Trump Promises to Sign Stablecoin Law Before August At Crypto Summit – OCC Approves Banks for Crypto Custody

Trump Promises to Sign Stablecoin Law Before August At Crypto Summit

US President Donald Trump announced at the first crypto summit held at the White House that he expects the stablecoin law to be presented to him before August. The summit was attended by important crypto names such as Coinbase CEO Brian Armstrong, Kraken co-CEO Arjun Sethi and Representative Tom Emmer, as well as SEC and CFTC officials. Trump emphasized that he would protect the long-term strength of the US dollar, while stating that the Biden administration was forcing crypto companies to close their bank accounts and vowed to remove such obstacles.

A day before the summit, Trump signed an executive order that provides for the creation of a strategic Bitcoin reserve and digital asset stock to be financed with Bitcoin assets seized by the Treasury Department. The new regulation foresees the government converting altcoins other than Bitcoin into BTC in the long term. These developments are considered part of the work carried out with the aim of making the US a global leader in the crypto space.

OCC Approves Banks for Crypto Custody Services

The US Office of the Comptroller of the Currency (OCC) announced that banks can perform activities such as crypto asset custody services and stablecoin transactions without prior approval.

The new regulation also allows national banks to operate as validators in decentralized networks. The removal of restrictions imposed during the Biden period makes it easier for banks to enter the crypto sector. OCC Acting Chairman Rodney Hood stated that banks can provide crypto services with strong risk management practices. The decision came on the heels of the Crypto Summit at the White House and Trump’s decision to create the Bitcoin Strategic Reserve. However, experts emphasize that the uncertainties in the banking sector will not completely end until the Fed and FDIC withdraw their anti-crypto policies.

Bitcoin Volatility at Its Highest of the Year

Bitcoin’s price volatility reached its highest level of the year at 59.4% last week and has been around 58% since then. This volatility coincided with US President Donald Trump’s decision to create a strategic crypto reserve and the summit he held with leading figures in the digital asset sector. However, despite these developments, Bitcoin’s price continued to fall and fell to $ 83,000.

The executive order signed by Trump includes a comprehensive calculation of the US government’s approximately 200,000 BTC assets. Officials stated that this reserve would be protected like a digital “Fort Knox.” However, investors were disappointed to learn that this reserve would be financed with seized assets instead of government purchases. In addition, global market fluctuations that came with the Trump administration’s announcement of new taxes also played a role in Bitcoin’s loss of value.

Michael Saylor Stated, “The US Should Buy 25% of the Bitcoin Supply”

Strategy founder Michael Saylor suggested that the US government purchase 5% to 25% of the Bitcoin supply between 2025 and 2035 through programmatic purchases. Saylor stated that this reserve could provide an annual return of more than $10 trillion by 2045.

In his report presented to President Trump and officials at the crypto summit in the White House, Saylor emphasized that the US should adopt the “Never sell your Bitcoin” strategy, arguing that this reserve would contribute to the relief of the national debt. The “Strategic Bitcoin Reserve” executive order signed by Trump does not include new purchases for now, but it does foresee the creation of budget-friendly BTC acquisition plans.

David Sacks Opposes Crypto Transaction Tax

The White House’s crypto and artificial intelligence advisor David Sacks opposed the idea of imposing a 0.01% tax on crypto transactions to finance the US’s strategic Bitcoin reserve.

Speaking on the All In Podcast, Sacks said, “Taxes always start small but spread over time. Income tax also initially covered very few people,” arguing that such new taxes could become a huge burden in the future. While tax policies were not clarified at the White House Crypto Summit, the Trump administration continues its plan to remove income tax and replace it with import tariffs.

Nasdaq Switches to 24-Hour Trading Model Inspired by Crypto Market

Nasdaq announced that it will start trading 24 hours a day in the second half of 2026. The plan aims to increase global investor interest and strengthen market accessibility.

Nasdaq Chairman Tal Cohen stated that talks with regulators and market participants are ongoing. While foreign investor presence in the US stock market reached $ 17 trillion by mid-2024, Cohen emphasized that this model will provide great advantages especially for investors from the Asia-Pacific region. Experts state that this step is inspired by the continuous trading model of the crypto market. Oracle Network Pyth CEO Mike Cahill said, “Markets do not sleep. Nasdaq’s step is a sign of getting closer to the DeFi model.” he said.

Fold Adds $41 Million Worth of BTC to Its Bitcoin Reserve

Bitcoin services company Fold, which started trading on Nasdaq in February, increased its reserve to 1,485 BTC by purchasing another 475 BTC worth $41 million. The company’s total Bitcoin holdings have reached approximately $130 million at current prices.

Fold financed the Bitcoin purchase by raising funds through a convertible bond issuance, similar to the strategy implemented by MicroStrategy. CEO Will Reeves emphasized that they believe Bitcoin will be the cornerstone of the new financial system and that the company’s strong Bitcoin treasury will increase shareholder value while strengthening its Bitcoin-focused financial services. Fold’s move comes on the heels of Trump’s decision to create a Bitcoin Strategic Reserve for the United States. But the company’s shares closed down 1.7% at $7.58 on Friday.

Utah Senate Approves Bitcoin Bill, But Removes Reserve Clause

The Utah Senate has approved Bitcoin legislation, but removed a critical provision that would allow the state treasury to invest in Bitcoin.

HB230, the bill that would grant Utah residents the right to mine Bitcoin, run nodes and stake Bitcoin, was removed from the bill in a final vote. However, the provision that would allow Utah to create its own Bitcoin reserve was removed from the bill in a final vote. The law will now be submitted to Utah Governor Spencer Cox for approval.

Meanwhile, similar bills aiming to create Bitcoin reserves in Arizona and Texas are awaiting a final vote in the state senates.

——————————————————————————————

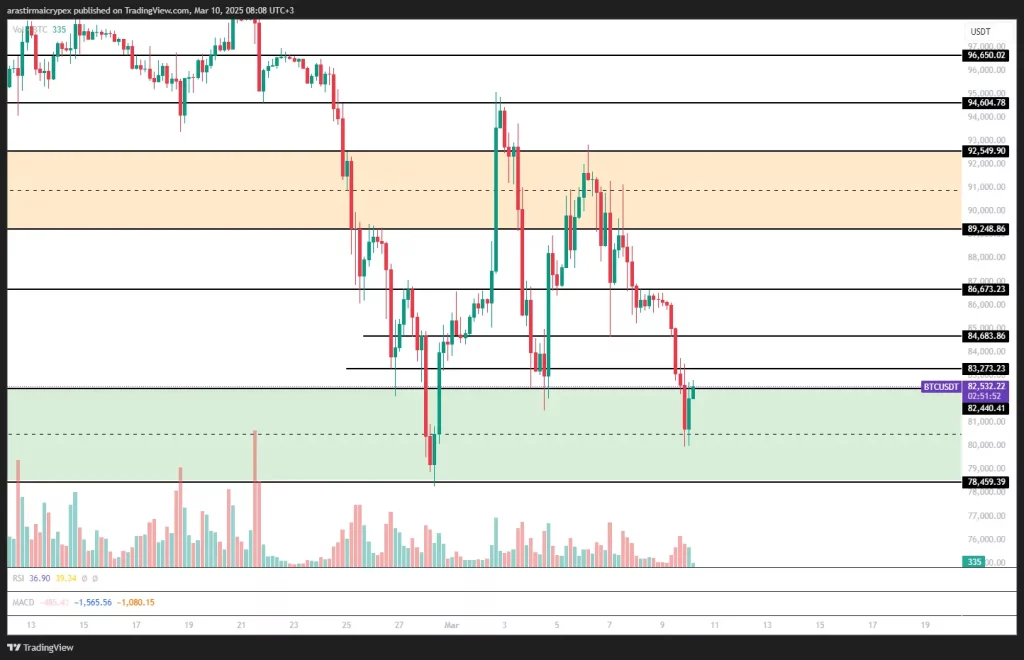

BITCOIN (BTC)

BTC is trading at $82,532 as of the morning hours, gaining 2.19%. Following yesterday’s sharp sell-off, BTC is trying to stay above the $82,440 support level. In order for the upward movement to continue, the $83,273 resistance must first be overcome. If this level is broken, the $84,683 and then the $86,673 levels can be followed as the next resistance zones. If it remains above the 86.673 level, BTC can be expected to continue its rise to the $ 89.248 level.

In the negative scenario, $ 82.440 stands out as the first support level. If this level is broken downward, $ 80.050, which was tested as of yesterday, can be expected to be tested again. If this level is broken, a pullback to $ 78,459 levels may be seen.

ETHEREUM (ETH)

ETH is priced at $ 2,068 as of the morning hours with a 2.32% gain in value. Following yesterday’s declines, ETH is trying to hold on to a point close to the $ 2,000 support level. In order for the upward movements to continue, the $ 2,075 level must first be overcome. If this level is broken, the $ 2,153 and then the $ 2,206 levels can be followed as resistance points. If it remains above the 2,206 level, an increase towards the $ 2,265 level can be expected.

In the negative scenario, $ 2,000 stands out as the first support level. Breaking this level could cause ETH to pull back to $ 1,908 levels.

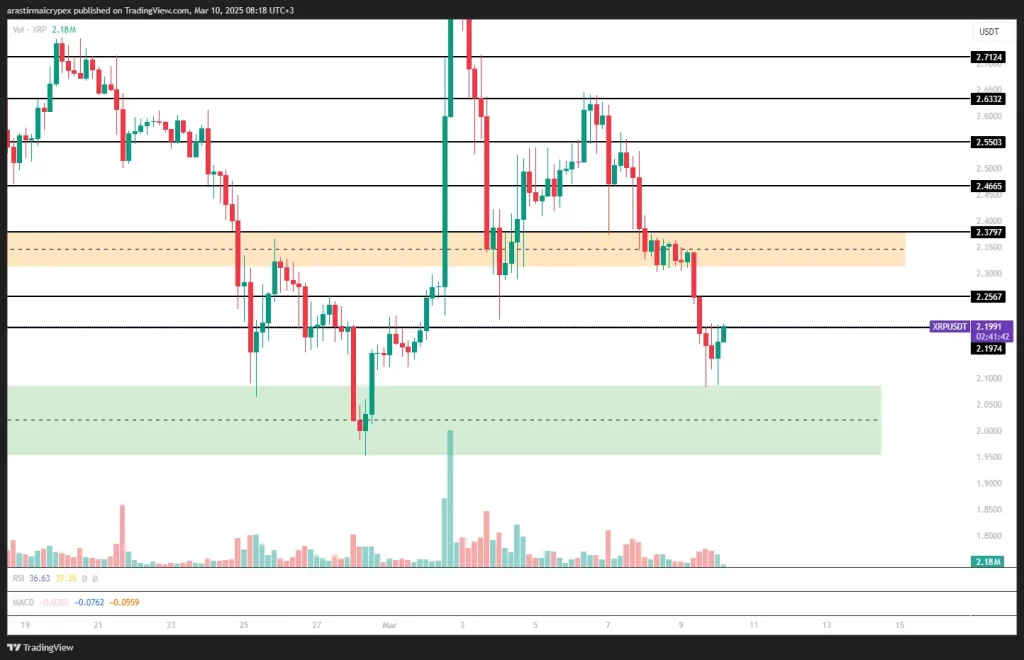

RIPPLE (XRP)

XRP is priced at $ 2.19 levels with a 2.86% gain as of the morning hours. Following the recent declines, it continues its upward movement by receiving a reaction from the $ 2.08 support level. In order for the upward momentum to continue, it will be important to first maintain stability above the $ 2.19 level. If this level is broken, the $ 2.25 region can be tested. For a stronger rise, the $2.37 level will be followed as critical resistance points.

In downward movements, the $2.12 level stands out as the first support point. If this level is broken, a pullback to the $2.08 region may be seen. In a deeper decline scenario, the $ 2.02 level stands out as strong support areas.

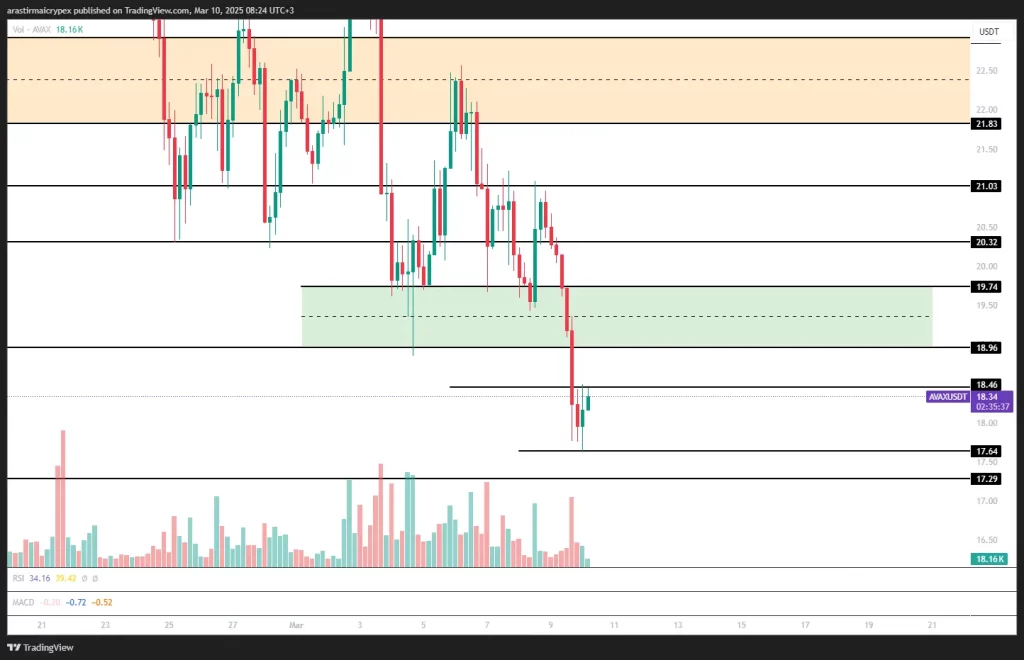

AVALANCHE (AVAX)

AVAX is trading at $ 18.35 as of the morning hours with a 2.11% gain in value. Testing the 18.46 level during the day, AVAX showed a slight reaction and retreated from here. If the upward movement continues, the 18.46 level stands out as the first resistance point. If this level is exceeded, the 18.96 region can be followed as a strong resistance. Above, the 20.32 level stands out as resistance.

In the negative scenario, the 17.64 level is an important support. If this area is lost, the 17.29 level may come to the fore.

SOLANA (SOL)

SOL is traded at $ 128.44 as of the morning hours with a 1.89% gain in value. SOL, which fell to the 125.22 support during the day, showed a recovery with the reaction it received from this level. If the upward movement continues, first 130.47 and then 135.47 stand out as resistance points. If this level is exceeded, the 139.58 and 147.06 levels can be followed as resistance.

In the negative scenario, the 125.22 level is an important support. If this region is lost, the 112.54 level may come to the fore.