It is very important to know what to do when cryptocurrencies, stocks or other investments held by investors unexpectedly lose value. The volatile nature of financial markets requires investors to take strategic steps to minimize possible losses. There is a concept that comes into play at this point, which functions as a safety net in the investment world. In fact, this tool, which is frequently heard of but its exact purpose and how it is used is unknown to everyone, is of vital importance for both professional investors and beginners. Let’s open the doors of this important financial tool together and ask “What is stop loss?” Let’s look for the answer to the question together.

What Does Stop Loss Mean?

Stop Loss is an important financial term generally used to limit investors’ losses. It is especially frequently used in cryptocurrencies, stocks, foreign exchange and other financial instruments. Stop loss, a type of order, is an important part of investment strategies. This financial term is also referred to as stop loss, stop loss, conditional order, conditional order, stop loss order.

Of course, stop loss is not used only for loss limitation. It is also an effective tool in profit taking processes. Although stop loss is mostly used on cryptocurrency exchanges and exchanges where stocks are bought and sold, it can also be preferred on other investment platforms. “What is stop loss? Now that we have basically answered the question, we can now start sharing details about this term.

What is the Use of Stop Loss? What are the advantages?

“What is the use of stop loss?” The question actually includes “What are the advantages of stop loss?” The answer to the question is also found. Therefore, these two questions can be examined under one heading. The importance of the Stop Loss order comes from the fact that it offers many advantages for those investing in financial markets. We mentioned in the previous title that the concept of stop loss basically means limiting the loss or realizing the profit. Now let’s take a comprehensive look at what this concept does and the advantages it offers.

- Limitation of Losses : Conditional order automatically sells investors’ assets that fall below a certain price level and limits the losses that may occur. Thus, large losses that may arise from sudden or long-term market movements can be prevented. For example, for a cryptocurrency purchased at $10, the stop loss level is set at $9. If the price of this cryptocurrency drops to $9, it will be sold automatically. This limits any further damage that may occur.

- Avoiding Emotional Decisions: It is common for investors to panic and make emotional decisions during market fluctuations. Stop loss order is actually effective in acting with a predetermined strategy. Thus, the stop loss order prevents emotional decisions by enabling action with a predetermined strategy. This helps make more disciplined and logical investment decisions.

- Reducing the Obligation to Follow: Following the market is a challenging process. Thanks to the stop loss order, the obligation to follow the market can be reduced. Setting a stop loss level helps investors secure their positions. Thus, a certain level of risk can be maintained without being constantly on guard in the market.

- Securing Profit: Some investors may also use stop loss orders to gain profit. In this method, a sell order is placed when the asset reaches a certain profit level. Thus, if there is a profit in the transactions carried out, this development can be secured.

What are the Disadvantages of Stop Loss?

https://research.icrypex.com/wp-content/uploads/2023/03/stop-loss-dezavantajlari-nelerdir.jpg

While the Stop Loss order provides many advantages to investors, it also brings some disadvantages. Possible stop loss disadvantages are as follows:

- Misleading Signals During Market Fluctuations: Short-term price fluctuations can trigger the stop loss level. This may result in the investor’s position being closed unexpectedly. Such a development may cause investors to lose positions that may be profitable in the long term.

- Determining the Wrong Stop Loss Level: Reaching a wrong conclusion when determining the stop loss level may mean unexpected losses for investors. A stop loss level that is too narrow may trigger frequently and lead the trader to close positions unnecessarily. A very wide stop loss level may cause the investor to experience large losses.

- Possibilities Depending on Market Volatility: During periods of high volatility, stop loss orders may occur at prices different from expected. Fast movement in the market may cause the stop loss level to be exceeded and the order to be executed at a different price.

- Effect on Investment Strategies: Constant triggering of stop loss orders due to short-term fluctuations may make it difficult for investors to implement their planned long-term strategies.

- Possibility of Order Not Execution: When market liquidity is low, stop loss orders may not be executed at the expected price level. Especially in sudden price drops, it may not be possible for the order to be executed at the specified stop loss level and the investor may have to sell at a lower price than expected.

- Exposure to Market Manipulations: In some cases, big players or manipulators in the markets may knowingly trigger stop loss levels and cause investors to close their positions.

How Does Stop Loss Work?

Stop loss works automatically after an order placed by the investor. A total of 3 stages take place, from the first stage to the last stage. These stages are as follows:

- Defining the Stop Loss Order

Stop Loss order is a type of order that allows the investor to automatically sell the asset he owns when the price drops to a certain level. The investor determines in advance at which price level the stop loss order will be activated. This price level represents the maximum amount of loss the investor can accept.

- Determining the Stop Loss Level

Determining the stop loss level is shaped according to the investor’s risk tolerance and investment strategy.

- Activation of Stop Loss Order

The Stop Loss order is automatically activated when the specified stop loss level is reached. That is, when the asset price falls to the specified level, the asset is sold without the investor taking any action. This process helps the investor limit his losses and prevents large losses. For example, an investor can set the stop loss level at $9 for a cryptocurrency purchased for $10. In this case, when the price of the purchased cryptocurrency drops to $9, the conditional order is activated and the stock is automatically sold. This scenario can also be used to make a profit from the transaction and vice versa.

How to Place a Stop Loss Order?

Placing a stop loss order may seem complicated to some investors, but it is possible to use this tool in just a few steps. Especially ICRYPEX users can place a stop loss order very easily.

How to Make Stop Loss in Crypto?

A stop loss order on ICRYPEX can be completed in three steps. These steps are as follows:

1- Become a Member

Complete the ICRYPEX Register process for free.

2- Deposit Money to Your Account

“Deposit” button on the home page. Then, click on the “Deposit” button to deposit money to your ICRYPEX account via bank transfer, or click on the Deposit Cryptocurrency button, select the cryptocurrency you want to deposit, and complete the cryptocurrency transfer from a different platform by providing the generated address.

3- Place a Stop Loss Order

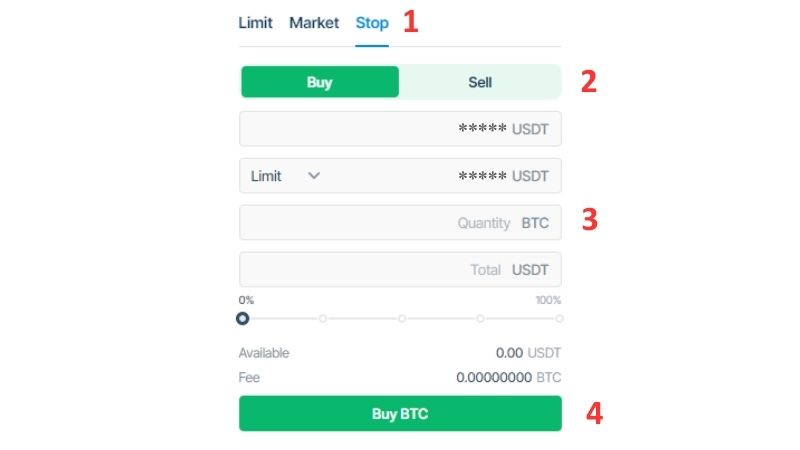

- “Pro Trade” button under the “Trade” button on the home page.

- Choose which currency pair you will trade. In this example, BTC/USDT parity is preferred

- Click on the Stop tab. Specify your preference in which direction the transaction will be (buy or sell). In the Quantitly section, specify the amount you want to buy or sell. Click BTC (sell BTC if selling) button.

After all these transactions, your stop loss order will be created. The entire process regarding the orders placed can be followed from the Open Orders, Order History and Transaction History tabs on the pro buy and sell page.

How to Make Stop Loss in the Stock Exchange?

Using stop loss in the stock market involves similar processes to using stop loss in crypto. Those who want to carry out this transaction specifically on the stock exchange can follow the steps shown to them by the institution from which they receive service or will receive service.