What is Hyperliquid?

Hyperliquid, launched in late 2023, is a project that is rapidly gaining prominence among decentralized perpetual trading platforms. Unlike other decentralized exchanges (DEX), Hyperliquid operates on a Layer-1 blockchain that it developed itself, where it uses the order book (CLOB) system entirely on-chain. In this way, users can trade quickly and fluently, as in centralized exchanges (CEXs).

Solutions such as Arbitrum or Optimism, despite offering Ethereum security, can face difficulties such as delays in transaction speed and limited capacity. Hyperliquid, on the other hand, was designed with the goal of “high performance” from start to finish by building its own chain. This positions it in a different place in terms of both technical infrastructure and user experience.

Layer-1 Order Book Approach

Hyperliquid’s infrastructure sets it apart from classic automated market maker (AMM)-based DEXs. While users in AMM systems trade directly with a pool, in Hyperliquid, orders are matched between buyers and sellers on-chain. While this structure is similar to other advanced DEX platforms such as Injective, dYdX v4 and Aevo, Hyperliquid is one of the rare projects that integrates this system with its own chain.

The biggest difference is that order matches occur directly on-chain and almost instantly (instant finality). The user interface is so fast and fluid that it can compete with centralized exchanges. The security of the network is provided by independent validator nodes that verify transactions.

Hyperliquid’s Native Token: HYPE

Hyperliquid’s native token, HYPE, plays a key role in the platform’s governance and liquidity system. The first major airdrop (community reward distribution) in November 2024 distributed 27.5% of the total supply to 94,000 users. The total market value of this distribution quickly exceeded 7 billion USD, making it one of the largest airdrops in history.

Token distribution is as follows:

| %31.00 | First Airdrop |

| %38.88 | Future Community Distributions |

| %23.8 | Contributing Team and Developers |

| %6.00 | Hyper Foundation Fund |

| %0.3 | Community Support Grants |

| %0.2: | HIP-2 Protocol Update |

The liquidity model works differently than traditional methods. The liquidity in Hyperliquid is provided by the community through a system called Hyperliquidity Provider (HLP). Users join the liquidity pool by depositing USDC (a stablecoin) into the system. The pool acts as a counterparty for most of the transactions on the platform, meaning that if someone is buying, the system sells to them. HLP investors share the profits or losses from these transactions. In short, the community does not just trade; at the same time it directly contributes to the operation of the system.

Hyperliquid Among the Top 10 DEX

As of 2025, daily total trading volume on decentralized exchanges reached 19.76 billion USD . In this growing ecosystem, Hyperliquid managed to achieve impressive growth in just a few months despite launching at the end of 2023.

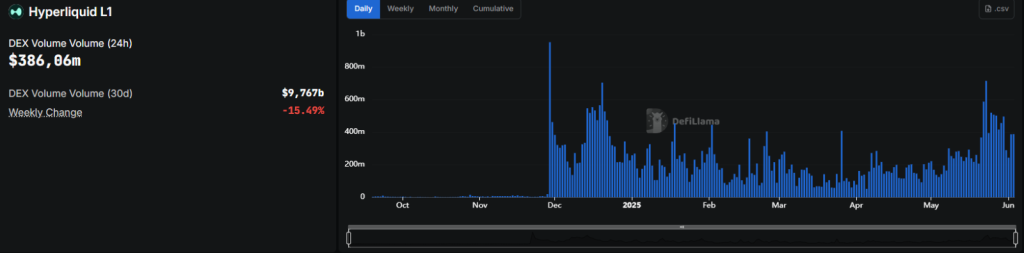

According to DeFiLlama data, as of June 2025, Hyperliquid L1 reached a transaction volume of

- 386 million USD daily

- 9.76 billion USD on a monthly basis.

The volume data shows that Hyperliquid is not only built on a strong infrastructure, but also It shows that it has become a platform that is rapidly being adopted by users. Thanks to this structure that combines speed, liquidity and user experience, Hyperliquid has the potential to gain a permanent place in a short time by ranking 8th among the top 10 DEX.

Volume, Liquidity and Valuation Increase

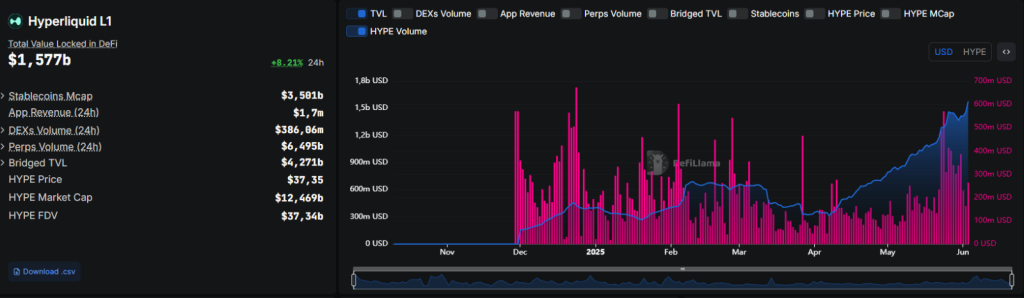

Hyperliquid is showing a strong growth trend not only in terms of transaction volume, but also in terms of total locked assets (TVL), revenue and token performance. According to DeFiLlama data, Hyperliquid L1’s total locked assets (TVL) has reached 1.57 billion USD as of June 2025. This means an increase of 8.2% in the last 24 hours.

- Daily perpetual transaction volume has reached 6.5 billion USD, showing that Hyperliquid has become a serious player not only in spot transactions but also in derivative markets.

- The platform’s daily application revenue has reached 1.7 million USD. This metric is critical for the sustainability of on-chain economic activity.

Also noteworthy is the volume the platform has gained from stablecoins and bridged assets:

| Total TVL in DeFi | $1.58b |

| Bridged TVL | $4.27b |

| Stablecoin MCAP | $3.5b |

| Perpetual Volume | $56.65b |

| HYPE Market Cap | $12.57b |

All this data proves that Hyperliquid has gone beyond being just a DEX and has built a complete financial ecosystem built on its own Layer-1 chain. Both the market cap ($12.46 billion) and fully diluted valuation ($37.3 billion) levels of the HYPE token reflect investors’ long-term confidence in the project.

Speed, Security or Return?

As the decentralized perpetual derivatives market grows, Hyperliquid has become one of the prominent projects in this field in terms of performance, user experience and innovation. However, the competition in the market is quite fierce. Strong players such as GMX, dYdX and Jupiter Perps are among the main competitors trying to dominate Hyperliquid’s field.

In the face of these strong competitors, Hyperliquid has already managed to become one of the most popular and successful projects among decentralized platforms with the advantages and differences it offers. While Hyperliquid continues to increase its user base and volume with its refund strategies, marketing approaches and ease of use, its native token HYPE has already become the 11th most valuable crypto asset by reaching a market value of 12.2 billion USD. Unless this structure and user approach change in the coming period, Hyperliquid seems to be one of the most important candidates to become a top 10 coin.