What is Tether (USDT)? How Does It Work?

As the cryptocurrency world grows and develops rapidly, new projects and technologies are constantly added to the market. In this dynamic ecosystem, some cryptocurrencies attract more attention and use than others. One of these is Tether (USDT). In this article, we step into the fascinating world of Tether USDT, which can be defined as a digital dollar, which was developed as a digital representation of the American dollar, which is widely used all over the world. What is Tether, which has become a favorite of investors and crypto enthusiasts looking for financial stability? The basic principles behind Tether USDT and the advantages it provides make it an indispensable part of the crypto market. If you are ready, let’s start discovering the secrets of Tether USDT!

Tether USDt Project

Tether USDt is a cryptocurrency pegged to the US dollar. It is a digital asset known as a stablecoin that is widely used in cryptocurrency markets. So 1 Tether USDt is equal to 1 US dollar. This is actually the clearest answer to the question of how many dollars is 1 Tether. Those who want to get more information about stablecoin can check out this article: What is Stable Coin ? What Are Their Types and Advantages?

Tether USDT, which can also be described as a digital dollar, is the largest stablecoin by market value. This shows that Tether USDt has a great dominance over the cryptocurrency industry.

Now that we have briefly summarized what Tether USDT is, we can start sharing details about this cryptocurrency.

What is Tether (USDT) used for? What are the advantages?

Tether is widely used in cryptocurrency exchanges and has many different uses. These usage purposes can be listed as follows:

- Value Stability: Tether is designed so that 1 USDT equals 1 US dollar. This serves as a safe haven for investors looking to hedge against fluctuations in cryptocurrency markets.

- Fast and Low-Cost Transfers: Unlike traditional banking systems, transactions made with USDT are fast and low-cost. This feature provides great convenience, especially in international money transfers.

- Liquidity: Providing high liquidity in cryptocurrency exchanges, USDT allows investors to make fast purchases and sales. This allows market opportunities to be evaluated more effectively.

- Serving as a Bridge Between Fiat Money and Crypto: Tether serves as a bridge between fiat currencies and cryptocurrencies, helping users gain easier access to the world of crypto money.

- Trade and Payment Tool: Tether can be used in commercial transactions if it is accepted as a payment tool on e-commerce platforms. Payments via USDT have become popular among businesses and customers because they are fast and low-cost.

- Safe Haven: When volatility increases in crypto markets, investors can move their assets to USDT, which is seen as a safer haven. This helps prevent loss of value during market uncertainties.

- Loan and Borrow: Some cryptocurrency platforms allow users to borrow or lend in exchange for USDT. Such platforms help users provide liquidity if USDT is provided as collateral. This allows investors to manage cash flow without having to sell their assets.

- Yield Tool: Some crypto platforms or wallets, including ICRYPEX, offer users the opportunity to yield via USDT. Users can earn additional income by keeping their USDT on such platforms. This can be considered a low-risk investment tool. Those who want to benefit from this opportunity can visit the ICRYPEX earn page.

How Does Tether Work?

A user deposits a fiat currency (e.g., US Dollar) into Tether’s reserve. This is usually done through a cryptocurrency exchange or a Tether service provider. The user purchases USDT in exchange for fiat currency that Tether deposits into their reserve account. This transaction takes place with a 1 to 1 dollar parity, meaning that when 1 dollar of fiat money is deposited, 1 USDT is received.

When users want to convert USDT to fiat currency, they send the USDT back to the Tether reserve. This process means USDT is removed from circulation and destroyed. In this way, Tether coin continues to have a stable value by maintaining its 1 to 1 dollar parity.

Tether (USDT) exists on multiple blockchains. Originally running on Bitcoin’s Omni Layer, Tether USDt now operates on a variety of blockchains including Algorand, Avalanche, Ethereum, EOS, Liquid Network, Near, Polygon, Solana, Bitcoin Cash’s Standard Ledger Protocol, Statemine, Statemint, Tezos and Tron. Available as digital tokens built on chains. Stating that it is a completely transparent company, Tether Limited states that they publish a record of their current reserve assets.

Who is the Founder of Tether?

If you ask who Tether is, it is known that the company was founded by Tether Limited in 2014 and USDT was launched in 2015. The common vision of the founders was to create a stable and reliable digital asset in the cryptocurrency world. In addition to USDT, Tether Limited also produces digital currencies pegged to the fiat currency of the euro, Mexican peso and Chinese yuan.

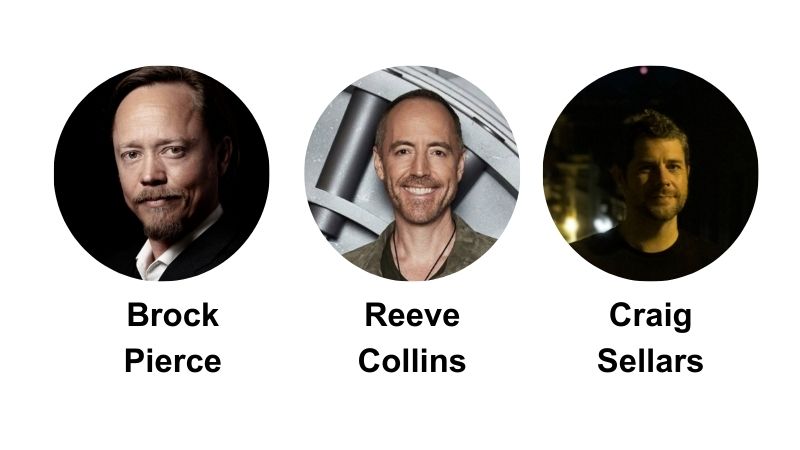

In fact, when Tether appeared in 2014, it was called Realcoin. It later gained a new brand name as Tether. The founders of Tether Limited are Brock Pierce, Reeve Collins and Craig Sellers.

Brock Pierceis an important figure in the world of entrepreneurship and cryptocurrency. Pierce has had many successful ventures before. For example, he was among the founders of important cryptocurrency investment companies such as Blockchain Capital and served as president of the Bitcoin Foundation. Pierce has played a major role in the adoption of cryptocurrency technologies and digital assets with his activities to date.

Reeve Collinsis another of Tether’s co-founders. Collins has extensive experience in digital advertising and online marketing. Before founding Tether, he held important positions in various technology and media companies, mainly as a founder. He made significant contributions to the development and promotion of Tether.

Craig Sellarsplayed a critical role in the development of Tether’s technical infrastructure and protocol. Sellars is also known as the lead developer of the Omni Platform. The Omni Platform is the protocol on which Tether was originally built, supporting the creation, movement and exchange of NFTs and digital assets. In addition, Sellars holds important positions in a wide variety of blockchain projects; It attracts attention with its performance that pushes the limits in advanced technology, decentralized systems and software development.

What is Tether Dominance?

Tether (USDT) dominance refers to the share of Tether USDT in the total cryptocurrency market. It is usually expressed as a percentage (%) and compared to the total value in the cryptocurrency market.

Some inferences can be made from the dominance value of Tether USDT. Tether USDT has high dominance; It can mean fear of the market, uncertainty, correction, and risk aversion. Tether USDT has low dominance; It can mean market confidence, a bull market, high risk appetite and new investments.

Changes in Tether dominance are an important indicator for understanding market dynamics and determining investment strategies.

Tether USDt Lose Stability?

Designed to be fixed at 1 dollar, the sole purpose of Tether USDt is to keep its price stable. However, it has been observed that the stability of Tether USDt has been disrupted from time to time. So, “Why is USDT falling?” When we look at it, the result is no different from the reason for the decline of other crypto assets. The main reason for this is the rapid disposal of USDT by the masses. That is, there is a sudden decrease in demand.

The detailed reasons behind the intense selling of USDT may be as follows:

- Reserve concerns by Tether USDT

- Regulations that can be implemented by states

- Crypto market fluctuations

- Actions or statements made by very big names

- News circulating in the market or media

It cannot be said that USDT constantly disrupts its stability. In fact, when an analysis is carried out since the day it started to be traded on the stock exchanges, it can be said that it has maintained its stability.

Is Tether Reliable?

It is important to note that other cryptocurrencies available as stablecoins, including Tether, are not risk-free. This raises the question: “Is Tether USDt reliable?” It may bring up the question. People regarding Tether USDt may wonder how transparent this crypto asset is or whether it is regulated.

Tether Limited, the founder of Tether USDT, has also faced criticism for not providing regular audits to prove that the number of Tethercoins in circulation is backed entirely by US dollar reserves. There was even a Tether case in this context. So, what is the Tether case?

What is the Tether Case? When Did the Tether Case Happen?

Tether coin also came to the fore with a lawsuit. If you ask when the Tether case started, the year is 2019. A group of investors filed a class-action lawsuit against Tether and Bitfinex, the crypto exchange with which Tether cooperates. The Tether case was filed with the allegation that these 2 companies manipulated the cryptocurrency markets by applying for USDT and made inaccurate statements about the assets supported by USDT.

The US District Court shared a 6-page detailed and definitive decision with the public and rejected the class action lawsuit filed against Tether and Bitfinex after this long-lasting case. The court decided that no facts showing that ‘the actual value of USDT has decreased’ could be found, and that there were no reasonable claims of rights violation in the plaintiffs’ complaint.

Following the Tether case, the Tether side made a statement based on the decision; They emphasized that the dismissal of the class action at an early stage is an indication that the allegations made do not have any merit.

Although there are such developments regarding Tether, it is worth remembering that it is currently one of the most widely used stablecoins in its digital asset. In fact, among all assets in the cryptocurrency world, when ranked according to market volume, it comes after Bitcoin and Ethereum.

How to Buy Tether (USDT)?

Owning USDT, the digital dollar, can be considered an indispensable part of the cryptocurrency world today. Because USDT is the first cryptocurrency that comes to mind for buying or selling almost all cryptocurrencies. It also means a kind of cash. Considering all this, the question “How to buy Tether?” The question has been one of the frequently wondered topics in the cryptocurrency world. At this point, ICRYPEX appears as an advantageous choice for users. You can immediately get information about how much Tether is from ICRYPEX and start buying and selling USDT in a fast, safe and transparent way.

USDT, also known as digital dollar, can be bought and sold via ICRYPEX at any time of the day. ICRYPEX takes all necessary measures to ensure a smooth trading experience for its users. Whether you are a new investor or an investor who has been trading in this market for years, ICRYPEX offers you a reliable and user-friendly platform.