Open Interest in Bitcoin Futures Reached Highest Level Since November 2021

With levels not seen since November 2021, open interest in Bitcoin futures on centralized exchanges has reached a new high. According to CoinGlass, total open interest in Bitcoin futures reached $22.9 billion on Monday, the largest figure since the last quarter of 2021 and close to a peak of around $24 billion at the time. Open interest in Bitcoin futures has increased by almost 30% since the beginning of 2024. This gain corresponds with Bitcoin’s price rising 23% since the beginning of the year to $52,300, a level last seen in December 2021.

South Korea Reported 2-Year Delay in Crypto Taxation

The ruling People Power Party in South Korea is allegedly pushing for a two-year additional tax deferral on earnings from Bitcoin investments. This appears to be part of the party’s campaign for the general election in April. The program was originally planned for 2023 but has been postponed to January 2025. Currently, the proposal of the People’s Power Party aims to move the program to 2027.

Vitalik Buterin Predicts Ethereum’s Verkle Trees Rise

Vitalik Buterin expressed his excitement on social media about the upcoming addition of ‘Verkle Trees’ to the Ethereum network. He underlined that this development will improve the overall user experience, reduce disk space needs and improve staking node functionality.

Record Amount of Entry into Digital Asset Funds

Digital asset funds saw a record inflow of $2.45 billion last week, bringing the total inflow since the beginning of the year to $5.2 billion. When examined regionally, 99% of entries occurred in the Americas. When we evaluate on a coin basis, there was an inflow of 2.43 billion dollars in Bitcoin. As for altcoins, there was an inflow of 21.1 million dollars in Ethereum, 0.6 million dollars in Litecoin and 0.4 million dollars in Ripple, while there was an outflow of 1.6 million dollars in Solana and 5.6 million dollars in Cardano. Additionally, there was an inflow of $5.8 million into short-Bitcoin.

Japan Approves Bill Allowing Investment Companies to Hold Crypto

The Japanese government has approved a bill allowing investment trusts to buy and hold crypto, signaling the country’s regulatory framework is shifting towards digital currencies. The bill primarily aims to promote job creation and strategic investments in various sectors, including technology and green energy. Within the scope of the new legislation, investment trusts that are effective in private equity, venture capital and real estate investments will now include crypto in their portfolios.

BlackRock Labeled BTC as ‘Progress’ in Latest Spot Bitcoin ETF Ad

BlackRock has stepped up its media advertising campaign for its spot Bitcoin ETF, labeling Bitcoin as ‘progress’ and not as a currency. BlackRock’s first ETF ad, published on January 11, also adopted a mature approach by targeting the ‘boomer’ audience. Additionally, BlackRock’s IBIT ETF ranks first among inflows with $5.3 billion.

Cooperation Agreement with Chiliz and South Korean Football League

Chiliz announced a multi-year partnership with the K League, a professional soccer league in South Korea. This collaboration aims to significantly increase fan participation in the league. According to a statement made yesterday, Chiliz stated that the agreement will see the football league join the Chiliz Chain ecosystem to promote its brand and products to fans globally.

AltLayer Closes $14.4 Million Strategic Round Co-Led by Polychain and Hack VC

A $14.4 million strategic investment round led by Polychain Capital and Hack VC was raised by AltLayer. According to the statement made yesterday, OKX Ventures, HashKey Capital, Bankless Ventures, Primitive Ventures, SevenX, Mask Network, IOSG and TRGC also participated in the round. The announcement states that the additional funding will be used to grow AltLayer’s workforce and improve its collection infrastructure. Valuation was not disclosed by AltLayer. The increase follows AltLayer’s native token launch last month. This rewards users for their contributions to community campaigns, owning AltLayer’s NFTs, and staking on Celestia and EigenLayer. The first airdrop consisted of approximately 300 million ALT tokens ($141 million), or 3% of the entire supply, of which 83% were claimed.

——————————————————————- —————————–

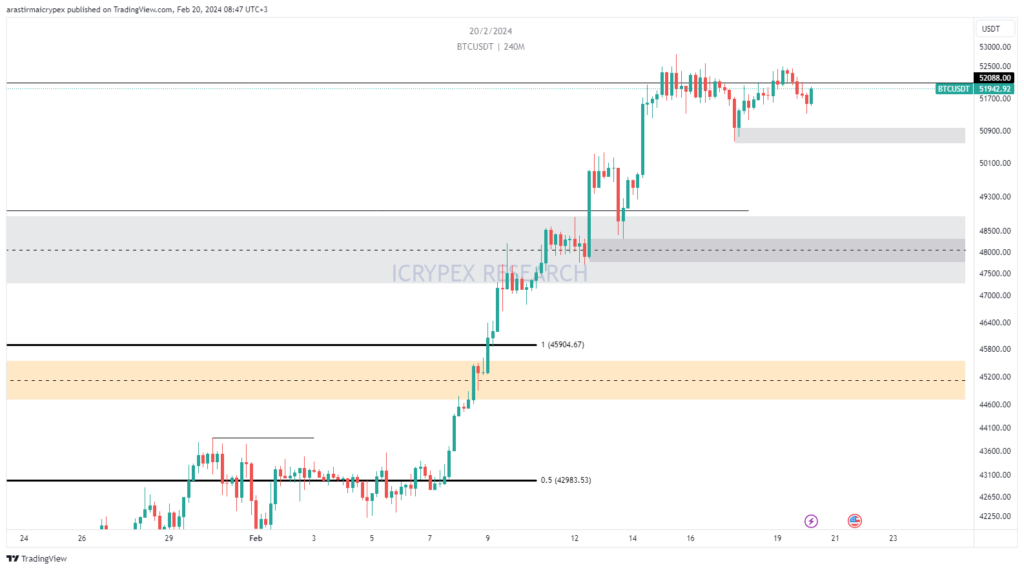

BITCOIN(BTC)

In today’s morning hours, Bitcoin is trading at $51,900, up 0.30%. $52,000 was a very critical level, it was lost again. After appearing at $52,500, it encountered a sell-off and retreated to $51,300. An increase up to $54,000 may be seen in prices above $52,000. If there is a break below $50,600, a retreat to $49,750 may be seen.

ETHEREUM(ETH)

Ethereum, which lost 43% of its value as of the morning hours, is priced at $ 2932. After a rise to $2984, there was a retreat to 2905. $2905 is a critical level, and as pricing continues above it, a rise to $3000 may be seen. In case of a downward break, the first support level appears to be $ 2845.

RIPPLE(XRP)

As of the morning hours, XRP is priced at $0.5662 with a 0.66% gain in value. After a rise to $0.5741, there was a decline to $0.555. The 0.55 region is a strong support zone and it started to trend upwards, but there is a rejection again. If $0.5580 breaks downwards, $0.54 appears as the first support level. The $0.60 level may be seen in the continuation of the upward movement.

AVALANCHE(AVAX)

AVAX is priced at $39.50 with a 0.05% depreciation as of morning hours. Yesterday, the level of 40 dollars was gained again, but it could not be maintained. The $39 region is a strong support level and it seems to have received a reaction from here for now. If the upward movement continues, a rise up to $42 may be seen. If the $39 level is lost, $37 appears as the next support level after this level.

SOLANA(SOL)

SOL is priced at $110.8 with a 0.68% depreciation as of the morning hours. When we examine the four-hour chart, we see an upward reaction from the rising trend line. If this movement continues, the resistance zone of $117.5 can be tested. In case of persistence above the resistance zone, a movement towards the $125 region may be possible. In case of a withdrawal, the $105 level can be followed as support.

CHAINLINK(LINK)

As of the morning hours, LINK is priced at $19,714 with a 0.63% loss in value. When we examine the four-hour chart, we see that there is a downward movement. In upward movements, the falling trend line and horizontal level can be followed as resistance. These levels are $20,400 and $20,680. If there is persistence above these two areas, $ 21 and then $ 21,300 levels can be tested. In case of a withdrawal, the levels of 19,500 and $ 19 can be followed as support.

FTM

FTM is priced at $0.4372 with a 1.30% gain in value as of the morning hours. When we examine the daily chart, we see that the $0.4255 resistance level has been broken upwards. If persistence is achieved above this region, the $0.45 level can be targeted. In case of a withdrawal, the $0.43 level can be followed as support.

ACH

ACH is priced at $0.02560 with an 11.55% gain in value as of the morning hours. When we examine the daily chart, we see that the $0.024 resistance level has been broken upwards. If this movement continues, the $0.028 level can be tested. In case of a withdrawal, the $0.0245 level can be followed as support.