Avalance Foundation Announces 5 Tokens It Holds

The top 5 community currency tokens of the Avalanche Foundation have been announced. These products include meme currencies such as Coq Inu, Gecko, Kimbo, NoChill and Tech. Last year, the foundation announced plans to purchase community tokens exclusive to the Avalanche network.

Solana Market Cap Hits ATH

Solana market capitalization reached $81.1 billion this morning, an all-time high in Asia. Its market capitalization peaked in November 2021 at approximately $77.9 billion. Solana’s price rose 10% in the last day to $183.55 at around 9:30 a.m. Hong Kong time, but is still just shy of its November 2021 all-time high of $259.96.

Ethereum ETF Comment from VanEck

As the Ethereum ETF decision approaches, some think this ETF is not worth investing in. One of the underlying reasons for this is that investors themselves can buy ETH and stake it and be rewarded. However, VanEck said the Ethereum ETF could bring huge demand. Since Ethereum uses proof-of-stake consensus, investors can stake on their own. VanEck portfolio manager Kanade emphasizes that the Ethereum ETF has as great potential as the Bitcoin ETF.

EL Salvador Moves Its Assets to New Wallet

El Salvador President Nayib Bukele stated that the country transferred most of its Bitcoin assets to cold wallets. In a post on X, Bukele said the cold wallet configuration is the country’s first bitcoin piggy bank. The screenshot he included in the post shows that the address received 5,689.69 BTC, which was worth almost $406 million at the time of the post. This amount is almost twice EL Salvador’s estimated Bitcoin holdings of $200 million.

180% Increase in Chainlink CCIP Revenues in the Last Two Months

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) revenues have increased by 180% in the last two months as adoption of the multi-chain bridging platform has increased. CCIP revenues, which were around $61,000 in January, rose above $171,000 in the first two weeks of March. Additionally, according to Dune Analytics data, the total cumulative revenue for the CCIP launched in July 2023 reached $377,724.

Another Record from BlackRock’s Spot Bitcoin ETF

IBIT, BlackRock’s spot Bitcoin ETF, broke the daily trading volume record. According to data dated March 14, IBIT surpassed its previous record of $3.7 billion with a transaction volume of over $3.9 billion. Thus, IBIT became the strongest performing ETF in terms of trading volume and net inflow among the ten new ETFs that started trading in January.

Polkadot Announces New Software Development Kit (SDK) for Web3 Applications

The Polkadot network announced that it has launched a new Software Development Kit (SDK) that will be used by Web3 developers to build scalable and multi-chain decentralized applications. According to the statement, with this new software kit, Web3 developers will be able to create Polkadot-based dApps without any problems.

Hong Kong in Phase Two for CBDC Pilot

The Hong Kong Monetary Authority (HKMA) announced on Thursday that it has launched the second phase of e-HKD, the CBDC pilot application. The HKMA has previously completed phase 1 of a pilot program testing the use of a CBDC in domestic retail payments, offline payments and settlement of tokenized assets. The aim of the second stage tests is to discover new application areas of e-HKD.

——————————————————————- —————————–

BITCOIN(BTC)

As of the morning hours, BTC is priced at $67,555 with a 5.29% loss in value. After the announcement of macroeconomic data at the level of 72,400 yesterday, we fell to the level of 68,600 dollars. After receiving a reaction from here, there was an increase to $71,700, but the selling pressure continued and there was a retreat to $67,500. $67,000 is a critical level, and as long as pricing continues above this level, the $70,000 level can be targeted again. If a price below is seen, a withdrawal may occur up to $64,000.

ETHEREUM(ETH)

ETH is priced at $3680 with a 5.17% loss of value as of the morning hours. After the Dencun update, there was a decline to $3730, followed by an upward correction to 3960. In case the retreat deepens, $3550 appears as major support. If it receives support from here, prices up to $3900 may be seen again. If $ 3550 breaks downwards, we may see a retreat to $ 3350.

RIPPLE(XRP)

As of the morning hours, XRP is priced at $0.63 with a 5.83% loss in value. With the move yesterday, there was a decline to $ 0.6386, but with support from this region, there was an increase to $ 0.6758. The $0.66 support level was lost. If the level of $ 0.60 is maintained, there may be an increase to the level of $ 0.72 again. Since we are now at the bottom of the horizontal band, the possibility of support levels working increases. If the withdrawal deepens, withdrawals up to $0.58 may be seen.

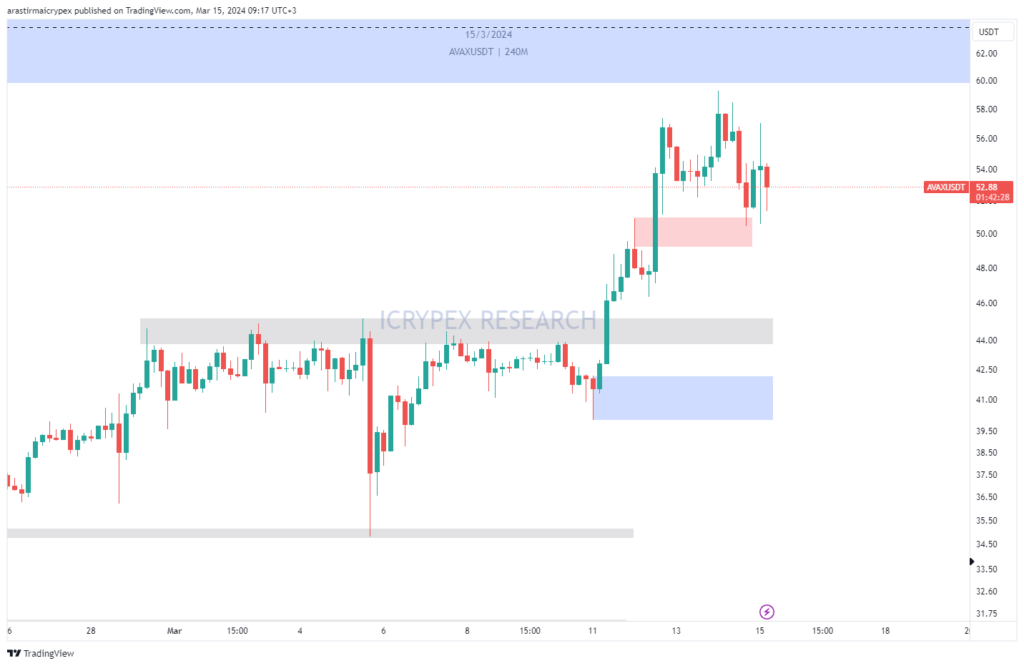

AVALANCHE(AVAX)

AVAX is priced at $52.98 with a 2.56% gain in value as of the morning hours. With yesterday’s downward movement, there was a retreat to almost $50. With the reaction received from this region, pricing around 57 dollars appeared again. For the continuation of the rise, it is very important that prices above $50 continue. If the level above 55 dollars is sustained, an upward movement up to 65 dollars may occur. In case the retreat deepens, $50 appears as the first support position.

SOLANA(SOL)

SOL is priced at $178.15 with a 0.72% gain in value as of the morning hours. When we examine the hourly chart, we see that a strong movement occurred with the upward break of the resistance zone of $ 150 and the $ 188 level was tested. SOL, which has experienced some withdrawal from this region, seems to have received a reaction from the $173 level, which is currently the support zone. If the reaction movement continues, the $185 level can be followed as resistance. In case of a withdrawal, if the support zone is broken downwards, a downward move to the $165 level may be possible.

CHAINLINK(LINK)

As of the morning hours, LINK is priced at $19,437, with a 6.92% loss in value. When we examine the hourly chart, we see that the downward movement accelerated with the downward break of the support zone of $ 20.26 and the $ 19 level was tested. If the reaction movement from the support zone continues, the $ 19.50 and $ 20 levels can be followed as resistance. In case of withdrawals, if the $ 19 level is broken downwards, the $ 18.50 level can be followed as support.

APT

APT is priced at $13.4115 with a 6.15% loss in value as of the morning hours. When we examine the four-hour chart, we see that there is horizontal movement between the $ 12.80 and $ 14.50 levels. APT, which tested the resistance zone of $ 14.50 yesterday, could not maintain its permanence and retreated slightly. If this movement continues, the $13 level can be followed as support. The $14 level appears as the short-term resistance zone.

FET

As of the morning hours, FET is priced at 2.6055 dollars with a loss of 8.60% in value. When we examine the four-hour chart, we see that there is a downward movement. In case of withdrawals, the $2.45 level appears as the support zone. If this region is broken downwards, a move towards the $2.30 region may be possible. In upward movements, if the resistance zone of $ 2.80 is broken, the $ 3 zone can be tested.