SEC Excludes Liquid Staking from Securities Laws

The U.S. Securities and Exchange Commission (SEC) announced in newly published guidance that liquid staking activities are not subject to securities laws. The SEC emphasized that staking receipt tokens (digital tokens representing staking rewards) are not considered securities under certain circumstances, but that this may change only if the deposited crypto assets are included in an investment contract. This clarification provides important regulatory clarity for investors and platforms conducting staking transactions.

The SEC’s decision is particularly critical for investors and firms planning to stake on proof-of-stake (PoS)-based networks like Ethereum (ETH). It has also been stated that the SEC’s approach could expedite the approval process for a spot Ethereum exchange-traded fund (ETF). Because liquid staking tokens can be used to manage liquidity in spot Ethereum ETFs, it could pave the way for major firms like BlackRock to gain approval for staking operations. SEC Chairman Paul Atkins stated that such developments are a significant step for the crypto markets as part of “Project Crypto.”

Trump Plans to Punish Bank Blocking of Crypto Companies

US President Donald Trump plans to sign an executive order aimed at curbing bank discrimination against the crypto industry. According to a report by the Wall Street Journal on August 4, the executive order would impose fines and other disciplinary measures on banks that block transactions with crypto companies. The order would specifically target transactions blocking digital assets for fiat currency. Many banks in the US have taken a stance against crypto transactions and have refused to accept transactions involving digital assets.

This decision is part of the Trump administration’s efforts to maintain the US’s leadership in the global digital asset market. While the crypto industry is facing concerns that banks are attempting to restrict access to financial services with initiatives like “Operation Chokepoint 3.0,” Trump’s move is being seen as a boost to the industry. Binance CEO Changpeng Zhao stated that this decision could provide access to banking services for crypto businesses worldwide. This step could mark a significant turning point for more open financial transactions in the crypto world.

Litecoin Reaches 5-Month High on ETF Expectations and $100M MEI Pharma Investment

Litecoin surged significantly Tuesday morning, reaching a five-month high of $128.40. This rise was accelerated by ETF approval expectations and MEI Pharma’s $100 million investment last month. MEI Pharma had previously announced plans to use Litecoin as a corporate treasury. Additionally, the probability of a Litecoin ETF being approved in 2025 is around 80%, but most users believe the XRP ETF will be approved first.

Although the price of LTC rose 5.8% in the last 24 hours to $123.60, it rose 12.3% last week and is up 41% this month. Furthermore, Litecoin appears to be gaining value thanks to institutional investments, with more companies incorporating crypto assets into their investment strategies. MEI Pharma’s Litecoin investment reinforces hopes that other crypto firms will take similar steps, and it is predicted that LTC could attract more institutional investment in the future.

Trump to Nominate Fed Board Members and President

US President Donald Trump announced that he will make his decision on the appointment of members of the Federal Reserve (Fed) Board of Governors by the end of this week. The vacancy was created after Fed member Adriana Kugler left her position to return to Georgetown University. Trump indicated that Kugler’s replacement could be a potential replacement for Jerome Powell.

Trump announced that he is narrowing down four candidates for the Fed chair position. These include economic advisor Kevin Hassett, former Fed board member Kevin Warsh, and current Fed member Christopher Waller. Trump also said he was forced to eliminate Treasury Secretary Scott Bessent as a Fed chair candidate because Bessent preferred to remain at the Treasury. Trump’s appointments are critical, particularly in terms of how he will manage the balance between inflation and economic growth.

Blockchain-Focused Figure Technology Joins the Crypto IPO Wave and Files with the SEC

Figure Technology Solutions, which aims to transform financial services with blockchain technology, is preparing to enter traditional financial markets by filing for a confidential initial public offering (IPO) with the United States Securities and Exchange Commission (SEC). The company has filed with the SEC to carry out its planned stock offering in 2025. The number of shares and price range in the application have not yet been determined and will be determined by market conditions.

The number of IPO applications from crypto companies continues to increase, and this is seen as an indicator of the convergence of digital and traditional markets. Figure Technology’s IPO could be a significant turning point for the crypto sector. The company offers blockchain-based financial services through Provenance Blockchain and processed over $30 billion in on-chain lending and securities transactions in 2024. This development highlights the potential for companies in the crypto space to attract more investors through IPOs.

Bhutanese Government Moves 517 Bitcoins Worth $59 Million to New Wallet

The Bhutanese government has moved 517 Bitcoins worth approximately $59 million to a new wallet. This move, according to Arkham Intelligence data, reflects Bhutan’s aim to strategically manage its digital assets. The Bhutanese government has similarly sold its Bitcoins to platforms like Binance in the past. With this latest transfer, Druk Holdings, the government’s investment arm, continues to hold 10,769 Bitcoins, worth approximately $1.2 billion.

Bhutan, a country known for its support of crypto, became the first to launch a crypto-backed payment system for its tourism sector in May. It also aims to strengthen its economy and stem the brain drain by mining cryptocurrencies powered by green energy. The government plans to use digital assets to attract investment aligned with corporate ESG (environmental, social, and governance) goals.

Bit Mining Acquires 27,191 SOL for $4.9 Million and Launches Solana Validator

Bit Mining invested $4.9 million by acquiring 27,191 SOL and launched its own validator to manage Solana investments. With this move, the company aims to transition into the Solana ecosystem, earn rewards through staking, and contribute to the security of the network. Bit Mining’s move is part of the company’s strategy to add crypto assets to its balance sheet.

This move marks the growing number of companies joining Solana’s institutional treasuries strategy. In addition to Bit Mining, other companies like DeFi Development Corp (DFDV) and Upexi have also increased their own investments in Solana by purchasing large amounts of SOL. These companies aim to generate passive income by staking their SOL holdings through validators and contribute to the security of the ecosystem. These developments offer investors greater exposure to Solana through publicly traded companies.

Michigan Pension Fund Invests $10.7 Million in Bitcoin ETF

Michigan’s state pension fund has increased its Bitcoin investment, investing $10.7 million in the ARK 21Shares Bitcoin ETF (ARKB). With this investment, made between March and June 2025, the fund increased the number of ARKB shares from 100,000 to 300,000, increasing its value from $4.1 million to $10.7 million. This move is notable as Michigan’s growing confidence in regulated Bitcoin assets.

ARKB is a spot Bitcoin ETF that tracks the real-time price of Bitcoin and offers the opportunity to invest in BTC without owning it directly. Michigan’s investment reinforces the institutional acceptance of Bitcoin, as other public funds follow suit. Furthermore, the SEC’s increase in the limit for Bitcoin ETF options contracts to 250,000 makes it easier for institutional investors to create hedging and income strategies. These developments could help further legitimize Bitcoin in regulated markets.

Brazil to Hold First Public Hearing on National Bitcoin Reserve on August 20

Brazil plans to accept Bitcoin as part of its national reserves. The Brazilian Chamber of Deputies will hold its first public hearing on the creation of a national Bitcoin reserve on August 20, 2025. The hearing will take place within the framework of Bill 4501/2024, introduced by Eros Biondini, which aims to include Bitcoin in Brazil’s strategic reserves. The bill stipulates that Bitcoin and other digital assets will account for a 5% share of the country’s foreign exchange reserves.

According to the bill, the Central Bank of Brazil and the Ministry of Finance would be responsible for Bitcoin’s custody, risk management, and reporting. Bitcoin reserves would be stored in “cold wallet” infrastructure in accordance with global standards. This step is intended to allow Bitcoin not only to serve as a reserve diversification tool but also as a macroeconomic buffer and lay the foundation for accelerating local blockchain adoption. If the bill is passed, the executive branch would be responsible for regulating the program within 180 days.

Indonesia Explores Including Bitcoin in Its National Reserve

Indonesia has joined the ranks of countries exploring including Bitcoin in its national reserve. A proposal to use Bitcoin as an investment vehicle is being discussed under the country’s newly established Daya Anagata Nusantara Investment Management Agency (BPI Danantara). This proposal is gaining widespread support due to Bitcoin’s potential to diversify national reserves, hedge against inflation, and reduce reliance on traditional fiat currencies. Furthermore, establishing a national reserve strategy through Bitcoin mining aims to strengthen Indonesia’s long-term economic strength.

BPI Danantara’s planned investment of IDR 300 trillion (approximately $18.3 billion) in Bitcoin could play a significant role in reducing Indonesia’s national debt. The Bitcoin Indonesia community has expressed openness to further discussion of the idea, provided it meets strong regulatory and governance requirements, despite a cautious approach from Indonesia’s financial regulator, the OJK. These developments could allow Indonesia to become the first country in Southeast Asia to include Bitcoin in its sovereign wealth fund.

SharpLink Acquires 83,561 ETH, Reaching a Total of 521,939 ETH

SharpLink Gaming continues to rapidly expand its Ethereum strategy. Between July 28 and August 3, the company purchased 83,561 ETH for approximately $303.7 million, bringing its holdings to a total of 521,939 ETH. These purchases were funded by proceeds from SharpLink’s ongoing at-the-market (ATM) financing facility. The company’s total Ethereum holdings are now valued at over $1.9 billion, a 19% increase in the past week.

SharpLink is expanding its strategic investments in Ethereum while also generating income from staking rewards. As part of the ETH treasury strategy launched on June 2, it has earned 929 ETH staking rewards. As the company continues to increase its Ethereum concentration, this growth aims to strengthen Ethereum’s role in decentralized finance infrastructure. Joe Lubin is known to be the CEO of ConsenSys and the president of SharpLink.

————————————————————————————————

BITCOIN (BTC)

Bitcoin is trading at $113,900 as of morning hours with a loss of 0.26%. The price continues to move within the falling channel. BTC, which failed to break the $115,000 level, is moving just above the 113,827 support level. If it can hold on to this support level, it can be expected to test 115,221 and then 115,817 in the continuation of the rise. If it stays above this zone, $118.175 could be targeted.

In case of a possible pullback, 111.824 could be met as the first important support level. If this level is broken, $ 110.507 and then $ 108.373 can be expected to work as support.

ETHEREUM(ETH)

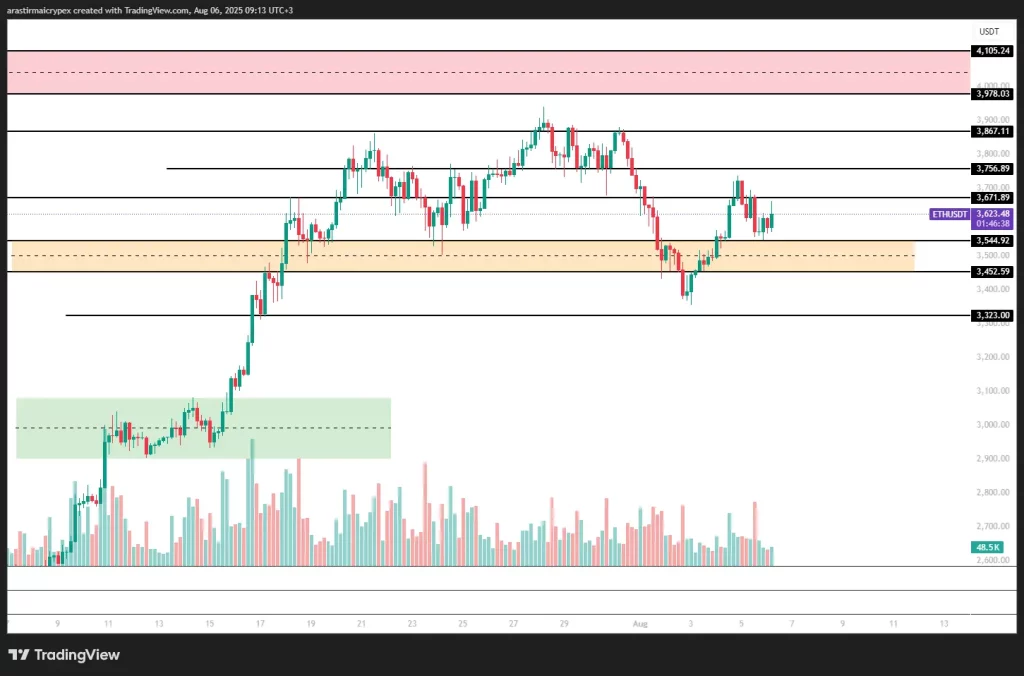

ETH is priced at $3,623 as of the morning hours, losing 0.32% of its value. Yesterday, a strong recovery was observed from $3,544.92 and it seems to have held above this level. The current move is testing the $3,671 level.

If it can stay above this level, a rise towards $3,756.89 is possible for ETH. However, closes below $3,544.92 could spark further declines towards the $3,452.59 and $3,323.00 levels.

RIPPLE(XRP)

XRP is priced at $2.93 with a 1.06% loss as of the morning hours. There was a sharp retreat from $3.05 yesterday and there is now a possibility of moving towards the support zone at $2.83.

If buying pressure occurs at this level, the region between $3.05-3.15 can be targeted. However, if it falls below the $ 2.83 level, the probability of a further decline towards $ 2.74 and then $ 2.65 may increase.

AVALANCHE(AVAX)

AVAX is trading at $22.02 with a 0.50% gain as of the morning hours. AVAX, which is currently trading just below the critical resistance area at $22.03, may rally towards $22.86 if it breaks this level. This zone is a key resistance area, and if the price breaks above it, it could allow it to target the $23.89 level.

In a possible pullback, if it drops below $22.02, the $21.43 and $20.71 levels will be the next key support points.

SOLANA(SOL)

SOL is trading at $163 levels with a 0.09% loss as of the morning hours. Currently trading close to the $162 support zone, SOL may carry the risk of a pullback to $156.08 if it stays below this level. These levels can be watched as important support points.

On the other hand, if the price breaks and stays above the $167.40-$169.55 zone, the $173.71 and $177.70 levels can be watched as resistance points.