Trump’s New Tariffs Shake Crypto Markets

After President Donald Trump announced sweeping tariffs, global markets were rocked and crypto markets also saw sharp declines. The new regulation imposes a 10% base tariff on products imported to the US, with some products seeing a rate as high as 49%. Following this development, Bitcoin fell 3% to $82,300, while Ethereum and Solana lost more than 6% of their value.

Experts say that rising hardware costs could put US-based Bitcoin miners in a difficult position. Since most ASIC mining devices come from China, these tariffs are thought to increase production costs. On the other hand, some analysts suggest that the Trump administration could buy Bitcoin with the revenue from the new tariffs. This development could cause investors to turn to safe haven assets due to uncertainty.

Stablecoin Bill Passes House Committee

The U.S. House Financial Services Committee has approved the Stablecoin Transparency and Accountability Act (STABLE) by a vote of 32-17. The legislation aims to create a new regulatory framework for stablecoins, including reserve requirements and anti-money laundering measures.

The bill comes amid ongoing controversy over the Trump family’s investments in the crypto sector. Democrats have proposed additional regulations that would limit the president and cabinet members’ involvement in the stablecoin market. The legislation will now face a vote in the House of Representatives and could go through a similar process in the Senate before being sent to the President for approval.

Fidelity Launches Crypto IRA Accounts With Bitcoin and Ethereum

Fidelity Investments has announced the launch of “Fidelity Crypto for IRA,” a service that allows individuals to add crypto assets to their retirement portfolios. The new individual retirement account (IRA) is offered through Fidelity Digital Assets and initially only allows trading in Bitcoin, Ethereum, and Litecoin.

There are three different account types offered: the Fidelity Crypto Roth IRA, the Fidelity Crypto Traditional IRA, and the Fidelity Crypto Rollover IRA. Investors must be U.S. citizens and reside in an eligible state. Fidelity said it will provide education and support to investors as interest in digital assets grows. The move follows the growing popularity of crypto-asset-focused investment vehicles.

Grayscale Launches 2 New ETFs That Income from Bitcoin Volatility

Crypto asset management firm Grayscale has listed two new exchange-traded funds (ETFs) that offer investors the opportunity to generate income from Bitcoin’s volatility. The Bitcoin Covered Call ETF (BTCC) and the Bitcoin Premium Income ETF (BPI) are set to begin trading on the New York Stock Exchange on Wednesday.

These ETFs aim to generate income using covered call strategies. While BTCC focuses on providing regular cash flow by selling options close to the Bitcoin price, BPI offers investors the opportunity to take advantage of BTC’s upside potential by selling options at more distant price levels. In this period of continued volatility for Bitcoin, Grayscale’s new ETFs aim to balance risks by offering investors different sources of income.

Ripple Integrates RLUSD Stablecoin into Cross-Border Payments

Ripple has integrated its stablecoin RLUSD, which it launched in December, into the Ripple Payments system. Cross-border payment providers such as BKK Forex and iSend have started using RLUSD to improve liquidity management.

RLUSD, which was launched after receiving approval from the New York Department of Financial Services (NYDFS), has grown by 87% in the last month and reached a market value of $244 million. Ripple Stablecoin President Jack McDonald stated that growth exceeded the company’s expectations and that they are collaborating with NGOs to use RLUSD for relief distributions.

PayPal Opens SOL and LINK Support to US Users

PayPal has announced that it has added Solana (SOL) and Chainlink (LINK) to its digital asset support list. Users in the US and US regions will now be able to buy and hold SOL and LINK. With this addition, PayPal’s supported digital assets include PYUSD, BTC, ETH, LTC, and BCH.

However, it is not yet clear whether SOL and LINK will be transferable to external wallets. PayPal has been offering crypto buying and selling since 2020 and expanded its services in 2024 by allowing businesses in the US to directly hold crypto and make on-chain transactions. The latest move is seen as part of the company’s strategy to increase crypto adoption.

SMBC, Ava Labs, and Fireblocks Launch Stablecoin Efforts in Japan

Japanese financial groups Sumitomo Mitsui Financial Group (SMBC), business systems firm TIS Inc, Avalanche developer Ava Labs, and digital asset infrastructure company Fireblocks have signed a memorandum of understanding (MOM) to explore the commercialization of stablecoins in Japan. The collaboration will focus on developing strategies for the issuance and circulation of stablecoins pegged to the U.S. dollar and Japanese yen.

It will also examine how stablecoins can be used to exchange real-world assets such as tokenized stocks, bonds, and real estate. Stablecoins continue to be at the center of regulatory frameworks around the world, with Japan’s steps in the field seen as a development that supports the growing institutional interest in the crypto market and the transformation of the financial sector.

Democrats Request Records from SEC on Trump World Liberty Financial

Senator Elizabeth Warren and Representative Maxine Waters have asked the U.S. Securities and Exchange Commission (SEC) to preserve and share records on Trump family-backed World Liberty Financial (WLFI) and the USD1 stablecoin project. The letter requests documents on whether the Trump family’s financial ties influenced SEC policies or enforcement decisions.

The Trump family reportedly owns 75% of WLFI and earned $400 million from token sale proceeds. Democrats are investigating such political and financial connections that could compromise the SEC’s independence. The SEC has not yet responded to this request.

Justin Sun’s Bankruptcy Claims and the FDUSD Crisis

First Digital Trust (FDT) has rejected Tron founder Justin Sun’s claims that its FDUSD stablecoin is insolvent, calling it a “smear campaign.” The company emphasized that FDUSD’s reserves are fully backed by U.S. Treasury bonds and that all assets are reported transparently. Claiming that Sun’s claims are actually a result of a dispute over TrueUSD (TUSD), FDT announced that it plans to take this process to court.

Following Sun’s statements, FDUSD fell to $0.87, then recovered to around $0.98. The crisis also poses a serious risk for Binance. Since the platform holds 94% of the FDUSD supply. Binance’s decision to prioritize FDUSD after withdrawing from BUSD has raised questions about the stability of the stablecoin and raised the possibility that regulators could reexamine it.

AVAX Could Increase in Value by 10 Times by 2029

According to Standard Chartered analyst Geoff Kendrick, Avalanche (AVAX) could see a major increase in value in the coming years thanks to its scalability solutions. According to the bank’s estimate, AVAX could reach $55 by the end of 2025 and $250 by the end of 2029. The network’s subnet architecture and recent cost-cutting updates play an important role in this rise.

Avalanche’s current market value is $9 billion and developer interest is increasing. Kendrick states that AVAX could increase in value more than Bitcoin and Ethereum. The analyst, who pointed out that the subnet creation costs were reduced to almost zero with the major network update carried out in December, emphasized that this development made the ecosystem more attractive.

———————————————————————————————

BITCOIN (BTC)

BTC is trading at $ 83,455 as of the morning hours with a 1.12% gain in value. While the level of 79,989.33 stands out as a strong support, the price reacted upwards after approaching this level. However, the price, which reached the resistance zone shown by the green area around 86,000, faced sellers here and retreated. If this zone cannot be overcome, it may be possible for the price to test the 79,989.33 support again. In the upward scenario, if this resistance zone is broken, the levels of 95,717.39 and 96,060.85 can be targeted. In general, it will be important to follow the price movements that will occur at critical support and resistance levels to determine the direction of the market.

ETHEREUM (ETH)

ETH is priced at $ 1,832 with a 2.06% gain as of the morning hours. While the 1,768.98 level stands out as an important support, the price has approached this level and reacted from here. In upward movements, the red line at 2,100 can be followed as resistance. If the price can exceed this level, the 2,797.50 level may be the next target. On the other hand, if the support level is broken, the purple zone below around 1,600 stands out as a strong demand area. In the short term, the reactions of the price to the support and resistance zones will be decisive in terms of direction determination.

RIPPLE (XRP)

XRP is traded at $ 2.0676 as of the morning hours with a 2.19% gain in value. In downward movements, the blue support zone around 1.9000 USDT stands out as an important demand area. In upward reaction purchases, the blue box at 2.5000 USDT can be followed as resistance. If the price can exceed this level, the orange zone between 2.7220 – 2.8716 USDT appears as a strong supply area. Considering the price movements, reaction purchases from support levels and price reactions in resistance areas will be decisive in terms of short-term direction determination.

AVALANCHE (AVAX)

AVAX is trading at $ 18.97 as of the morning hours with a 4.50% gain in value. While the 21.88 level in particular stands out as a strong resistance point, the price encountered selling pressure again before approaching this level. In downward movements, the 17.74 level is watched as an important support area. Since this level has been a region that has received reactions before, whether the price can hold on here may be a directional determinant in the short term. If the 17.74 support is maintained, a recovery above 20.00 may be possible. However, if it falls below this level, the downward momentum may accelerate.

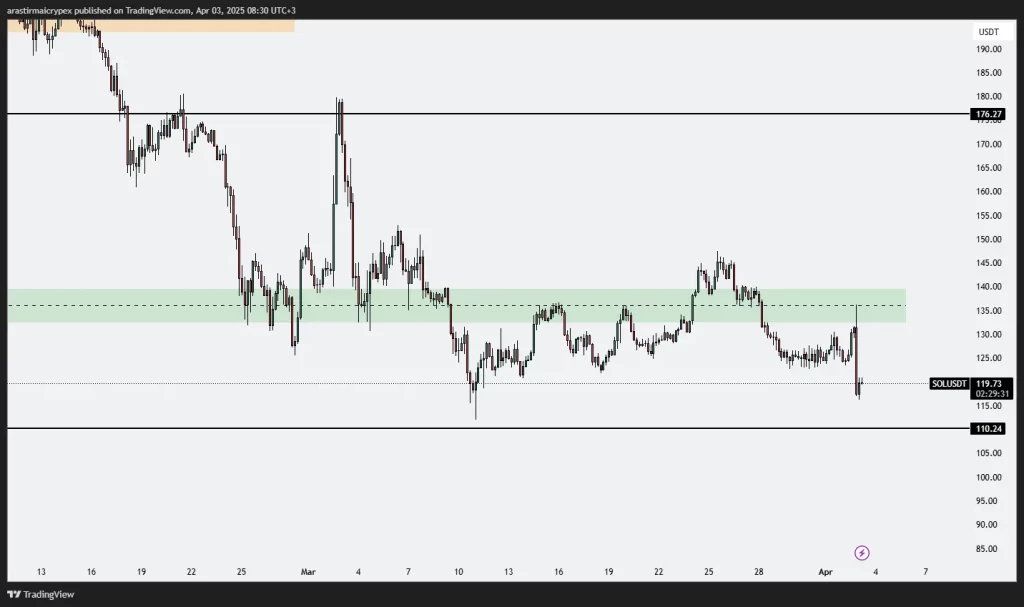

SOLANA (SOL)

SOL is trading at $ 119.72 with a 1.98% gain as of the morning hours. Especially the green zone in the 138 – 140 USDT range works as a strong resistance area and the price has been rejected sharply after testing this zone. Below, the 110.24 level stands out as an important support. Although it is seen that the price reacted from this level and moved upwards, there is a high risk of encountering selling pressure when it approaches the resistance zone again. It is seen that the price is stuck between these two levels in the short term. For an upward breakout, 140 must be exceeded, but if the downward pressure increases, declines below the 110.24 level can be followed.