What is Clover Finance (CLV), How Does CLV Token Work?

The biggest force behind the existence of cryptocurrencies is undoubtedly blockchain technology. This technology, which works wonders in many areas such as increasing transparency in financial transactions, supporting decentralized structures, and increasing reliability, actually brings some complications. Clover Finance, which mainly focuses on inter-chain incompatibilities and complications on the part of developers, offers solutions in this context. In this article, where we will take a closer look at the Clover Finance project, we will ask “What is CLV token?” We will also discuss what the project’s local cryptocurrency does and many more details about the project.

What is Clover Finance Project?

The Clover Finance project is basically designed as a blockchain operating system. It is built as a one-stop infrastructure platform for cross-chain and decentralized applications. Clover is a private Layer-1 chain based on Substrate, a toolbox for creating custom types of blockchains that are Ethereum Virtual Machine (EVM) compatible, cross-chain interoperable, and also function as Parachains in the Polkadot ecosystem, enabling applications on Ethereum to run.

Network congestion plays a huge part in increasing Ethereum gas fees. In fact, the fact that Defi and NFTs have become so popular has greatly increased the network fees in Ethereum. This being the case, developers and users are looking for more cost-effective alternatives. A faster solution Polkadot can be considered as an alternative to Ethereum. However, at this point it should be taken into consideration that the DeFi ecosystem is also smaller than Ethereum.

The problem of interoperability and scalability can be solved by allowing these networks to freely transmit data. Developers can use each network for its strongest attributes. The CLV coin project comes into play at this point with the solutions it offers.

Clover Finance, which rebranded on March 10, 2022, was repositioned to include Web3 and became CLV. In this context, it aimed for an easier approach to a wider audience by launching new wallet and chain products.

Clover Finance focuses on delivering high-quality connectivity in the ever-growing and expanding crypto space, with products built with interoperability and cross-chain in mind. Usability can be a controversial issue in decentralized applications. This can actually pave the way for users to easily get lost among tons of options. CLV’s goal is to provide readable, easy-to-use Web3 products suitable for a wider range of users.

There are two CLV products: CLV Chain and CLV Wallet. Both of these products are for decentralized everyday use and can meet users’ needs in DeFi, social, gaming and all other Web3 needs.

CLV Products: CLV Chain and CLV Wallet

“What is CLV token?” Before answering the question, it would be useful for those who want to get to know the Clover Finance project better to look at the products offered by CLV. These products can be briefly summarized as follows.

What is CLV Chain?

CLV Chain has a multi-blockchain structure. It is a series of special interoperable chains and is divided into two as follows:

- CLV Mainnet (M-Chain) – Governance and exchange chain.

- CLV Parachain (P-Chain) – It is an EVM compatible smart contract chain.

Validation and securing of both blockchains is done by the Substrate framework.

What is CLV Wallet?

CLV Wallet is a non-custodial, multi-chain and multi-platform application that helps users manage crypto assets and interact with all types of decentralized applications. CLV Wallet is available on mobile, desktop, and universally on the Web.

The features of CLV Wallet are summarized as follows:

- Users can import their accounts.

- EVM compatible chains can be supported.

- Multi-chain accounts can be created, imported and managed in a single wallet.

- NFT assets can be supported.

- It is possible to switch between multiple wallets.

- Tokens can be transferred cross-chain in a single wallet.

- dApps can be interacted with.

What is CLV Coin?

CLV coin is actually classified as a token, not a coin. The main reason for this is that it does not have its own blockchain. CLV token, the native cryptocurrency of CLV M-Chain , is primarily used to participate in network consensus, transaction fees, platform rewards, and staking for network governance. The total supply of CLV has been determined to be 1,000,000,000 units.

When looked at in more detail, the usage areas of this token are as follows:

- Participation Fees: Gas fee can be paid with CLV token. In addition, gas fees can be paid with any network token.

- Governance: CLV token can be locked to elect council members and direct development through on-chain governance.

- Verification: Can be staked for network verification.

- Treasury: It can be used to finance projects from the treasury.

- Nomination: CLV token can be staked to nominate a personal node validator using one-click distribution.

- Deployment: CLV token can be used to distribute smart contracts and dApps on CLV Chain.

“What is CLV coin?” After answering the question, we can now take a look at the advantages offered by this cryptocurrency.

What are the advantages of Clover Token?

Clover Finance provides certain benefits to the cryptocurrency ecosystem with its advantages. Facilitating the participation process for both users and developers can be considered one of its biggest advantages. In general, the advantages of CLV are as follows.

- Gas Fee: The network has an identity-based gas fee schedule. Those who participate more in the network and make more transactions pay less. This strategy is supportive in encouraging users and creating value specifically for the CLV token. A certain denominator of the gas fees is transferred to the network nodes that maintain the blockchain. The rest of these fees go to the dApp developers.

- Security: In this project, security is positioned as the main priority by the developer team. Thanks to enterprise-level protections, users and data are secured against cyber attackers. For example, all network functions have secure end-to-end communication.

- Staking: CLV holders can stake their tokens and earn rewards by helping secure the network. There are two ways to earn this reward: staking CLV tokens and nominating users themselves as node validators. It should also be noted that users can also nominate other nodes. It is worth remembering that the more tokens deposited, the more rewards you will receive.

Who is the Founder of CLV?

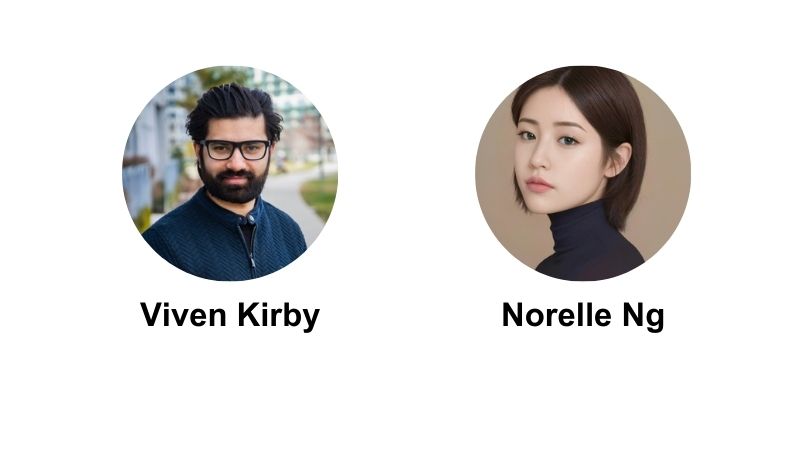

CLV’s journey began in May 2020 with Viven Kirby and Norelle Ng as its core founders, with growing needs for interoperability and compatibility of blockchains. Its launch took place in 2021.

Viven Kirby is an experienced enterprise resource planner. Considering his past experience before CLV Finance, he worked as a Microsoft Dynamics architect at a company called AXSource, with expertise in regulatory and quality consultancy and Microsoft Dynamics. Considering his responsibility on the CLV Finance side, Kirby served as the project leader and later became a core participant in the company called Fancy Studios.

Norelle Ng is a blockchain expert with a background in Human-Computer Interaction. Norelle Ng, who is a consultant at Bithumb Global and Guru Online AdBeyond (Group) Limited; He was a mentor at Outlier Ventures, a funding company, a board member at Forbes Technology Council, and head of customer relations at Amber Group.

Which Stock Exchange Has Clover Finance CLV?

Clover Finance continues its life as a project that has attracted the attention of many people thanks to its contributions to the blockchain. For this reason, it becomes a matter of curiosity from which exchanges the local cryptocurrency of this project, CLV, can be accessed. At this point, ICRYPEX, a fast, safe and transparent cryptocurrency exchange, provides great convenience for those who want to buy and sell CLV. Thanks to ICRYPEX’s user-friendly interface and reliable infrastructure, CLV can be traded quickly and easily.