Important Step In Litecoin ETF Approval Process – Michael Saylor Says US Should Buy Bitcoin

Important Step In Litecoin ETF Approval Process

Canary Capital’s spot Litecoin ETF (LTCC) has been added to DTCC’s ETF list, indicating that it is progressing through the approval process. However, the listing does not necessarily mean that the ETF will be launched. The fund is still under SEC review under Nasdaq’s 19b-4 filing, which was published in the Federal Register on Feb. 4. The SEC has up to 90 days to approve or reject the proposal. If approved, Litecoin would become the first crypto asset outside of Bitcoin and Ethereum to have a spot ETF. The development comes as part of a growing number of new spot crypto ETF applications, thanks to the Trump administration’s more positive regulatory approach.

Michael Saylor Says US Should Buy 20% of Bitcoin

Michael Saylor, founder of Strategy, formerly known as MicroStrategy, argued that the US should buy 20% of the Bitcoin supply, stating that this would strengthen the dollar and even pay off the national debt. Speaking at the CPAC conference, Saylor drew attention to the risks of countries like China or Saudi Arabia buying Bitcoin before the US. Emphasizing that Bitcoin is a decentralized and incorruptible asset, Saylor rejected the addition of other crypto assets to the US strategic reserve. Strategy currently holds 478,740 BTC, worth around $47 billion. Strategy shares have increased by 360% in the past year. Saylor also suggested that in the future, AI systems will shift more toward digital currencies and away from traditional banking.

Metaplanet Increases Bitcoin Holdings to 2,100 BTC

Metaplanet has made a new purchase worth $6.6 million, increasing its Bitcoin holdings to 2,100 BTC and aims to reach 10,000 BTC by 2025 and 21,000 BTC by 2026. The Japanese investment firm has been aggressively accumulating Bitcoin as a hedge strategy since mid-2024. To fund these purchases, Metaplanet issued stock purchase rights and zero-coupon bonds through its EVO FUND. The company’s stock price has increased by 4,000% in the past year thanks to its Bitcoin-focused approach, and it is expected to be included in the MSCI Japan Index on February 28. CEO Simon Gerovich emphasized that the move to Bitcoin Standard makes Metaplanet the largest BTC-focused company in Tokyo.

Brazil Approves World’s First Spot XRP ETF

Brazil has taken a significant step in the crypto market by approving the first spot XRP ETF, which will be managed by Hashdex, and the ETF will be traded on the B3 exchange. The move, which indicates growing investor interest, reinforces Brazil’s leading role in the region, where crypto transactions over $1 million increased by 48.4% between the end of 2023 and the beginning of 2024. The country ranks second in terms of total crypto asset volume, just behind Argentina. This approval also came at the same time as the increasing number of spot XRP ETF applications in the US. Analysts estimate the probability of the SEC approving an XRP ETF in 2025 at 80%. The US is also reviewing ETF applications for other altcoins like Solana and Litecoin.

ECB Working on Blockchain-Based Payment System

The European Central Bank (ECB) is advancing plans to build a blockchain-based payments system, which could pave the way for the issuance of digital euros. The project will take place in two phases. First, an integration with the TARGET payment system will be achieved, followed by exploring a longer-term blockchain-based solution. The ECB sees this initiative as part of its efforts to increase financial market efficiency and strengthen Europe’s monetary independence. The project is also in line with the ECB’s goal of creating a single capital market across Europe. Although the timetable has not yet been announced; The ECB announced that it will continue to develop the system and collaborate with stakeholders.

Societe Generale Brings EURCV Stablecoin to Stellar

SG-FORGE, the blockchain arm of Societe Generale, has extended its euro-backed stablecoin EUR CoinVertible (EURCV) to the Stellar network, providing scalability, speed and low cost. Originally launched on Ethereum, EURCV will now benefit from Stellar’s fast and low-cost transaction advantages. EURCV is one of the first stablecoins to fully comply with the EU’s MiCA regulations, increasing transparency and security. SG-FORGE sees this integration as a bridge between traditional finance and digital assets, while providing access to Stellar’s vast network of financial institutions. The move suggests that stablecoins and regulated digital assets will play a more central role in the future financial system in Europe.

Javier Milei Seeks Support in the US to Overcome Crypto Scandal

Argentine President Javier Milei has traveled to Washington to engage with the IMF and conservative political circles in an effort to distract from his recent cryptocurrency scandal. During his visit, he met with IMF Managing Director Kristalina Georgieva to try to finalize a new financing deal for Argentina. He is also set to speak at CPAC, where he has a strong supporter base and is receiving significant attention from conservative circles in the US. The scandal has tarnished Milei’s anti-corruption image but has not had a major impact on markets. Milei, who is trying to finalize the IMF agreement and continue his economic reforms with the support of the US and Trump, wants to both ease the pressures in domestic politics and strengthen international support.

———————————————————————————————

BITCOIN (BTC)

BTC is priced at $ 98,250 as of the morning hours with a 0.07% loss in value. It is seen that the price showed a recovery after touching the support level at 94,088. BTC, which is currently traded at 98,244, is in a short-term upward trend. However, the level of 100,137 above appears as a strong resistance area. If this resistance is broken, the price may be likely to move towards the 102,000 – 105,000 region again. In the downside scenario, if the 94.088 support is broken, a pullback to the 88.722 level can be expected.

ETHEREUM (ETH)

ETH is priced at $2,750 with a 0.40% gain as of the morning hours. The price is currently trading at 2,749 and the 2,690 (0.5 Fibonacci) support is protected according to Fibonacci levels. In the downside scenario, the 2,520 level stands out as a critical support. In the upward movement, a break above the 2,859 (Fibonacci 1.0) level could trigger an increase. The price is stuck in a narrow range, indicating that a breakout is imminent, so closing below 2,690 increases the downside risk, while strong buying pressure may occur above 2,859.

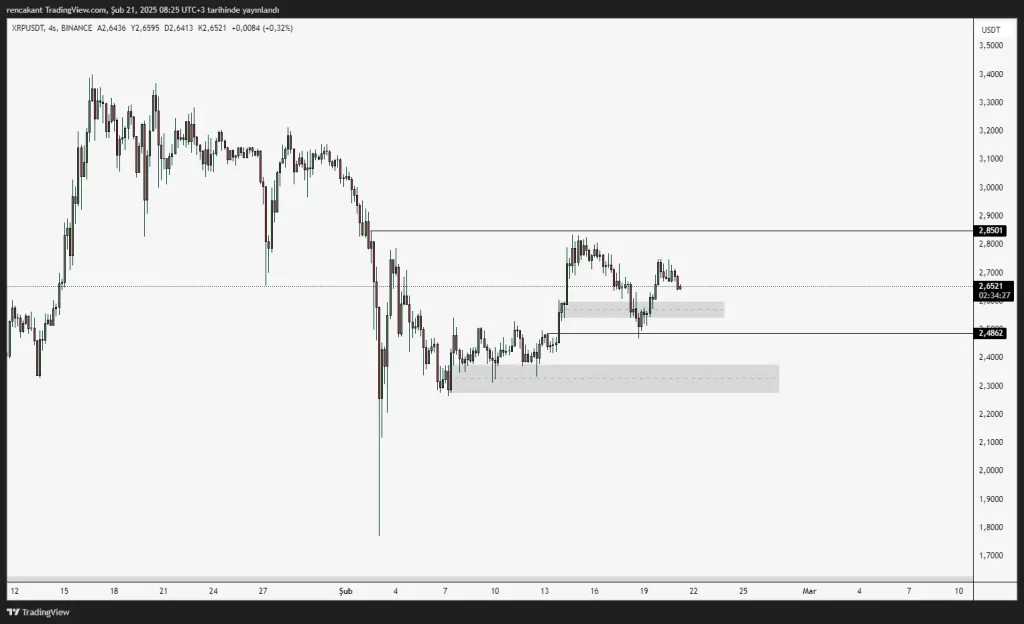

RIPPLE (XRP)

XRP is priced at $ 2.65 as of the morning hours with a 1.41% loss in value. The price seems to have been rejected from the 2,850 level and is currently trading at 2,652. We see that the price is in a downward structure and short-term liquidity is being tested. If the downward movement continues, the 2,486 level stands out as an important support area. If this area is broken, the price may make a deeper correction and decline to the 2.35 – 2.40 area shown in the gray box. However, if the price finds support in the 2,650 area, an upward move may begin again. A close above 2,850 could increase the bullish momentum and push the price higher.

AVALANCHE (AVAX)

AVAX is trading at $25.02 with a 25.01% loss in value as of the morning hours. The 23.50 – 24.00 band has worked as an important support area and the price has recovered from here. However, the falling trend line corresponding to the 26.00 level above is creating resistance. If the price breaks this trend line, the probability of the rise continuing will increase and the first target may be the 28.00 – 29.00 levels. However, if the price is rejected by the trend line, there is a risk of falling back to the 23.50 – 24.00 support area.

SOLANA (SOL)

SOL is priced at $ 174.71 as of the morning hours with a 0.75% loss in value. The price, which is currently traded around 175, is in a short-term recovery process. However, for this rise to continue, the previous support level in the 185 – 190 region must be overcome. If the price holds above 175, an increase towards the 185 – 190 region can be expected in the short term. However, failure to overcome this zone may increase the downward pressure again and cause a pullback to the 160-165 support.