SEC Ends OpenSea Investigation

The U.S. Securities and Exchange Commission (SEC) has decided to close its investigation into NFT platform OpenSea. OpenSea CEO Devin Finzer stated that this development is a positive step for the crypto and NFT sectors. The SEC sent a Wells notice to OpenSea in August 2024, suggesting that the platform may have operated as an unregistered securities market. However, the drop in the investigation was interpreted as a decrease in pressure to classify NFTs as securities.

Senators Request SEC to Clarify Crypto ETP Staking Restrictions

Seven U.S. senators sent a formal letter to the SEC, stating that staking restrictions on crypto exchange-traded products (ETPs) put U.S. investors at a disadvantage. The group, led by Senator Cynthia Lummis, demanded that the SEC explain why it excluded protocol staking from ETPs.

The letter emphasized that staking’s exclusion from ETP issuers’ S-1 filings reduces the competitiveness of US asset managers and prevents investors from benefiting from the core functionality of blockchain networks. The senators asked the SEC to clarify the rationale for this ban and whether staking can be offered as a regulated investment vehicle.

It was stated that ETPs in the US are at a competitive disadvantage compared to similar products in Canada, Europe and the UK that include staking, and requested that the SEC respond by April 1.

The Largest Hack in Crypto Asset History

Singapore-based crypto platform Bybit has announced a bounty program to recover $1.4 billion in funds lost in the largest hack in its history. The company will give a 10% reward of the amount recovered to individuals or organizations that help recover the funds. This would be one of the largest bounty programs, with a total recovery of up to $140 million.

The attack was reportedly carried out by the North Korea-linked Lazarus Group, and the stolen funds have reportedly begun to be mixed. So far, 15,000 cmETH ($43.5 million) and 181,000 USDT have been successfully recovered.

Michael Saylor May Continue Bitcoin Purchases

Michael Saylor, co-founder of the company that transformed from MicroStrategy to Strategy, hinted at a new wave of BTC purchases by sharing a Bitcoin chart. The company last purchased 7,633 BTC on February 10, bringing its total assets to 478,740 BTC. Saylor stated that they plan to buy more Bitcoin using the “smart leverage” strategy in the first quarter of 2025. The company’s BTC investment currently exceeds $ 46 billion, while the value increase is calculated as 47.7%. Although there are some doubts about the sustainability of Strategy’s Bitcoin purchase plan, large institutional investors continue to show interest in the company.

Montana Joins US States That Reject Bitcoin Reserve Act

Montana; North Dakota has joined states like Wyoming and Pennsylvania in rejecting a proposal to include Bitcoin in state reserves.

House Bill 429, which was defeated by a vote of 59-41 in the House of Representatives, aimed to create a special budget of $50 million that would allow public funds to be invested in Bitcoin, stablecoins and precious metals.

Representative Curtis Schomer, the sponsor of the proposal, argued that such investment could provide higher returns compared to traditional bonds, while noting that Bitcoin is the only digital asset with a market value of $1.8 trillion that meets the criteria. However, the bill failed to gain enough support, and Montana joined the ranks of states that have paused their Bitcoin reserve plans.

Hong Kong-based Investment Firm HK Asia Holdings Increases Bitcoin Purchases

Hong Kong-based investment firm HK Asia Holdings Limited has decided to increase its Bitcoin investments. The company purchased another 7.88 BTC on February 20, bringing its total assets to approximately 8.88 BTC.

It was stated that this latest purchase was made at a cost of $ 761,705, while the company’s average purchase price per Bitcoin was announced as $ 97,021.

HK Asia’s Bitcoin investment caused a major increase in the company’s stock price. After the company announced that it purchased 1 BTC on February 16, its shares rose 93%.

————————————————————————————————

BITCOIN (BTC)

BTC is priced at $ 95,680 as of the morning hours, down 0.61%. BTC is approaching the resistance point at 96,374. If this level is exceeded, an upward movement towards the levels of 97.746 and 99.510 may be seen. However, if the price cannot break this resistance, a pullback towards the support points at 95.033 and 94.094 may occur. Especially the level of 93.227 is a critical support point and if this level is dropped, the decline may continue to the level of 91.792.

ETHEREUM (ETH)

ETH is priced at $ 2,725 as of the morning hours with a 3.37% loss in value. ETH retreated with the selling pressure from the $ 2,836 level and fell to the $ 2,761 support. ETH, which is currently traded at $ 2,794, may trend towards the $ 2,836 resistance again if it can hold above $ 2,761. If this level is exceeded, the strong resistance area in the $ 2,919 region should be followed. If this zone is broken, the price may accelerate its upward move and test new highs. In a possible bearish scenario, a loss of the $2,761 support could drag ETH towards the $2,678 and $2,622 levels. In particular, the $ 2,581 region stands out as an area where buyers are concentrated and can form a strong support.

RIPPLE (XRP)

XRP is priced at $ 2.49 as of the morning hours with a 3.04% loss in value. XRP dropped to $ 2,466. XRP, which is currently traded at $ 2,498, may rise towards the $ 2,633 resistance again if it can exceed the $ 2,550 level. If it persists above this level, the $ 2,787 and $ 2,900 levels can be followed as critical resistance zones. If the downward movements continue, the loss of the $ 2,466 support could pull XRP to $ 2,379 levels. If it falls below this zone, $ 2,256 stands out as a strong support.

AVALANCHE (AVAX)

AVAX is trading at $ 24.08 as of the morning hours with a 3.10% loss in value. If AVAX can overcome the $ 24.72 resistance, it may rise towards the $ 25.55 level again. If it persists above this level, the $ 26.54 and $ 27.64 levels can be followed as critical resistance zones. If the downward movements continue, the loss of the $23.93 support could pull AVAX down to $22.92 levels. If it falls below this area, $22.36 stands out as a strong support. Therefore, it is important for investors to follow the identified support and resistance levels carefully.

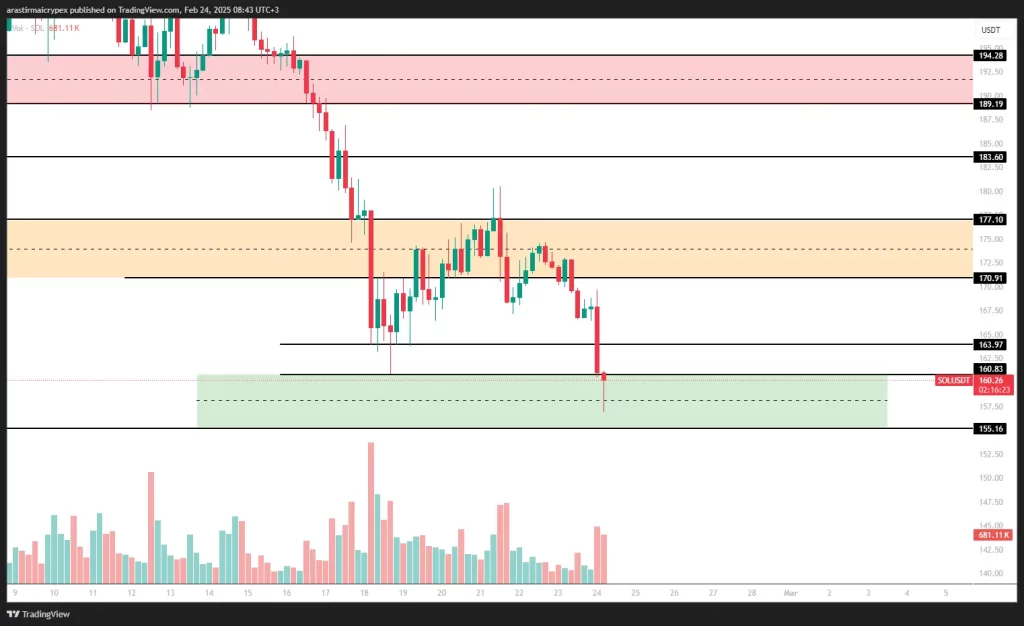

SOLANA (SOL)

SOL is priced at $ 160.24 as of the morning hours with a 4.57% loss in value. If SOL can overcome the $ 163.97 resistance, it may rise again towards the $ 170.91 level. If it remains above this level, the $ 177.10 and $ 183.60 levels can be followed as critical resistance zones. Especially breaking the $ 189.19 level may cause the upward movement to accelerate. If the downward movements continue, a decline to $ 158 levels may occur with the loss of the $ 160.26 support. If it falls below this region, selling pressure can be expected to increase and a decline to $ 155.16 can be seen.