What is Avalanche (AVAX), What Does It Do?

There is an exciting phenomenon in the crypto world: Avalanche. This project may immediately evoke a snowstorm in our minds, but it is actually one of the most popular and powerful players in the digital world. Avalanche is not just a cryptocurrency or a blockchain project, it is a revolutionary technology platform designed to solve fundamental problems such as scalability, speed and reliability. In this article, we will look at the powerful dynamics behind this rise of Avalanche, to understand its native cryptocurrency “ What is AVAX coin ? ” and take a look at other details about this project.

Project Avalanche

The Avalanche project serves as a blockchain platform that enables high-performance, scalable, customizable, secure and interoperable. It has the ability to support a multi-chain smart contract to run decentralized applications ( dApp ). It was developed to provide solutions to problems such as scalability, security and speed that can be seen in blockchain platforms.

Avalanche, seen as a competitor to Ethereum Thanks to its open source nature, anyone can view the code of this project and contribute to this project. Although it is classified as a competitor to Ethereum, its compatibility with Ethereum is a great advantage for it.

Proof of Work ( PoW ) Using the consensus mechanism, Avalanche has smart contract functionality, giving it uses such as creating non-fungible tokens (NFT) and blockchain games, as well as creating dApps.

Providing successful results in terms of scalability, Avalanche leaves many other blockchain platforms behind in terms of efficiency, thanks to its structure designed to process thousands of transactions per second. Offering lower transaction fees compared to platforms such as Ethereum helps it be preferred by users as a more cost-effective solution.

Now that we have shared the basic details of the Avalanche project, which is known to continue to be actively developed by Ava Labs, “What is AVAX coin ?” We can answer the question.

What is AVAX Coin ?

AVAX is the native cryptocurrency of the Avalanche project. Since this project has a private blockchain network, it is launched as AVAX coin instead of AVAX token.

AVAX is used to support transactions in its ecosystem. When we look at the areas of use; It is seen that it is used for purposes such as distributing system rewards to those who participate in staking transactions to secure the network, participating in governance and facilitating transactions on the network by paying fees.

How Much Is AVAX Supply?

“How much supply is AVAX?” When looked at, it is seen that the maximum supply consists of 715,748,719 units of AVAX and the total supply consists of 436,716,485 units of AVAX.

How Does Avalanche Work?

For a blockchain network to verify transactions and remain secure, it must use a protocol that allows its nodes to reach consensus. In cryptocurrency projects, the realization of this transaction is concentrated between Proof of Work ( PoW ) and Proof of Stake ( PoS ), which ensure consensus . Avalanche’s choice is Proof of Stake .

A user-initiated transaction is reached by a validator node by taking a small, random sample of other validator nodes. By repeating this sampling process, validators communicate with each other and eventually reach a consensus. In this way, a validator’s message is sent to other validators, continuing to sample the validator until the entire system agrees on a result.

Avalanche has three blockchains that can perform different tasks instead of a single task. These block chains are; They can be listed as X- Chain, C- Chain and P- Chain. Let’s take a brief look at these blockchains.

X- Chain (Exchange Chain )

It is a decentralized platform for the creation and trading of digital assets such as crypto tokens. Transaction fees on X- Chain are paid using AVAX.

C- Chain ( Contract )

AVAX C Chain is a blockchain that allows the creation of smart contracts. This chain uses the Ethereum Virtual Machine (EVM) powered by Avalanche.

P- Chain (Platform Chain )

It is a metadata platform that coordinates Avalanche’s validators. It also tracks and enables the creation of new subnets, allowing developers to create their own blockchains.

Projects on Avalanche

Avalanche is home to many diverse projects. These projects operate in various areas such as DeFi (decentralized finance), NFTs (non- fungible digital assets), games and more. The speed, scalability, and low transaction fees provided by Avalanche support the growth and development of these projects.

Among the projects on Avalanche, DeFi protocols occupy an important place. Protocols that enable investors to provide liquidity, lend, borrow and perform other financial transactions take advantage of Avalanche’s unique features to provide more efficient and user-friendly services.

Additionally, with the increasing popularity of NFTs, many NFT platforms and markets also operate on Avalanche. Artwork, digital collectibles, game items, and more are traded as unique assets on Avalanche.

The gaming industry has also grown rapidly in the Avalanche ecosystem. While blockchain-based games offer players the ability to manage and trade their digital assets, Avalanche’s low transaction fees and fast transaction times allow players to have a better experience.

that these are just a few category-specific examples and many projects are active on Avalanche. Avalance paves the way for diversity and innovation in the crypto world by providing an open infrastructure to developers and users from different sectors. Projects in the Avalanche ecosystem continue their existence with different usage purposes and features.

Considering the information obtained from the Avalanche website, the top 5 cryptocurrency projects on Avalanche, in order of market value, are as follows.

- AAve (AAVE)

- WOOfi (WOOFI)

- Curve (CRV)

- Uniswap (UNI)

- GMX (GMX)

Of course, considering that the market value of these projects can change instantly, it should be remembered that this ranking can never remain constant.

Who Owns AVAX?

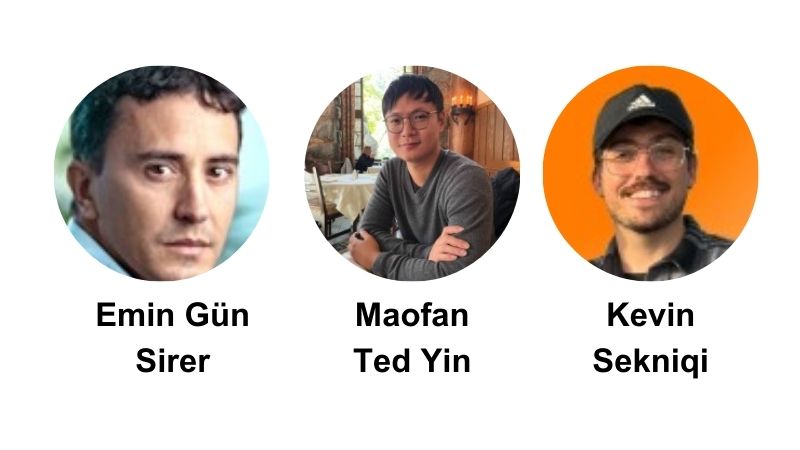

The first information about the Avalanche project was shared by a group with the nickname Team Rocket in the InterPlanetary File System (IPFS) in May 2018. Afterwards, under the leadership of Emin Gün Sirer, an associate professor of computer science at Cornell University, Maofan Ted Yin and Kevin Sekniqi , researchers and doctoral students at Cornell University,Developed by. So, these names can be accepted as AVAX coin holders.

Avalanche in March 2020 The AVA code base for the consensus protocol has been released as open source and is available for use. Avalanche’s initial coin offering (ICO) was completed in July 2020, and Avalanche launched in September of the same year.

AVAX Coin Future

With its unique algorithm and high transaction speed, AVAX has become the popular choice of investors. Additionally, the Avalanche network’s strong consensus protocol and interoperability between blockchains make it an attractive platform for developers and users. Due to AVAX’s unique features and increasing adoption, it may have strong potential in the long term. Of course, it is still difficult to predict the future of AVAX, because the market performance of cryptocurrencies depends on many factors.

However, the adoption of the Avalanche protocol and the continued appreciation of the features offered by the platform by users may increase the value of AVAX. Additionally, factors such as the general state of the cryptocurrency market, regulations, technological developments and general economic conditions may also affect the future of AVAX coin.

Which Exchanges Have AVAX?

AVAX, which is widely known in the cryptocurrency world, is listed on many different cryptocurrency exchanges. These include decentralized finance ( DeFi ) platforms. AVAX coin trading can be easily carried out on ICRYPEX, an innovative cryptocurrency exchange. It offers its users a safe, fast and user-friendly trading experience while listing leading cryptocurrencies in the industry such as ICRYPEX and AVAX.