SEC May Classify Ethereum as a Security Discussions are on the Agenda

CoinDesk’s latest report shows that the US Securities and Exchange Commission is preparing to classify Ethereum as a security. If this happens, it is considered to have serious implications for the entire crypto market, including spot Ethereum ETFs. In addition, CFTC, another major regulator, had previously approved Ethereum futures ETFs and described Ethereum as a commodity rather than a security.

Bitcoin ETFs Seen Low Inflows All Week

Wall Street’s Bitcoin ETFs set a new record with a record-breaking five-day net outflow. While outflows reached $888 million, Grayscale’s GBTC led the decline. Additionally, low inflows were seen, particularly in Blackrock’s IBIT and Fidelity’s FBTC funds. Although the money outflows coincide with the decline in Bitcoin price, analysts state that the trading activities of companies such as Genesis may also play a role in this situation.

Do Kwon Released

Do Kwon, co-founder of Terraform Labs, was released from prison in Montenegro. The country’s Supreme Court considered extradition requests from South Korea and the United States, where Kwon faces fraud charges related to the collapse of Terra Luna. The Supreme Court’s decision to release Kwon came after the lower court’s extradition decision in favor of South Korea was questioned. Kwon’s passport was confiscated to prevent him from leaving Montenegro. Do Kwon is currently in a shelter for foreigners.

Strong GitHub Activity from Cardano

Despite the criticism, Cardano remains one of the most prominent blockchain protocols in terms of GitHub activity. According to IntoTheBlock data, Cardano has once again surpassed the leading Layer 1 blockchains Ethereum, Avalanche, Litecoin, and Tron in terms of developer engagement. Between March 11 and 17, Cardano recorded 978,780 commits on GitHub, surpassing its closest rival, Ethereum, which recorded 407,170 commits in the same period. The blockchain analysis platform’s data also shows that Avalanche has 315,770 commits, Litecoin has 84,110 and Tron has 79,380 commits. Cardano has experienced a surge in its total value locked in DeFi this year, reaching $520 million on March 14, according to DefiLlama. This figure dropped to 385 million dollars as of March 20.

Development from the Prime Minister of Iceland that will upset the miners

Although Iceland is the world’s largest per capita producer of energy and a significant producer of Bitcoin hashrate, it is focusing on moving away from crypto mining. Prime Minister Katrín Jakobsdóttir aims to increase food production in the country and direct renewable energy away from crypto mining and towards Iceland’s households and other industries. The decline in electricity due to high demand and few new power plants under construction will result in the crypto mining industry not growing in the country. Motivated by the desire to be less dependent on imported food, the Prime Minister states that it would be better to focus on agriculture.

Goldman Sachs Clients Are Active in the Crypto Market Again

Goldman Sachs clients have reportedly begun returning to the crypto market with the approval of spot Bitcoin ETFs. According to a March 24 report from Bloomberg, Goldman Asia Pacific Head of Digital Assets Max Minton said many of the firm’s largest clients have recently become active or are ‘exploring becoming active’ in the crypto sector.

Strong Performance from BlackRock and Fidelity Spot Bitcoin ETFs

BlackRock and Fidelity Investment’s spot Bitcoin ETFs, IBIT and FBTC, have become the most popular funds offered by the two asset managers, according to data shared by Bloomberg ETF analyst Eric Balchunas. IBIT accounted for more than half of BlackRock’s net inflows for the year, despite the company’s large portfolio of 420 ETFs, the data showed. Similarly, FBTC accounted for 70% of Fidelity’s net inflows from the beginning of the year.

Polygon zkEVM Blockchain Resumes Operation After 10-Hour Outage

The Polygon zkEVM blockchain experienced an outage on March 23 and was unable to sort new blocks for 10 hours. The Polygon team acknowledged this outage with a post published on the X platform. After the necessary work, it was announced that the problem was solved. The Polygon zkEVM outage did not affect Polygon’s main blockchain or chains designed with Polygon’s Chain Development Kit (CDK).

Restrictions Coming to Anonymous Cryptocurrency Accounts in the EU

The European Union has toughened its stance on anonymous cryptocurrency accounts. The proposal to prevent the use of financial systems for money laundering or terrorist financing was approved by the European Parliament on March 19. While the proposal aims to restrict anonymous payments made with cash and cryptocurrencies, anonymous cash payments of €3,000 or more for individuals and cash payments over €10,000 for commercial transactions are completely banned.

Strong Performance in Phantom Before Sonic Upgrade

Three elements stand out in Sonic Upgrade. The first of these is FVM, or Fantom Virtual Machine. FVM increases transaction volume considerably. Carmen, the new storage system, reduces storage requirements by up to 90%. It offers validators more cost-effective options. It accelerates the Foundation’s capacity to set up archive nodes by up to 36 hours. The improved Lachesis consensus process results in significant transaction pooling. Prior to this upgrade, FTM had seen an increase of approximately 190% and is priced above $1 again.

——————————————————————- —————————–

BITCOIN(BTC)

As of the morning hours, BTC is priced at $67,230 with a 0.05% gain in value. The upward movement continues after receiving support at $60,800. We see $68,300 working as resistance. In order for the rise to continue, a break above this level must be achieved and stability must be achieved. After 68,300 starts to act as support, a rise to $ 72,000 can be seen again. $66,000 is currently working as support. If there is a break below this level, a withdrawal may occur up to $62,500.

ETHEREUM(ETH)

ETH is priced at $3460 with a 0.13% gain in value as of the morning hours. After the decline to 3060 dollars, we continue to rise by finding support at this price. After rising to $3590, it encountered selling pressure from this region and retreated to this region. We can identify $3590 as a strong resistance zone. For the continuation of the rise, it is necessary to ensure permanence by breaking above this region. If there is a breakout, there may be an increase up to $4200. If there is a loss of the $ 3310 region, a withdrawal may occur up to $ 3200.

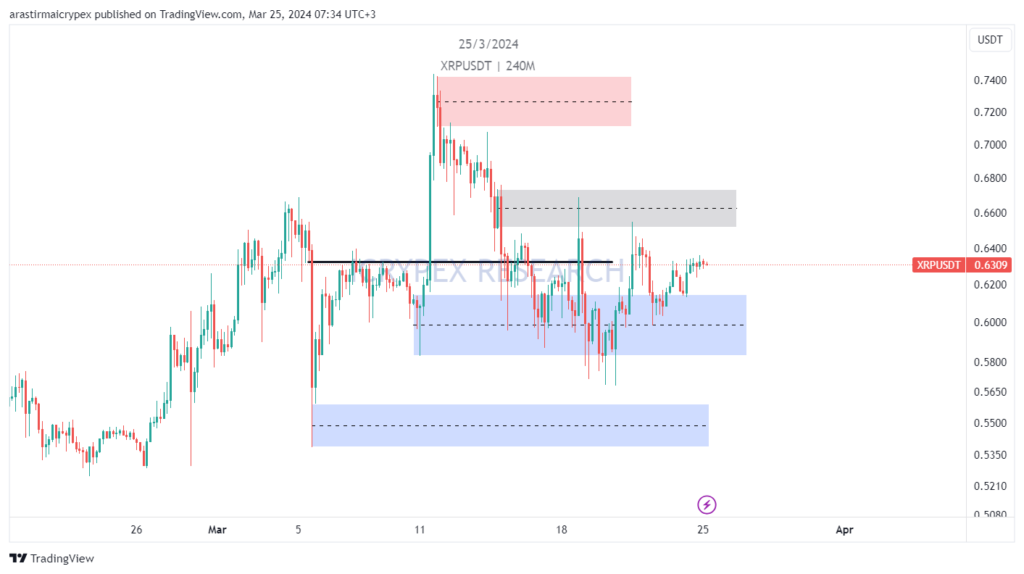

RIPPLE(XRP)

As of the morning hours, XRP is priced at $0.6309 with a 0.24% loss in value. We see a recovery in price after a drop to $0.5685. Following this decline, there was an increase to $0.6686. These two levels can be the lower and upper levels of the new horizontal zone. The $0.60 region is of great importance for XRP, and as prices rise above this region, an increase up to $0.72 can be seen. Below the $0.60 region is critical, and in case of a downward breakdown, a retreat to $0.50 may be seen.

AVALANCHE(AVAX)

AVAX is priced at $56.31 with a 1.02% gain in value as of the morning hours. We are in a rising trend structure in the medium term. After the trend is touched, the rise continues to be seen. The 57 – 58 dollar area is the resistance zone, and if there is a break above this level, a rise up to 65 dollars can be seen. For the continuation of the rise in the medium term, the $66 level must now be broken. If there is a break above $66, a rise up to $73 may be seen. In case of a break below the trend, $50 is a region that is likely to act as major support.

SOLANA(SOL)

SOL is priced at $186.25 with a 1.21% gain in value as of the morning hours. When we examine the hourly chart, we see that the resistance areas of $177.30 and $185 were broken with the upward movement experienced over the weekend. If this movement continues, the $190 level appears as an important resistance zone. Above this level, the $200 level can be followed. In case of a pullback, the $185 and $180 levels can be followed as support.

CHAINLINK(LINK)

As of the morning hours, LINK is priced at $18,985 with a 2.44% gain in value. When we examine the hourly chart, we see that the resistance level of $18,805 is broken upwards. If this movement continues, a move towards the $19,500 level may be possible. In case of a retreat, the broken resistance zone can be followed as support.

MKR

MKR is priced at $3260 with a 3.33% gain in value as of the morning hours. When we examine the four-hour chart, we see that there is a rising channel movement. The closest resistance zone is the $3300 region. If this region is passed, a movement towards the top of the channel may be possible. In case of a withdrawal, the $ 3200 region can be followed as support.

FTM

FTM is priced at $1.11 with a 3.98% gain in value as of the morning hours. When we examine the four-hour chart, we see that it received a reaction from the support zone of $ 1,036 with a withdrawal movement. If this reaction movement continues, the $ 1.15 level can be followed as resistance.