What is Ethereum (ETH)? How Does ETH Coin Work?

In the age of digital revolution, there is a shining star at the center of blockchain technology: Ethereum. Going beyond Bitcoin and offering much more than just a cryptocurrency, Ethereum has the potential to revolutionize modern financial systems and applications. So, what is Ethereum and why has it become so important? In this article, we will step into the world of Ethereum and explore together the basic principles and impressive capabilities behind this innovative platform. If you’re ready, let’s start!

What is the Ethereum Network?

Ethereum is a decentralized global software platform powered by blockchain technology. It is designed to be scalable, programmable, secure and decentralized. It is used with the abbreviation ETH in the cryptocurrency market. Vitalik It was introduced in 2014 under the leadership of Buterin and launched in 2015.

It has its own network like Bitcoin. It is known as the largest cryptocurrency by market value after Bitcoin. However, it is not a correct approach to say that Ethereum is in direct competition with Bitcoin. Its goals, features and even technology are different from Bitcoin.

is more functional than Bitcoin, which is designed as a payment system. It exists as a platform that supports the development of smart contracts and decentralized applications (dApp). At the same time, Ethereum (ETH) allows its users to earn returns through staking, use and store NFTs, play games, use social media, and much more. It is a blockchain preferred by technology developers and businesses to improve the functioning of many industries and daily life. Moreover, many cryptocurrencies are built on the Ethereum network due to its functionality. Considered this way, Ethereum forms the basis of many new blockchain-based technological advances.

What is ETH Coin?

ETH coin is the native cryptocurrency of the Ethereum project. In fact, this definition is based on the question “ What is Ether?” It is also the answer to the question. Because this cryptocurrency is also referred to as Ether.Ethereum has its own private network. That’s why it is called coin. The supply of ETH, which is functional in many areas within the Ethereum ecosystem, is unlimited.

The purposes of ETH within the Ethereum ecosystem are as follows:

- It is paid as a commission for using the Ethereum network,

- staked and distributed as a reward as a result of this action,

- It can be used as collateral to create different cryptocurrency tokens.

ETH coin, some examples are as follows:

- Decentralized finance (DeFi) applications

- Non-fungible token (NFT)

- smart contracts

- Decentralized applications (dApp)

- identity management

- Supply chain management and traceability

- Game

- Tracking energy and carbon emissions

- Health data management

- Management processes and decentralized autonomous organizations (DAO)

- cross-border payments

As can be seen, ETH is not just a cryptocurrency but also has many functionalities. As a result of all this, it ranks second in terms of market value in the cryptocurrency world.

Coins on the Ethereum Network

The Ethereum network is not limited to just Ether (ETH), it hosts a wide ecosystem of crypto assets. There are many different types of cryptocurrencies on this network. These cryptocurrencies;

- Shiba Inu (SHIB),

- Dai (DAI),

- Render (RENDER),

- Arbitrum (ARB),

- Ondo (ONDO)

Projects such as these can be given as examples. The list of coins on the Ethereum network can be accessed via CoinMarketCap, a well-known data provider in the cryptocurrency world.

How Does Ethereum ETH Work?

In order to better understand the working principle of Ethereum, it is useful to first take a look at the basic components of Ethereum. These components are as follows.

Smart Contracts: These are the rules that determine the conditions under which money can change hands.

Ethereum Blockchain: In Ethereum, it is where a record of its entire history is stored, every transaction and smart contract call.

Consensus Mechanism: It is a method of verifying and recording data on the blockchain. It also helps secure the network and is responsible for putting new tokens into circulation.

Ethereum Virtual Machine (EVM): Applies Ethereum rules and checks whether a sent transaction or smart contract complies with the rules.

Ether: It is the token of Ethereum that is required to make transactions on Ethereum and execute smart contracts.

resides on thousands of computers around the world, with users participating as “nodes” rather than a central server like Bitcoin. In this way, the network becomes extremely resistant to attacks. Considering that thousands of people keep the network running, just one computer crashing doesn’t mean anything. As a result, it becomes almost impossible for the network to collapse.

Ethereum is essentially a single decentralized system running a computer called the Ethereum Virtual Machine (EVM). Each node has a copy of this computer, so any interaction must be verified before everyone can update their copy.

Staking on the Ethereum network is a process where users participate in verifying transactions and earn rewards in return. This is a significant change from Proof of Work, otherwise known as traditional mining, and is much more energy efficient. With staking, validators lose their staked Ethereum (ETH) assets if they verify fraudulent transactions. In this way, validators are incentivized to perform their duties correctly. ETH is constantly recirculated with staking rewards.

Ethereum supports smart contracts, which are self-executing contracts where contract terms are written directly into code. These smart contracts offer efficiency and trust in transactions by automating processes that typically require intermediaries. For example; A smart contract can be programmed so that a freelancer can automatically receive payment when he completes the work at hand. In this way, the need for an intermediary is eliminated.

What is Ethereum Mining?

Ethereum (ETH) initially used the Proof of Work model, like Bitcoin. It launched the Proof of Stake mechanism in September 2022 to implement safer, less energy-consuming and new scaling solutions. In this way, “How is Ethereum produced?” The answer to the question has also changed. Now, those who want to produce Ethereum, that is, those who want to mine Ethereum, do not need powerful hardware parts as in Bitcoin. Instead, people who have 32 ETH can produce Ethereum as a validator. This system is called staking.

Ethereum mining allows ETH holders to earn a reward for helping secure the Ethereum blockchain network. This system can be described as ETH owners locking their ETH for a certain period of time. Each person who performs this action is referred to as a validator. Validators are randomly selected by the network.

What are Ethereum Forks?

A fork is a change to a particular cryptocurrency protocol. Fork is divided into two: soft and hard. Soft Fork includes minor changes. A hard fork involves major changes. An Ethereum fork is a change or update to the software or protocol of the Ethereum blockchain network. These changes are usually made to improve the performance of the network, fix security vulnerabilities, add new features, or solve existing problems.

One of the most well-known examples of Ethereum forks is the Ethereum Classic split. After the DAO hack incident in 2016, the Ethereum community carried out a hard fork to get back the stolen funds, which caused the network to split in two.

Other Ethereum forks are as follows:

2015 – Frontier

2015 – Frontier Thawing

2016- Homestead

2016 – Tangerine whistle

2016 – Spurious Dragon

2017 – Byzantium

2019 – Constantinople

2019 – Istanbul

2020 – Muir Glacier

2020 – Staking deposit contract distribution

2020 – Start of the Bracon Chain

2021 – Berlin

2021 – London

2021 – Altair

2021 – Arrow Glacier

2022 – Gray Glacier

2022 – Bellatrix

2022 – Paris

2023 – Shanghai-Capella

2024 – Cancun-Deneb

This is the Ethereum fork that took place until July 2024. New Ethereum forks may occur in the future.

What is Ethereum 2.0?

Ethereum 2.0 is an update to the Ethereum blockchain that includes several improvements.

Ethereum has gone through many updates to date, but it has come a long way with the Ethereum 2.0 update. With this process, which was completed in September 2022, Ethereum has significantly improved its performance, reduced transaction fees, and left the Proof of Work mining model behind and switched to the Proof of Stake consensus mechanism, which is touted as a more environmentally friendly model. “What is Ethereum merge?” There are definitely people wondering what it is. This process of Ethereum is also known as “Ethereum merge ”.

The Ethereum network was experiencing some congestion due to technical limitations. These bottlenecks centered around scalability and availability. In order for Ethereum to be adopted by a wider audience, the Ethereum 2.0 update was actually essential. In order for Ethereum to adapt to any use case, its blockchain needed to be able to handle network interactions on a much larger scale. This brought about a radical change.

Who is the founder of Ethereum?

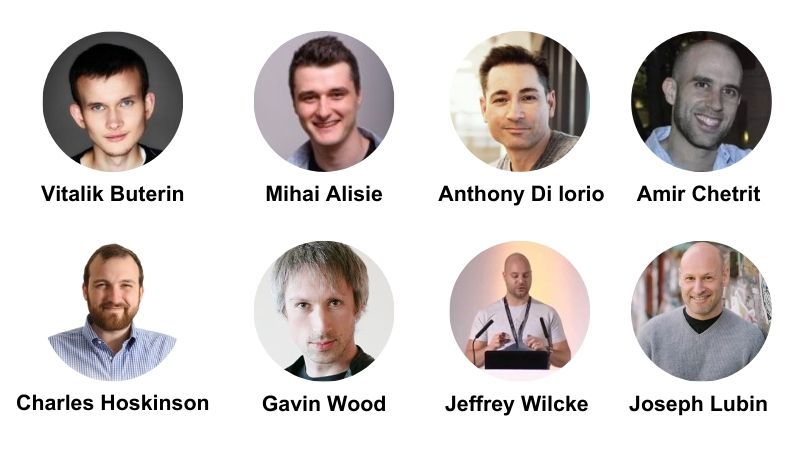

Ethereum founder today Vitalik Buterin, but a total of 8 founding partners took part in the implementation of the project. Among these eight names, Vitalik The reason why Buterin’s name stands out is that the Ethereum network was first proposed by this person.

Buterin created Ethereum, inspired by Bitcoin. Buterin, who published a technical document in 2013 emphasizing that Bitcoin is an alternative blockchain, stating that beyond its financial uses, developers can implement their own decentralized applications (dApp) using a new programming language, was reached by several developers after this initiative. These people helped Buterin bring his vision to life. These names; Mihai Alisie, Anthony Di Lorio, Amir Chetrit, Charles Hoskinson, Gavin Known as Wood, Jeffrey Wilcke and Joseph Lubin.

Although Ethereum started its journey by 8 names, it is an open source blockchain platform created by thousands of developers around the world. Ethereum is decentralized. This shows that it cannot be controlled by a single person and that a single person cannot own it.

There is also the Ethereum Foundation. Ethereum Foundation, founded in July 2014, Vitalik Buterin and Gavin It was designed by Wood. This foundation exists as a non-profit organization that supports Ethereum and related technologies. The purpose of this formation is not to control and lead Ethereum.

How Much Was Ethereum When It First Released?

Ethereum (ETH) has come a long way since its launch in 2015 as one of the pioneers of the cryptocurrency world. While Ethereum is known for supporting smart contracts and decentralized applications (dApps), its price movements have also attracted the attention of the crypto community. The price change of Ethereum over the years can be examined in detail below.

| Year | Highest Price | Lowest price |

| 2015 | $3 | $0.20 |

| 2016 | $21.50 | $0.92 |

| 2017 | $727 | $8 |

| 2018 | $1,152 | $136 |

| 2019 | $348 | $116 |

| 2020 | $756 | $89 |

| 2021 | $4,387 | $716 |

| 2022 | $3,892 | $882 |

| 2023 | $2,245 | $1,180 |

Ethereum has experienced a wide variety of price movements with ups and downs since 2015. Ethereum, which initially had a fairly low price, was worth a few dollars in its early years. For this reason, it cannot be said that it received much attention and value. However, in 2017, it experienced a huge increase and exceeded the $100 mark. This was a turning point that showed the potential of Ethereum.

However, Ethereum’s biggest exit occurred in 2020 and 2021. The popularity of DeFi (Decentralized Finance) applications and NFT (Non-Fungible Token) craze has increased the demand for Ethereum. In early 2021, the price of ETH exceeded $1,000, breaking an all-time record. This massive breakout highlighted Ethereum’s future potential.

Is Ethereum Trustworthy?

With the idea of purchasing Ethereum, investors naturally think: “Is Ethereum reliable?” question may appear. Ethereum stands as a shining star of innovation in the rapidly evolving landscape of blockchain and cryptocurrencies.

Ethereum (ETH) is a decentralized platform designed to empower developers and entrepreneurs to create and distribute dApps using smart contracts. Smart contracts are like digital automatons that perform tasks when predefined conditions are met, revolutionizing traditional agreements and processes. These self-executing contracts are executed on the Ethereum Virtual Machine (EVM), providing an environment of unparalleled trust and transparency.

Ethereum’s security framework has undergone a tremendous change with the transition from Proof of Work (PoW) to Proof of Stake (PoS) consensus mechanism. PoS reduces the incentive for malicious behavior by relying on validators who lock ETH as collateral. This seismic change in approach improves safety as well as improving energy efficiency.

Smart contracts embody Ethereum’s promise of automation, efficiency, and trust. These digital agreements execute exactly as programmed, without human intervention or potential bias. But the allure of the autonomy provided by smart contracts comes with its own risks. Its irreversible nature means that once a smart contract is implemented, its code is fixed. Any bug or vulnerability becomes permanent and often leads to serious financial losses.

With every failure encountered on the ETH side to date, the Ethereum community has demonstrated extraordinary resilience and determination. Each detected vulnerability turned into an opportunity to improve the system. The spirit of collaboration, innovation, and shared learning in the Ethereum ecosystem is its greatest strength. By directly acknowledging vulnerabilities and challenges, Ethereum has evolved, implementing robust solutions and good practices. These measures include official verification, Optimistic These include layer 2 scalability solutions such as rollups and proactive security auditing.

Ethereum’s commitment to continuous improvement is evident, and its security-conscious approach is a beacon guiding its development.

How to Buy Ethereum?

Ethereum is one of the most popular and valuable assets in the cryptocurrency world. In this context, one of the most frequently asked questions is “How to buy Ethereum?” is the question. You can easily follow the Ethereum price live on the ICRYPEX cryptocurrency exchange and buy it from anywhere, at any time. ICRYPEX makes buying Ethereum very simple by providing its users with a safe and fast platform. Thanks to ICRYPEX, where users can easily carry out all kinds of transactions with a user-friendly interface, you can immediately start investing in Ethereum and own ETH, which is considered the second most valuable digital asset in the world by market value.

–

“TradingView is a platform that offers comprehensive charting and analysis tools for cryptocurrencies such as BTCUSD (Bitcoin/US Dollar). It offers a variety of chart types and drawing tools that you can use to monitor the price of BTCUSD, identify trends and perform technical analysis. You can also customize your charts and analyze with technical analysis tools such as indicators, moving averages, Bollinger bands, etc.

TradingView also provides other data and information for cryptocurrencies. For example, for BTCUSD you can see market depth, trading volume, open positions and more. It also offers tools such as the Economic Calendar to help you keep track of major news events that may affect the price of BTCUSD.

TradingView is also a social platform and you can share ideas and analysis with other users. You can explore ideas shared by the community, analyze and participate in discussions.”