MicroStrategy Purchased Another 9,245 BTC for $623 Million

MicroStrategy purchased an additional 9,245 Bitcoins for $623 million, or about $67,400 per Bitcoin, according to the announcement Tuesday. It used $30.7 million in extra cash, on top of $592.3 million from the convertible debt issue, to buy Bitcoin most recently. Currently, MicroStrategy owns approximately 214,246 BTC, or more than 1% of total Bitcoin. According to the statement, he paid approximately $7.53 billion for Bitcoin, or $35,160 per Bitcoin.

BlackRock Launches $100 Million Tokenized Asset Fund

BlackRock, the world’s largest asset management firm, has created a new tokenized asset fund, according to a March 19 SEC filing. It is currently unknown which asset classes the fund aims to tokenize. According to data, the fund will be active on the Ethereum blockchain with an initial capital of 100 million USDC.

Bitcoin Emphasis from Japan State Pension Fund

Japan Government Pension Investment Fund (GPIF), known as the world’s largest pension fund with total assets of $1.5 trillion, announced that it wants to consider Bitcoin among its investment options. GPIF’s interest in Bitcoin and alternative assets forms part of a comprehensive strategy to explore innovative avenues for portfolio diversification. However, this does not mean that GPIF will definitely include Bitcoin in its portfolio.

Growth in Galaxy Asset Management Assets

Galaxy Asset Management (GAM) reached $10 billion in assets. This success points to growing institutional interest in cryptocurrencies and blockchain technology. According to the data, it appears that assets grew by 24.8% compared to last month. One of the biggest reasons for this growth is the Invesco Galaxy spot Bitcoin ETF.

Increased Earnings from Bit Digital Compared to Last Year

Bitcoin mining firm Bit Digital announced a profit of $44.9 million for 2023. This amount means an increase of 39% compared to 2022. The company announced that it mined 1507 BTC in 2023, which represents a 21% increase compared to 2022. Additionally, the company stated that this growth was due to a ‘higher active hash rate’.

Smart Contracts Platform Soroban Comes to the Stellar Network

One of the biggest updates in the project’s decade was the launch of Soroban, a payments-focused on-network smart contracts platform by the Stellar Development Foundation (SDF). Soroban’s mainnet phase 2 went online today after a two-year testing period, enabling the development of user-ready decentralized applications. Soroban expands the range of applications developed on the Stellar blockchain by providing developers with a new method for implementing smart contracts. The platform uses WebAssembly (WASM), a binary code format designed for blockchain and traditional web interactions.

SEC Delays Hashdex and Ark 21Shares Ethereum ETF Decisions

The SEC has postponed the date by which it will decide whether to accept the Hashdex Nasdaq Ethereum ETF. If approved, the Hashdex ETF will hold futures contracts and spot Ethereum. The SEC announced on Tuesday that the deadline for the decision will be postponed to May 30, 2024. In order to allow itself sufficient time to consider the proposed rule change and the issues addressed therein, the SEC said, “The Commission believes that it is appropriate to establish a longer time frame for issuing an order approving or denying the proposed rule change.” said

Crypto Market Turned Negative as $230 Billion Lost in One Day

The cryptocurrency market turned negative in the last few days, with the biggest losses occurring on the last day. Specifically, a total of over $230 billion in cryptocurrency was lost among over $650 million in liquidations. It is seen that the 24-hour capitalization loss in the market is 233.33 billion dollars.

——————————————————————- —————————–

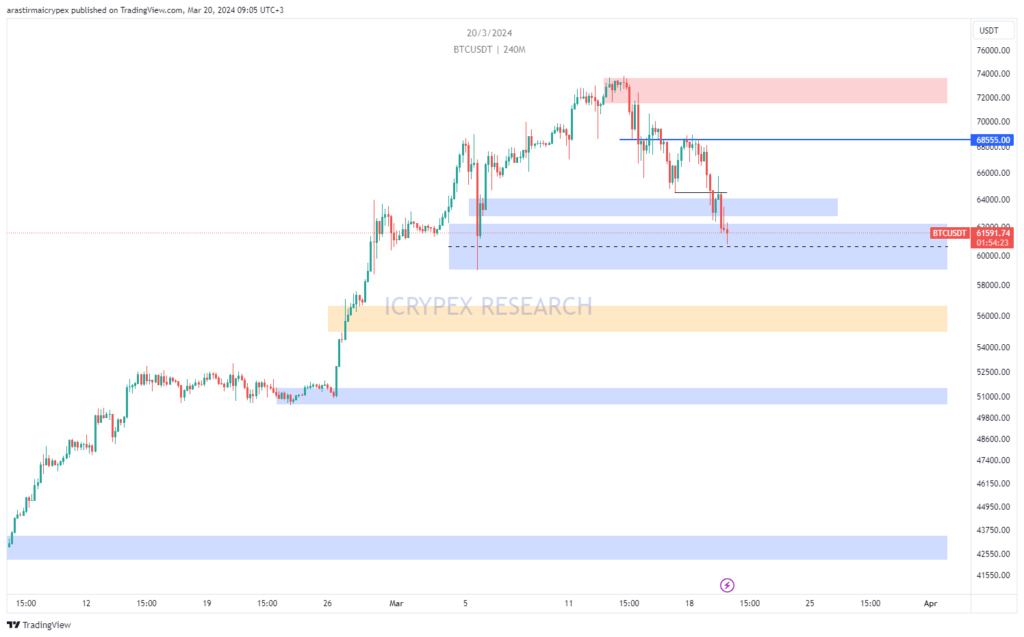

BITCOIN(BTC)

As of the morning hours, BTC is priced at $61,650 with a 0.61% loss in value. The retreat continues due to the selling pressure from Friday. After losing the $62,800 level, the pullback continued and reached the major support zone between $62,000 and $60,000. If there is an upward reaction from here, there may be a rise up to $64,000. In case of a downside breakout, $58,500 appears as the first support position.

ETHEREUM(ETH)

ETH is priced at $3114 with a 1.35% loss of value as of the morning hours. The withdrawal is currently continuing. The $3000 region is a critical level. It seems to be holding on here for now. If there is an upward reaction from here, increases up to $3320 may be seen. In case of a downward movement, $2770 may act as support.

RIPPLE(XRP)

As of the morning hours, XRP is priced at $0.5809 with a 0.60% loss in value. A correction occurred after retreating to $0.5692 in the morning hours. The retreat is still ongoing. The 0.60 level now acts as resistance. If there is a break above this level, we may encounter increases up to $0.70. If the withdrawal deepens, there may be a drop to $0.55.

AVALANCHE(AVAX)

AVAX is priced at $50.24 with a 5.37% loss in value as of the morning hours. $50 is a critical level. It needs to hold above this level. If it holds, the $60 level can be seen again. In case of a downward break, $50 will act as resistance and a drop to $48 may be seen.

SOLANA(SOL)

SOL is priced at $165.14 with a 2.77% loss of value as of the morning hours. When we examine the hourly chart, we see that the $180 and $167 levels, which we follow as support zones, have been broken downwards. If this movement continues, the $160 region can be followed as support. In upward movements, it seems important to maintain permanence first above the $168 and then $170 levels. If these two areas are crossed, the $175 level can be followed as support.

CHAINLINK(LINK)

As of the morning hours, LINK is priced at $16,392 with a 2.54% loss in value. When we examine the four-hour chart, we see that the $ 16,550 level, which we follow as the support zone, has been broken downwards. If this movement continues, the level of $ 16 and below $ 15,700 can be followed as support. In upward movements, first 16,500 and then 17 dollars levels can be followed as resistance.

ALGO

ALGO is priced at $0.2203 with a 4.34% loss in value as of the morning hours. When we examine the four-hour chart, we see that the downward movement started with the downward break of the head-and-shoulders formation. If this decline continues, the $0.21 region can be followed as support. If it receives an upward reaction from this region, a reaction rise to the $0.22 region may be possible.

LTC

LTC is priced at $77.63 with a 1.07% depreciation as of the morning hours. When we examine the four-hour chart, we see that there is a downward trend movement. If the withdrawal movement continues, the $76 level can be followed as a support zone. In case of an upward reaction from this region, the $80 level appears as an important resistance.