Crypto Market Shook with Trump’s Warning to Iran

US President Donald Trump called for “unconditional surrender” to Iran and stated that their patience was running out. The crypto market was also shaken with this warning. Although Bitcoin briefly fell below $ 103,500, it started the new day with rapid recoveries. As the Israel-Iran air war entered its sixth day, Trump’s statements indicated that the US could adopt a more aggressive stance. While Iranian missile attacks on Israel were largely thwarted, explosions were also heard in Tehran and its surroundings. Trump threatened that they knew the location of Iran’s religious leader Ayatollah Khamenei. These statements came as Israel launched attacks targeting senior Iranian military officials.

Israel announced that it had launched its largest-ever air operation against Iran. Targets include Iran’s nuclear facilities.

US Senate Passes GENIUS Act to Regulate Stablecoins

The US Senate has passed the GENIUS Act, which would regulate stablecoin issuers, by a strong 68-30 vote. This marks the first time the Senate has passed a major cryptocurrency bill. The legislation now heads to the House of Representatives, where it could be amended before being voted on. Under the legislation, companies offering stablecoins in the US would be required to meet high reserve standards, ensure transparency, take measures against money laundering, and be subject to strict regulatory oversight.

While the crypto industry has hailed the development as a “historical milestone,” some Democratic senators — notably Elizabeth Warren — argue that the bill includes insufficient oversight and leaves the door open to foreign tokens. The bill aims to make the country a global leader in crypto regulation by allowing the proliferation of stablecoins pegged 1:1 to the US dollar. The GENIUS Act is being considered alongside the broader Digital Asset Market Clarity Act pending in Congress and is set to play a decisive role in the future of crypto regulation.

SEC, Ripple Request Delay on Appeals to Finalize Settlement

The U.S. Securities and Exchange Commission (SEC) and Ripple Labs have requested a delay on appeals to finalize their settlement. In a joint filing with the U.S. District Court for the Southern District of New York on June 12, the parties proposed to lift the injunction against Ripple and reallocate the $125 million penalty. Under the proposed new distribution, $50 million would be paid back to the SEC and $75 million would be repaid to Ripple. The SEC has agreed to provide a status update by August 15, 2025, and is seeking to suspend the appeals process until then.

The move comes after the court rejected its initial settlement request in May, citing a lack of “extraordinary circumstances.” The new filing argues that the settlement would end the litigation process more efficiently and is consistent with the SEC’s approach to similar crypto applications.

Litecoin Becomes One of the First Cryptos to Comply with EU Rules

The Litecoin Foundation has announced that its official white paper, prepared under the European Union’s new crypto regulation MiCAR (Markets in Crypto-Assets Regulation), has been registered with ESMA (the European Securities and Markets Authority). The development marks Litecoin’s pioneering step in legalizing activities such as initial public offerings or listings on exchanges within the EU. MiCAR aims to increase investor protection by introducing clear and mandatory transparency rules for crypto assets across the EU.

The approved white paper explains in plain language how Litecoin works, its risks and technical features. This step will allow European exchanges and companies to face fewer legal risks when trading Litecoin. However, despite this positive development, the Litecoin price fell by 6.10% in the last 24 hours to $82.77. On the other hand, Bloomberg analyst James Seyffart gave hope for the future by stating that he predicts a 90% chance of a Litecoin ETF being approved in 2025.

Ark Invest Sells $51 Million in Circle Shares

With Circle gaining 400% in value after its IPO, Ark Invest sold 342,658 CRCL shares, totaling $51.7 million. The sell-off affected the ARK Innovation (ARKK), Next Generation Internet (ARKW) and Fintech Innovation (ARKF) ETFs. Circle’s USDC stablecoin is seen as the main driver of the rally.

However, the rally has not been without its critics. Maelstrom CIO Arthur Hayes called Circle’s valuation “overinflated” and warned that a new bubble could form in the market with similar initiatives. Hayes suggested that this could lead to similar results to the TerraUSD crash.

The Blockchain Group Raises $8.3 Million for Bitcoin Purchases

The Blockchain Group announced that it will raise $8.3 million in new capital as part of a $342 million equity issuance program. The company aims to expand its bitcoin purchases by issuing approximately 1.6 million new shares at an average price of 4.49 euros. The company also sold $11.2 million in convertible bonds and stocks last week.

The Blockchain Group, known as Europe’s first Bitcoin treasury company, aims to grow its reserves and strengthen its position in the digital asset market with this strategy. The company’s shares, which currently hold 1,471 BTC, lost more than 4% after the announcement, falling to 5.53 euros.

Galaxy and Liquid Collective to Offer Ethereum Liquid Staking Service to Institutional Investors

Galaxy and Liquid Collective have formed a strategic partnership to offer Ethereum-based liquid staking service to institutional investors. The partnership comes after the U.S. Securities and Exchange Commission (SEC) announced in May that staking activities are not considered securities. Galaxy will provide over-the-counter (OTC) trading support for Liquid Collective’s liquid staking token, called LsETH, and will also serve as a node operator on the network. LsETH is the first liquid staking solution specifically designed for institutional needs.

Alluvial, the company behind Liquid Collective, stated that the platform is growing rapidly with over $700 million in locked assets (TVL). This initiative, which has the support of major players such as Coinbase, Kraken, BitGo and Anchorage Digital, aims to bring liquidity and institutional-level compliance to staking. As part of the partnership, it is planned to offer liquid staking services for Solana in the future. The SEC’s favorable regulations for staking and mining activities pave the way for such institutional solutions to become widespread.

SEC Postpones Franklin Templeton’s XRP and Solana ETF Applications

The U.S. Securities and Exchange Commission (SEC) has once again extended the review period for Franklin Templeton’s spot Solana and XRP ETF applications. XRP investors who were waiting for a decision on June 17 were disappointed by the SEC’s decision. It is also unclear whether the SEC will also postpone ProShares’ Solana and XRP ETF applications. ProShares had updated its decision date to June 25.

The updated documents state that the SEC has requested comments and feedback from the public and that the deadline has been pushed back to late July 2025. This suggests that the ETFs could be approved at the earliest. Despite this, market expectations are positive; according to Polymarket data, the probability of approval for the Solana ETF is 91% and the probability of approval for the XRP ETF is 89%. This shows that investors are still strongly expecting ETF approvals in 2025.

Malaysia Establishes Digital Asset Center

Malaysia has established the “Digital Asset Innovation Center” to encourage innovations in digital finance. Prime Minister Anwar Ibrahim described the initiative, which he announced at the Sasana Symposium 2025 in Kuala Lumpur, as “the beginning of a new era” in the country’s digital economy. The centre will provide a regulatory sandbox where applications such as programmable payments, ringgit-backed stablecoins and supply chain finance can be tested under the central bank’s supervision.

Malaysia’s move is part of its vision to make the country a regional fintech hub. Central Bank of Malaysia Governor Abdul Rasheed Ghaffour highlighted work being done in areas such as modernizing the country’s payment infrastructure, cross-border payment connections and asset tokenization. On the other hand, neighboring Singapore has tightened regulations on crypto services, requiring unlicensed digital token providers to cease operations by June 30.

——————————————————————————————

BITCOIN (BTC)

Bitcoin is testing the 105,778 support after being rejected from the 107,319 level. This level stands out as the area where buyers are active. If the price manages to hold above 105,778, a new movement towards the 107,319 – 111,861 region may be observed. In the opposite scenario, the 101,315 support may come to the fore again. The general structure is in the form of horizontal consolidation and a breakout should be expected for the clear direction.

ETHEREUM(ETH)

Ethereum is trying to find support in the 2.535 – 2.550 band. We see that this region has been an area where buyers have stepped in before. However, as long as the 2.679 resistance is not overcome, this region may only remain as a short-term reaction buying area. In case of a downside break, the 2.385 support should be followed as one of the previous low areas.

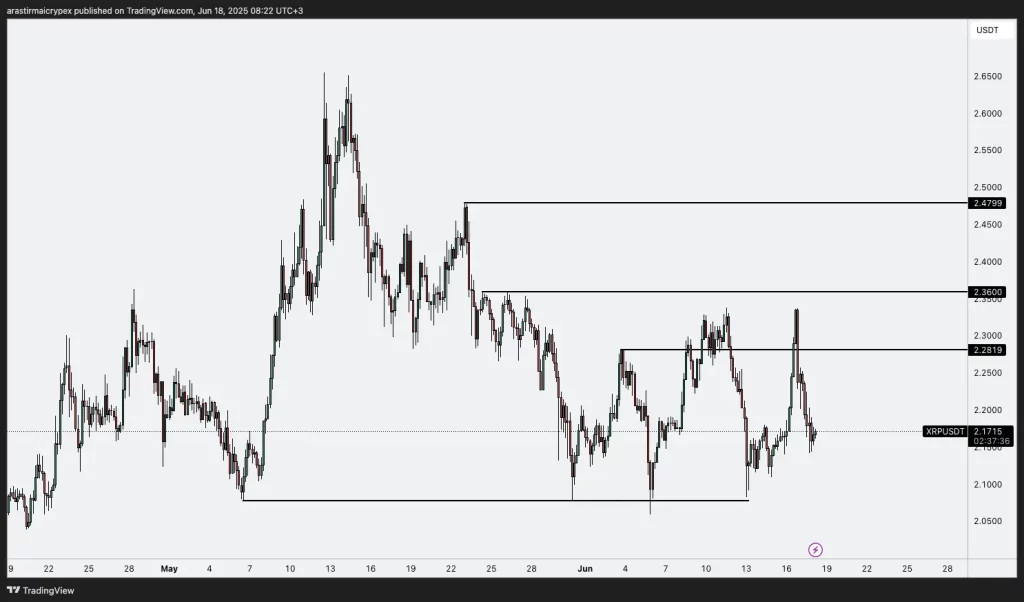

RIPPLE(XRP)

XRP has been pulled back to the 2.1715 level after being rejected sharply from the 2.2819 USDT level. If it continues to hold above this level, the price may test the 2.2819 and 2.36 levels again. However, the market seems indecisive given the current structure. In downward breakouts, a pullback to the 2.06 level may occur.

AVALANCHE(AVAX)

AVAX is trying to react after testing the 18.52 USDT support. However, the limited rises and the strong selling of the 20.25 – 21.48 resistance zone show that the downtrend continues in the short term. If the 18.52 support is broken, the probability of a pullback to 15.27 levels increases. In upward corrections, closing above 20.25 may weaken the short-term downtrend.

SOLANA(SOL)

SOL is once again approaching the important demand area in the 145 – 149 USDT band. We see that the price has previously left this area with a strong buying reaction. However, recent price movements suggest that the buyer power in this area may have weakened. If the downward pressure continues, closing below 144 USDT may pave the way for a deeper correction. In upward reactions, the 166 USDT level should be followed as the first resistance.