FED Left Interest Rate Fixed

With the decision announced at 21:00 yesterday, the Fed left the interest rate constant at 5.50%. However, the Fed has signaled that it expects to cut interest rates three times this year. Fed Chairman Powell said at the press conference held after the decision, “Recent indicators point to economic activities expanding at a strong pace. Employment increases have remained strong and the unemployment rate has remained low. Inflation has decreased over the past year, but continues to remain high.” said.

Grayscale Ethereum Trust Discount Value Reaches -20%

Grayscale Ethereum Trust discount fell to -20%, its lowest level since November 2023. This comes after optimism for spot Ethereum ETF approval waned by May. The decreasing discount value indicates that investors do not expect approval anytime soon. Additionally, Bloomberg ETF analysts lowered their estimates for approval status from 70% to 30%.

Three Consecutive Days of Exodus from Spot Bitcoin ETFs

There was a total outflow of $261.5 million from the spot Bitcoin ETFs whose data we examined on March 20, thus creating three consecutive days of outflow. We saw an outflow of 154 million dollars on March 18 and 326 million dollars on March 19. The total outflow amount for three days reached 742 million dollars. On the IBIT and FBTC side, where we saw high inflows, there were inflows of 49 million and 12 million dollars, respectively.

Collaboration Between Avalanche and Alipay+

Avalanche and China’s leading payment application Alipay+ have formed a partnership that aims to take digitalization solutions to the next level. According to the announcement, this collaboration aims to integrate Web3 technology into daily operations. This partnership has resulted in a comprehensive digitalization solution called Alipay+ D-Store. This solution combines e-wallet functionality with a Web3-enabled coupon program.

SEC Postpones VanEck’s Spot Ethereum ETF Decision

The Securities and Exchange Commission (SEC) has postponed its decision on whether to approve the VanEck spot Ethereum ETF. Instead, the SEC extended the review period by requesting public comments on the proposed ETF. This delay is part of the SEC’s standard process for evaluating new financial products, allowing time for public input and regulatory considerations before making a final decision on approval.

The Second Most Expensive CryptoPunk Ever Sold for the Second Time

On March 20, the second most expensive CryptoPunk ever sold for 4,850 ETH or $16.42 million. CryptoPunk #7804 is one of nine AlienPunks in a total collection of 10,000 NFTs. It outperformed the CryptoPunk #3100 sale on March 4 for 4,500 ETH ($16.03 million), which was the second most expensive CryptoPunk sale to date. The second most expensive CryptoPunk sale of the month is now CryptoPunk #7804. CryptoPunk #5822, which sold for 8,000 ETH, or $23.7 million, on February 12, 2022, still remains the most expensive CryptoPunk ever.

SEC Subpoenas Those Involved with the Ethereum Foundation

The U.S. Securities and Exchange Commission (SEC) has issued subpoenas to several companies that have business dealings with the Ethereum Foundation. This action indicates that the SEC is investigating potential securities law violations related to Ethereum’s initial coin offering (ICO) and subsequent sale of Ethereum tokens. The subpoenas are part of a broader regulatory investigation into the cryptocurrency industry, focusing on whether certain tokens should be classified as securities and therefore subject to securities regulations.

BlackRock Begins to Own MemeCoin and NFT

The asset management company now owns at least $40,000 worth of MemeCoins and NFTs after Onchain researchers discovered one of BlackRock’s purported wallets tied to a new tokenization fund. Data shows that $100 million USDC was deposited into Ethereum on March 15, exactly one day after the company launched a BlackRock USD Institutional Digital Liquidity Fund offering through a collaboration with San Francisco-based asset tokenization company Securitize. Since March 19, at least 40 coins and 25 NFTs, from the CryptoDickbutts S3 NFT to the PEPE coin, have been sent to BlackRock by anonymous cryptocurrency users.

——————————————————————- —————————–

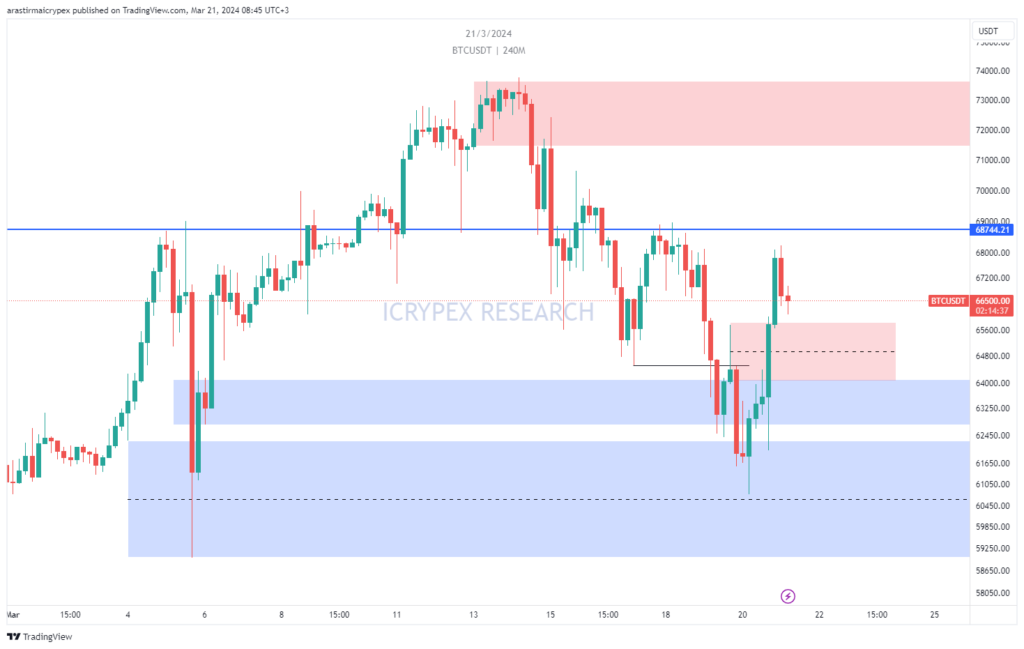

BITCOIN(BTC)

As of the morning hours, BTC is priced at $66,408 with a 2.12% loss in value. Yesterday afternoon, the price dropped to $60,750, but a significant increase was observed after the interest rate decision. After the $ 65,500 level was broken, the first signal was given for the market’s upward turn. $64,800 currently appears to be the first support position. If the rise continues after the pullback here, rises up to $69,000 may be seen. If the $64,000 level is lost, a retreat to $60,000 may occur.

ETHEREUM(ETH)

ETH is priced at $3476.77 with a 1.19% loss in value as of the morning hours. After a retreat to $3057, there was an increase to $3550. Yesterday, after the investigations opened against the Ethereum Foundation, a decline was observed, but then a serious buying occurred. $3550 is working as resistance, and in case of an upward break, it can move up to $3700. Our lower support zone currently appears to be the $3350 region. If it receives support from here, upward movements can be seen. In case of a downward breakout, $3150 appears to be the first strong support zone.

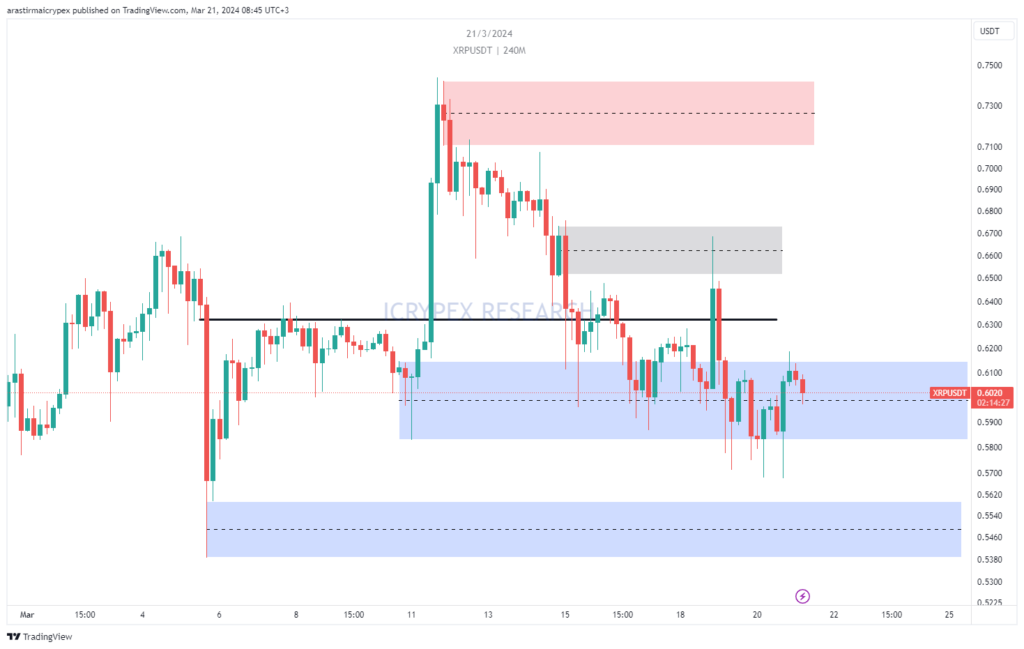

RIPPLE(XRP)

As of the morning hours, XRP is priced at $0.6030 with a 1.28% loss in value. A correction occurred yesterday after retreating to $0.5688. The 0.60 level is a very critical region and pricing above it has begun to be seen again. If there is a break above $0.62, we may encounter increases up to $0.70. If the withdrawal deepens, there may be a drop to $0.55.

AVALANCHE(AVAX)

AVAX is priced at $54.45 with a 4.57% loss in value as of the morning hours. $50 is still a critical level. It needs to hold above this level. If it holds, the $60 level can be seen again. Yesterday, there was an increase to the level of 58 dollars, but it could not be sustained. If the retreat continues, the range between $52 and $50 is among the regions that can hold the price.

SOLANA(SOL)

SOL is priced at $185.23 with a 3.44% loss in value as of the morning hours. When we examine the hourly chart, we see that there is an upward reaction movement from the $ 165 region, which we follow as the support zone, and the $ 194 level is tested. If the withdrawal movement continues, the $180 level can be followed as support. In upward movements, the $194 level, which previously experienced selling pressure, appears as an important resistance.

CHAINLINK(LINK)

As of the morning hours, LINK is priced at $17,890, with a 2.85% loss in value. When we examine the four-hour chart, we see that there is an upward reaction movement from the $ 16,550 level, which we follow as the support zone, and the $ 18,500 level, which we follow as the resistance zone, is tested. If it persists above this region, a move towards the 19 dollar and then 20 dollar region may be possible. In case of a withdrawal, the $17 level can be followed as support.

CYBER

CYBER is priced at $13,459 with an 8.46% gain in value as of the morning hours. When we examine the four-hour chart, we see that the $13 resistance level has been broken upwards. If this movement continues, the $14 level may be tested. In case of a withdrawal, the $ 13.10 level can be followed as support.

BCH

BCH is priced at $414 with a 0.93% gain in value as of the morning hours. When we examine the hourly chart, we see that there was a strong movement with an upward break of the $380 resistance area and the $400 level was passed. If this movement continues, the $420 level can be followed as resistance. In case of withdrawals, the 405 and 400 dollar regions appear as support.