF. The new fund aims to track AVAX price performance and will evaluate its assets through the MarketVector Avalanche Benchmark Rate. Bloomberg analyst James Seyffart noted that this is the first official SEC filing for VanEck’s AVAX ETF.

The huge success of Bitcoin spot ETFs and the new administration in the U.S. that has a positive approach to crypto have accelerated the altcoin ETF race. While ETF applications have also been made to the SEC for XRP, Solana, Litecoin and Dogecoin, analysts predict that some approvals may come later in 2025. According to JPMorgan’s report, the approval of altcoin ETFs could attract billions of dollars of institutional investment, with SOL and XRP funds seeing the greatest interest.

Trump-Backed WLFI Buys AVAX

World Liberty Financial (WLFI), backed by the Trump family, purchased AVAX and MNT for $2 million, while the total loss in the investment portfolio reached $118 million. WLFI has invested $343 million in 11 digital assets to date, with Ethereum accounting for the largest share and writing off $88 million in losses.

WLFI has partnered with the Sui Foundation after completing a $550 million token sale and plans to add Sui assets to its strategic reserve.

Goldman Sachs Includes Crypto in Shareholder Letter for the First Time

Goldman Sachs has acknowledged the growing role of blockchain and digital assets in financial markets by mentioning crypto assets for the first time in its annual shareholder letter. The bank noted that crypto assets are changing the competitive landscape, while also highlighting potential threats such as cybersecurity risks and market volatility. Goldman, which launched a crypto trading desk in 2021 and a Digital Asset Platform in 2022, has highlighted the increasing use of blockchain-based financial products.

CEO David Solomon describes blockchain technology as “very interesting,” but sees Bitcoin as a speculative asset. However, the bank made major investments in Bitcoin spot ETFs in the last quarter of 2024. It invested $1.27 billion in BlackRock’s IBIT ETF, while Fidelity increased its holdings in its FBTC ETF by 105% to $288 million. These steps show Goldman Sachs’ changing crypto strategy and its readiness for potential regulatory changes.

South Korea’s Central Bank Approaches Bitcoin Reserves Cautiously

South Korea’s central bank said it has not yet reviewed or discussed adding Bitcoin to its foreign exchange reserves. The bank emphasized that a cautious approach is needed due to Bitcoin’s high volatility.

Despite calls from some lawmakers and crypto lobby groups for Bitcoin to be used as reserves, the central bank stated that foreign exchange reserves should have high liquidity and an investable credit rating. On the other hand, South Korea is reportedly considering lifting its ban on crypto ETFs.

Pakistan Establishes Crypto Council

The Pakistani government has established the Pakistan Crypto Council (PCC) to regulate and integrate blockchain and digital assets in the country’s financial system. Pakistan, which previously stated that crypto assets would not be legalized, is moving towards adapting to the global digital finance transformation with this new step. The council will be chaired by Finance Minister Muhammad Aurangzeb and will include the Governor of the Central Bank of Pakistan, the Chairman of the Securities and Exchange Commission, and other senior officials.

The council’s goals include providing a clear framework for crypto regulations, cooperating with international blockchain organizations, and ensuring financial security. While there is great adoption in the country with 20 million active crypto users and $20 billion in transaction volume, the annual $35 billion remittance market is also expected to become more efficient thanks to the blockchain.

———————————————————————————————

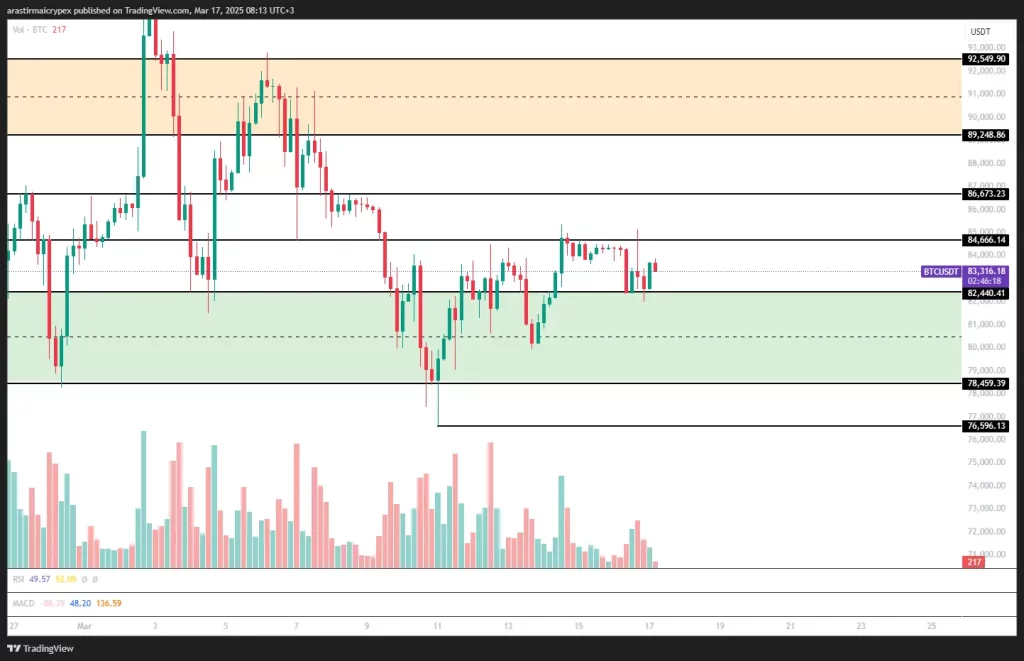

BITCOIN (BTC)

BTC is trading at $83,316 as of the morning hours with a 0.87% gain in value. BTC, which fell to $82,440 yesterday, is trying to recover by encountering purchases from this region.

In the negative scenario, if the $82,440 level is lost, the $78,459 level can be followed as the first support point. If this zone is broken, a drop to $76,596 may occur.

In the positive scenario, the $84,666 level stands out as the first resistance point. If this level is exceeded, the $86,673 and then $89,248 levels can be followed as the next resistance zones.

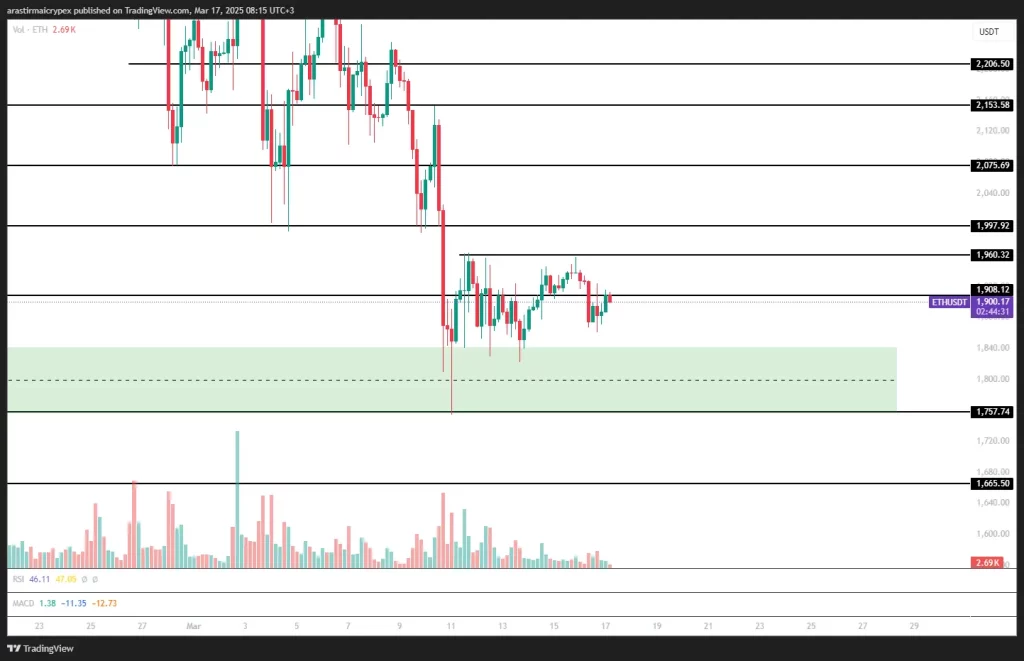

ETHEREUM (ETH)

ETH is priced at $ 1,900 levels with a 0.69% gain in value as of the morning hours. ETH, which has been following a sideways trend for the last few days, experienced a slight pullback by being rejected at $ 1,908.

In the negative scenario, the $ 1,840 – $ 1,800 region stands out as a strong support area. If this region is broken, the $ 1,757 level can be followed. In a deeper decline, the $1,665 area will be the main support point.

In the positive scenario, the $1,908 level stands out as the first resistance point. If this level is exceeded, the $1,960 and then the $1,997 levels can be followed as resistance. In a stronger rise, $2,075 and $2,153 levels can be targeted.

RIPPLE (XRP)

XRP is traded at $ 2.34 levels with a 2.27% gain as of the morning hours. XRP retreated somewhat by being rejected from the $ 2.37 region.

In downward movements, the $ 2.25 level stands out as the first support point. If this level is lost, the $ 2.19 level can be followed. In a deeper decline, the $2.13 and then $2.08 levels will be strong support areas.

In the upward scenario, the $2.37 area stands out as a significant resistance point. If this level is exceeded, a movement towards the $2.46 and $2.55 levels can be expected. Especially closing above $ 2.37 could pave the way for a stronger rise in XRP.

AVALANCHE (AVAX)

AVAX is trading at $ 18.56 as of the morning hours with a 1.70% gain in value. In a possible positive scenario, breaking the $ 18.96 level will be critical. In this case, the $ 19.74 and $ 21.03 levels can be followed as resistance. For a stronger rise, the $ 21.83 and $ 22.92 levels can be targeted.

In the negative scenario, the $ 17.87 level can be watched as the first support point. If it declines below this level, the $ 17.29 and $ 16.20 levels can be met as support. Especially if the $ 16.20 level is lost, a pullback to the $ 14.90 region may occur.

SOLANA (SOL)

SOL is traded at $ 128.57 as of the morning hours with a 1.92% loss in value. SOL, which was rejected from the resistance zone, is having difficulty exceeding the level of 135.47.

In case of a possible positive trend, the level of $ 126.71 can be followed as the first support point. Below this level, 118.17 stands out as the critical support zone. If this area is lost, selling pressure may deepen.

In upward movements, the 131 level is in the resistance position. If this level is exceeded, the 135.47 level can be followed as resistance. Above, the 147.06 and 155.25 levels stand out as strong resistance areas.