FED Kept Interest Rates Constant – Powell: Banks Can Serve Crypto Customers, But Must Manage Risks

FED Kept Interest Rates Constant

While the US Federal Reserve (FED) kept interest rates steady at 4.25% – 4.50%, the Bitcoin price remained flat. Analysts predict that if the Fed cuts interest rates two or more times during the year, Bitcoin could exceed $ 110,000 and rise to the $ 150,000 – $ 200,000 range. The Fed’s statement emphasized that economic growth continues, the unemployment rate remains low and inflation is still high.

Powell: Banks Can Serve Crypto Customers, But Should Manage Risks

Fed Chair Jerome Powell said that banks can serve crypto firms, but they should manage risks. Powell emphasized that despite regulatory obstacles, the FED is not against innovation. In the US, some crypto companies claim that they are being excluded from the financial sector, stating that they have difficulty opening bank accounts. After the collapse of FTX in 2022, authorities had warned about the risks associated with crypto assets. This situation initiated a process that is claimed to have led to a government crackdown called “Operation Choke Point 2.0”. While members of Congress are investigating the exclusion of the crypto sector from banking, major banks such as JPMorgan have also announced that they are cautious due to regulatory uncertainty in the sector.

SEC Reviewing Canary Capital’s Litecoin ETF Application

The US Securities and Exchange Commission (SEC) has accepted Canary Capital’s spot Litecoin ETF application and opened the public comment period. According to Bloomberg analyst Eric Balchunas, this is the first altcoin ETF application to be officially recognized by the SEC. Litecoin’s structural similarity to Bitcoin and its long history are seen as a logical next step for investors. The application could be part of a new process after spot Bitcoin ETFs were approved in January 2024, followed by Ethereum ETFs in May 2024. Nasdaq initiated the listing process for the ETF by filing a 19b-4 application. Now, all eyes are on whether the SEC will complete its 240-day review process.

Trump’s Media Company Steps Into Crypto Finance With Truth.Fi

Trump Media & Technology Group has announced a new fintech venture called Truth.Fi. The company will direct $250 million of its $700 million reserves into Bitcoin, crypto-related securities, ETFs, and traditional investment vehicles. Trump’s growing interest in crypto finance has been further highlighted by the media company, which owns Truth Social,’s move to diversify its financial strategy. The move has fueled speculation that Trump could include more crypto assets in his second-term policies. Truth.Fi’s investments are being interpreted as an indication of growing institutional interest in the crypto market.

Czech National Bank Considers Allocating 5% of Its Reserves to Bitcoin

The President of the Czech National Bank (CNB), Aleš Michl, has proposed that 5% of the country’s $146 billion reserves be directed to Bitcoin. If this move is approved, approximately $7.3 billion worth of Bitcoin will be purchased. Michl sees Bitcoin as a diversification tool at a time when institutional adoption is increasing. Drawing attention to the Trump administration’s crypto-friendly policies and Bitcoin ETFs in the US, Michl argues that Bitcoin will strengthen as an alternative investment vehicle in the long term.

Robinhood Launches Bitcoin Futures

Robinhood announced that it will soon offer Bitcoin futures to users. The company stated that the new service will launch “very soon” and announced that investors will be able to access Bitcoin through futures. The move is seen as part of the platform’s strategy to expand its crypto investment options. While Robinhood has previously offered Bitcoin trading support, its entry into the futures market could attract institutional investors and strengthen Bitcoin’s position in the financial ecosystem.

Cardano Moving to Fully Decentralized Governance with Plomin Hard Fork

The Cardano network is moving to fully decentralized governance with the Plomin hard fork. The update will give ADA holders direct voting rights over the future of the network, protocol changes, and treasury funds. The Cardano Foundation called it a “milestone in blockchain governance.” The update required 51% approval from Stake Pool Operators to be implemented, and as of last week, 80% of nodes had upgraded. As the ADA price continues to rise, this development is expected to attract more investors to the ecosystem in the long term.

Illinois Could Become First US State With Official Bitcoin Reserve

Illinois could become the first state in the US with an official Bitcoin reserve if the Strategic Bitcoin Reserve bill is approved. The bill, introduced by State Representative John Cabello, would authorize the Illinois Treasury Department to accept and store Bitcoin for a minimum of five years. After five years, BTC can be sold, converted, or converted to another crypto asset. Illinois residents will also be able to make voluntary BTC donations. While US Senator Cynthia Lummis advocated for the establishment of a national Bitcoin reserve; The Czech Central Bank and Texas Governor Dan Patrick are also working on similar reserve plans.

——————————————————————————————

BITCOIN (BTC)

BTC is priced at $105,280 as of the morning hours, gaining 1.49% in value. Technically, the 102,451 level worked as support and the price found buyers in this area. If the rise continues, the red resistance zone located in the 106,000 – 108,000 band should be followed carefully. This area has previously caused strong selling pressure and profit sales may be seen at these levels again. In the event of a pullback, it is important whether the price can hold on to the orange support area at 104,000. If this level is broken, the price is likely to decline back to 102,451. The overall structure suggests buyers have the upper hand in the short term, but volume and price action should be closely monitored as resistance levels are approached.

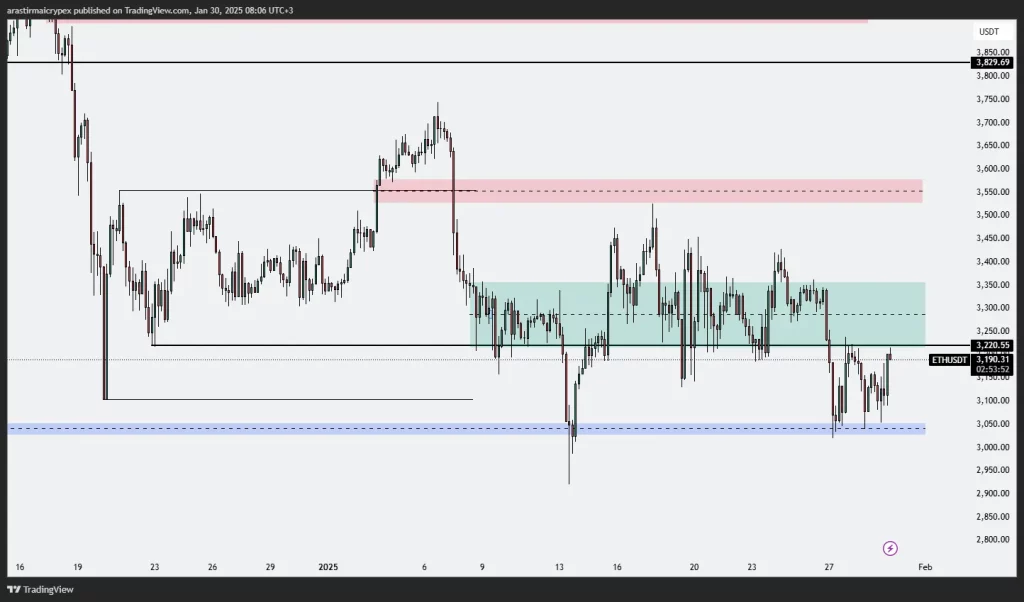

ETHEREUM (ETH)

ETH is priced at $ 3,194 as of the morning hours with a 2.60% gain in value. The price approaching this level is critical in terms of measuring demand for the resistance zone. If the price can break upwards of 3,220, the 3,350 level above and then the red resistance zone at 3,550 can be targeted. On the support side, the 3,050 level is highlighted by the blue zone and this zone stands out as a strong buying area. If the price can maintain this support zone during the continuation of the upward movement, the buyer behavior of market participants will be reinforced. However, if this support level is broken, the probability of the price testing lower levels, such as 2,950, may increase.

RIPPLE (XRP)

XRP is priced at $ 3,121 with a 1.73% gain as of the morning hours. The price is seen to be testing the resistance, and if an upward break occurs, the probability of the price moving higher may increase. In this case, the next target will be the previously determined resistance levels in line with the upward trend. At the support levels, there is a demand zone (orange area) between 2.8716 and 2.7220. This zone can work as a strong buying area in case of a downward correction. If the price tests this area and reacts upwards, we can confirm that buyers have stepped in. However, if this demand area is broken; a pullback to lower levels, for example to the blue zone (2,400 levels), may be seen.

AVALANCHE (AVAX)

AVAX is trading at $ 33.92 levels with a 3.45% gain as of the morning hours. The 35.63 level has been determined as the first resistance point. The price is showing a recovery towards this level, but it is important for a close above 35.63 for the upward movement to continue. If this level is exceeded, the price may show an upward potential towards 37.67 and then 40.30. In downward movements, the 32.95 level stands out as an important support. A close below this level could pull the price down to lower levels, especially the 30.00 region. In addition, the blue region on the chart (42.06 level) stands out as a strong supply region and selling pressure can be seen in a possible rise to this level.

SOLANA (SOL)

SOL is priced at $ 241.19 with a 5.71% gain as of the morning hours. The 245.52 level appears as a critical resistance. A close above this level is important for the continuation of the uptrend and may carry the price towards the 260 levels. However, the current level of 229.30 is the main support. If the price drops below this level, a stronger pullback may occur towards the 201.83 level. The chart shows that the price fluctuates between previously determined support and resistance levels. In downward movements, the blue colored region (210-220 range) stands out as an area where demand can intensify and the price can find support. However, at this point where the price is testing the 245.52 resistance, whether the upward momentum will continue is a critical question mark.