Senate Releases Crypto Market Restructuring Draft and Seeks Feedback

The U.S. Senate continues its efforts to draft new regulations for the crypto market and has released a 35-page market restructuring draft. This draft provides clearer definitions for digital assets and outlines how these assets could be exempted from existing regulations. Specifically, the draft refines the definition of digital assets as non-securities (ancillary assets) and specifies that sales of these assets may be linked to securities purchase and sale agreements.

The draft also requires the SEC and CFTC to work together to regulate crypto assets. These regulations aim to protect investors and foster innovation. The draft legislation has been released for public comment, with a deadline of August 5th for industry feedback. The senators say they will continue this process, in collaboration with President Trump, to establish a comprehensive, bipartisan regulatory framework for digital assets.

JPMorgan Chase Considers Plans to Offer Crypto-Collateralized Lending to Clients

JPMorgan Chase plans to allow clients to secure loans using crypto assets as collateral. According to the Financial Times, the bank has begun evaluating lending options based on crypto assets such as Bitcoin and Ether. This move signals a growing acceptance of crypto assets by traditional financial institutions.

Despite maintaining a cautious approach to Bitcoin, CEO Jamie Dimon stated this year that he would take steps to enable clients to purchase Bitcoin. JPMorgan’s move comes amid increasing crypto-friendly regulations in the US. The GENIUS Act, signed by Trump last week, aims to create a regulatory framework for stablecoins, which could make it easier for banks to engage more closely with the cryptocurrency sector.

Jerome Powell Resignation Rumor Debunked

A letter circulating online claiming that Federal Reserve Chair Jerome Powell resigned has sparked widespread confusion and market speculation. The letter claims Powell resigned due to tensions with President Donald Trump. However, the document has been revealed to be a complete fake, likely generated by artificial intelligence. The claim that Powell resigned is untrue, and the blurred and illegible stamp on the letter also suggests it is fake. Despite this, this claim has increased volatility in financial markets, particularly the cryptocurrency market.

The ongoing debate between Powell and Trump over interest rates is worrying markets. Trump wants interest rates lowered to support the economy, while Powell prefers to keep inflation under control and preserve the Fed’s independence. Powell’s resignation could create significant uncertainty in the markets, and investors may anticipate a short-term rally in Bitcoin and other crypto assets amid expectations that the new Fed chair will lower interest rates.

SEC Reverses, Delays Bitwise Crypto Index ETF Conversion Approval

The U.S. Securities and Exchange Commission (SEC) approved Bitwise’s plan to convert its crypto index fund into an ETF, but delayed the approval a few hours later. The Bitwise 10 Crypto Index ETF offers investment opportunities in leading crypto assets such as Bitcoin, Ethereum, XRP, Solana, and Polkadot, weighted by market capitalization.

The SEC paused the process, stating that it would review the decision after approval. This move is similar to the SEC’s recent approval of Grayscale’s digital large-cap fund’s ETF conversion, which it then reversed the following day. Experts indicate that the SEC may be working on a new crypto ETF framework, which could speed up the process. For now, Bitwise and investors are awaiting the SEC’s next move.

21Shares Files Application with the SEC for ETF Tracking Ondo Token

21Shares has filed an application with the U.S. Securities and Exchange Commission (SEC) for an ETF tracking ONDO, the native token of DeFi platform Ondo Finance. The fund, called the “21Shares Ondo Trust,” will directly hold ONDO tokens and track their performance against the CME CF Ondo Finance-Dollar Reference Rate. Coinbase will provide custody of the tokens.

ONDO is the native token of Ondo Chain, part of a layer-1 blockchain platform specifically focused on institutional financial markets and tokenized real-world assets (RWAs). The fund is a passive investment vehicle and will not involve any speculation or leverage.

SharpLink Gaming’s ETH Investment Exceeds $1.3 Billion, Growing with GENIUS Act Support

SharpLink Gaming, led by Joseph Lubin, has rapidly increased its Ethereum (ETH) investments, reaching a total of 360,807 ETH, valued at $1.33 billion. The company purchased 79,949 ETH in the last week, earning rewards by staking ETH and becoming a major institutional ETH holder. Additionally, SharpLink plans to use the $96.6 million in funds for additional ETH purchases to support the company’s growth.

Lubin stated that the GENIUS Act, signed into law last week, ends regulatory uncertainty for blockchain and digital assets, paving the way for Ethereum to realize its full potential. It was emphasized that SharpLink aims to transform the digital economy with this strategy by leveraging Ethereum’s security, scalability, and smart contract capabilities.

Public Companies Invest $3.2 Billion in Ethereum Treasury

Public companies have rapidly increased their Ethereum (ETH) holdings, reaching a total treasury exceeding 865,000 ETH. 10 of these 58 companies hold approximately $3.2 billion worth of Ethereum. Companies that have made recent strategic acquisitions indicate growing institutional confidence in Ethereum.

Companies like GameSquare Holdings, BTCS, SharpLink, and BTC Digital continue to purchase Ethereum, with SharpLink purchasing 79,949 ETH in July alone. This brings the company’s total ETH holdings to 360,807, approximately $1.3 billion. In addition, Bit Digital and Bitmine are among the companies that have rapidly increased their holdings of Ethereum by making large purchases. Ethereum’s growing role in institutional acquisitions is strengthening the place of crypto assets in financial strategies.

Telegram Launches TON Wallet in the US

Telegram has launched its TON Wallet crypto wallet for US users. Users can send, receive, and store crypto assets through this wallet. The wallet has a self-custodial structure, allowing users to manage their private keys. Telegram avoids complex setup steps and uses a simple key system linked to users’ Telegram accounts.

TON Wallet offers features such as staking, token swap, and fiat currency transactions. The wallet also enables fiat-to-crypto conversion in partnership with MoonPay, but Telegram does not provide direct financial services. Telegram, which left the TON blockchain in 2020 due to SEC proceedings, is still integrating some TON-based features into its platform.

Dogecoin Could Transform with Zero-Knowledge Proof (ZKP) Proposal

DogeOS has submitted a proposal to enhance its blockchain network with native Zero-Knowledge Proof (ZKP) verification, a DogeOS-based application layer. The upgrade, dubbed OP_CHECKZKP, aims to expand Dogecoin’s functionality by enabling smart contract compatibility with Ethereum.

This proposal would take Dogecoin a significant step toward becoming a smart contract platform and would also open up new use cases such as confidential transactions, cross-chain DOGE bridges, and decentralized applications (dApps). The ZKP integration could increase Dogecoin’s transaction capacity, while improving the network’s scalability and transaction speeds.

Bank of England May Postpone Digital Pound Plans

The Bank of England is reassessing its plans for a digital pound (Britcoin) due to the rapid development of private sector payment solutions. Alternatives offered by the private sector could reduce the need for government-backed digital assets. The Bank is not abandoning the digital pound entirely, but it may scale back its efforts in this area.

BoE Governor Andrew Bailey has expressed doubts about the necessity of a digital pound, stating that introducing a new currency would be unnecessary if collaboration with commercial banks is successful. As interest in state-backed digital currencies decreases worldwide, the BoE is reconsidering its current plans.

————————————————————————————————

BITCOIN (BTC)

Bitcoin is trading at $118,444 as of the morning hours, losing 1.23%. The price is facing a critical resistance level at $120,217. Breaking this level could allow the price to accelerate higher and create the potential for a rally to $123,000. However, if a sustained close is not made above this level, a new test around $118,000 may be needed.

In downward movements, the first support level can be met at $118,175, and the level of $116,050 can be followed below. If this level is broken, the price is likely to initiate a deeper pullback, with the $111.924 level acting as a key support level, where buyers are expected to step in. Below this level, the support of the psychological level of $ 110,000 will gain more importance.

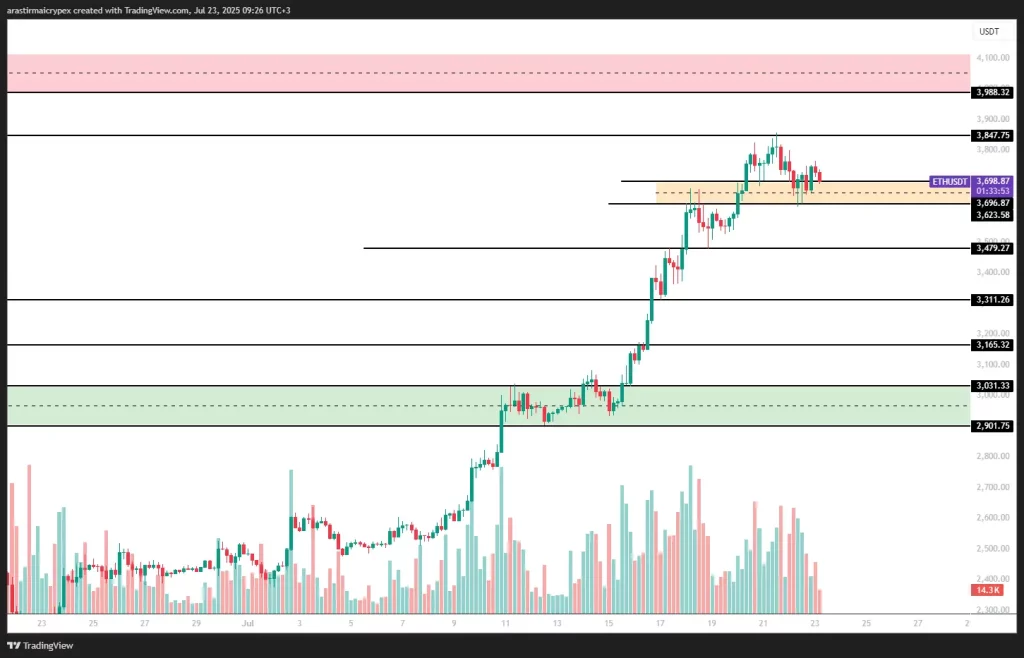

ETHEREUM(ETH)

ETH is priced at $ 3,701 as of the morning hours with a 1.23% loss in value. The price is currently trading in the short-term support area of $ 3,698. A stay above this level could trigger an upward movement up to $ 3,847. However, if it stays below the $ 3,698 level, pullbacks to $ 3,623 are possible. Below $3,623 could be a signal for a broader correction that could last up to $3,479. These levels will play a critical role in determining ETH’s short-term direction.

RIPPLE(XRP)

XRP is priced at $3.48 as of morning hours, losing 1.93%. The price is currently trading near the short-term support level of around $3,406. A close below this level could open the potential for a pullback to $3.3470 and $3.2449. On the other hand, if it stays above $3,406, a renewed upward move towards $3.6093 is possible. These levels will continue to be watched as key resistance and support points for XRP’s short-term direction.

AVALANCHE(AVAX)

AVAX is trading at $25.39 as of the morning hours, with a 1.85% decline. While the price is trading at $25.39, a support area has formed near the $24,792 level. If this support level breaks, the $23,911 and $22,590 levels could be the next potential support points. On the other hand, a close above $25.39 could create an opportunity for AVAX to continue towards $26,263 levels.

SOLANA(SOL)

SOL is traded around the $ 200 level with a 2.54% loss in value as of the morning hours. The price tested the $ 205 level with the recent strong rise, but faced selling pressure in this area and retreated. This shows that the $ 204 level is currently operating as a significant resistance area.

For the upward movement to continue, the $ 204 level can be expected to be exceeded. Then, the $ 208 level can be expected to work as a resistance. Otherwise, the current correction could continue towards the $193.06 and $179.05 levels. Despite a possible pullback, the $173.71 and $169.55 levels will remain strong supports.